From a strategist note - which includes analyst Austin Pickle - released yesterday

The note says that it is "time to give up the ghost" and that there is further pain for dollar bulls in the offing - although they say that it will not threaten the dollar's global-currency status.

"Our forecast is for continued dollar depreciation at least for the remainder of 2018. Heavier US government borrowing, a broad-based international economic recovery, and the forthcoming end to the ECB's accommodative history of past cycles repeats itself, or even rhymes, we may be faced with a weak dollar for years beyond 2018", the note argues.

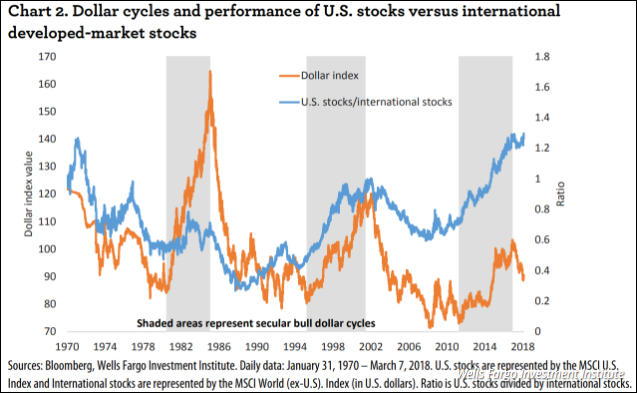

Meanwhile, they advise investors to diversify away from dollar-denominated allocations to international developed and emerging market equities as ways to protect investors from a weakening greenback.

They argue that "in dollar terms, international (developed market) stocks have consistently outperformed domestic stocks when the dollar depreciates - vice versa - and same goes for emerging market stocks".

The firm also says that they are bearish on commodities with "an unfavourable outlook for gold and other commodities in general" in the near-term.

That goes against the view of Goldman Sachs here.