Well, there was nothing hawkish

There was no smoking gun from the Federal Reserve statement, forecasts, dot plot or the press conference. There isn't a single headline you can point to that drove the market direction.

So to understand why the US dollar has been so soft, you need to go back to before the event. At the time, the worries were centered on something hawkish. That Powell would indicate more hikes were coming.

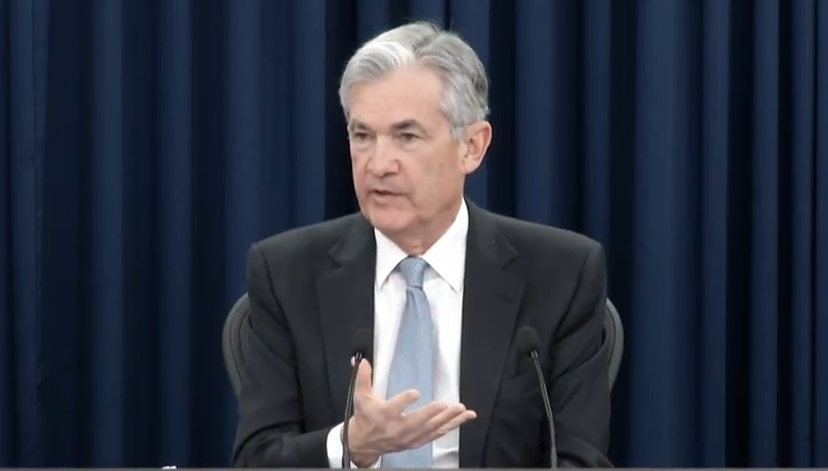

On that front, the only thing we really go was a change in the FOMC language to talk about stronger growth and a rise in the long-run dots. That said, Powell didn't emphasize the strong economy in the press conference and he downplayed the dots, saying there is no signal there.

So on net, the absence of anything hawkish is a dovish signal. As a result, the dollar struggled and the front-end of the curve rallied.

On him personally, he had a five-star performance. He's open, engaging, direct and tried to answer the questions. But he's not a hawk. He's Janet Yellen with looser bank regulation.