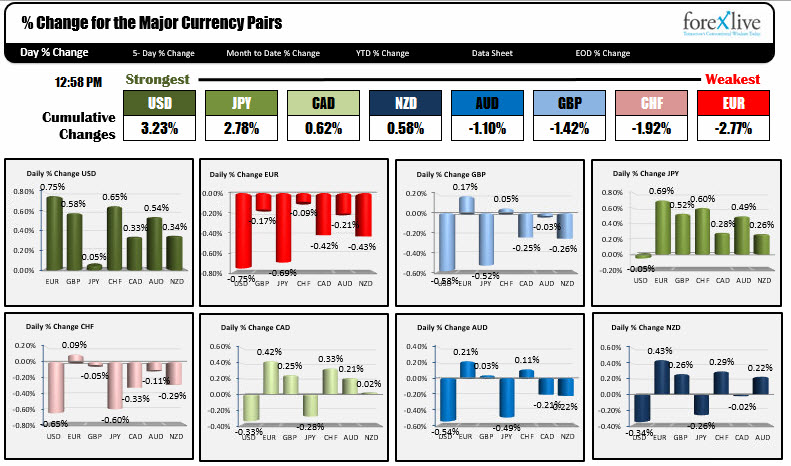

EUR is the weakest.

With Trump's decision on tariffs still 2 1/2 hours away (really....has the clock stopped?) , the USD is the strongest of the major pairs, while the EUR is the weakest. That combination makes the EURUSD the biggest mover. It has moved 0.75% on the day and trades near the lows.

Technically for the EURUSD, the pair moved to the 1.2300-10 area where the 50% of the March move higher and the 200 hour MA (green line in the chart below) are found. Earlier today, the pair stalled at the highs from yesterday (on Draghi comments) but then started to unwind.

- The 1.23847 floor was broken

- The 100 hour MA at 1.2367 was broken

- The 38.2% at 1.2334 was broken

Each step was progressively more bearish. A move back above the 38.2% would reverse part of the trend, but the 100 hour MA above should attract sellers near the 1.2360-67 area.

What isn't doing a lot vs the USD is the JPY. The USDJPY is near unchanged on the day, but the JPY crosses are on the move.

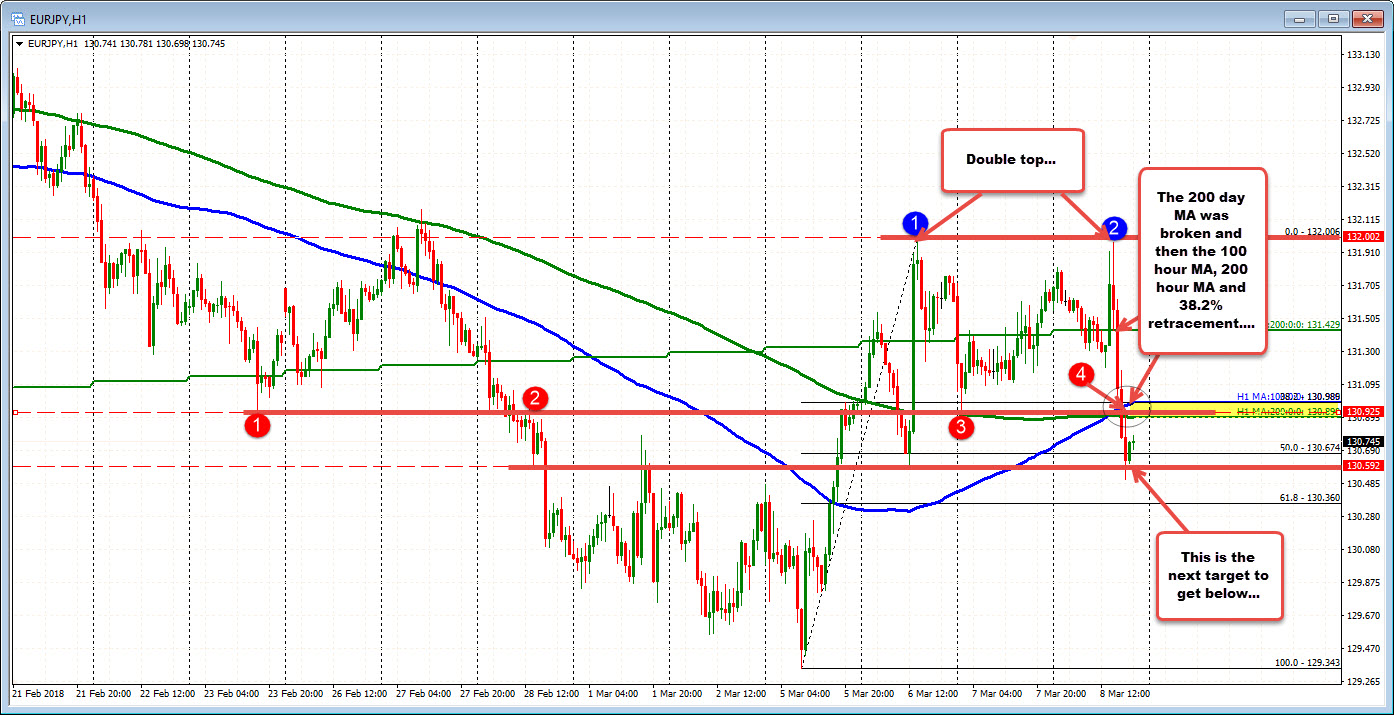

The EURJPY - like the EURUSD, stalled near the week highs at the start of the Draghi testimony (near 132.00) and then stepped down below the 200 day MA at 131.429. The 100 and 200 hour MA and the 38.2% retracement at the 130.89-99 was the next area to get and stay below.

The pair has found support below that cluster of support and traded the last few hours around the 50% retracement at 130.67. Going forward, a move back below that level will be more bearish.

The S&P index is trading near the 100 and 200 hour MAs but near the lows for the day. The 100 hour MA comes in at 2725.62 and the price just dipped back below that MA to a low for the day at 2723.22. The high reached earlier in the day, did get above the 200 hour MA at 2729.29, but that try failed. That helped turn the bias back lower.

The market is taking a cautious bias into the President's announcement. A move above the 200 hour MA will be eyed by the bulls through the event. Failure to do that, and the selling should intensify again for the broad index.