Cable just went for a see-saw ride after the UK retail sales data for December was released earlier

So, we saw cable fall on the release of the report to a low of 1.3905 followed by a spike to fresh highs of 1.3945 - not seen since the Brexit vote. And now, it's back down to 1.3911.

What's all the commotion about? Did the market fade the poor retail sales report in thinking that sterling will rebound?

When you look at one pair, you would argue so. But when take a closer look at other pairs, maybe not really. I mentioned here EUR/GBP is a better gauge for sterling performance and the pair jumped up by 20 pips to 0.8825 and is still there right now.

The spike in cable was caused by dollar selling, not a surge in sterling. And it has been for quite a while now. As cable continues to recover losses from the Brexit vote, you would think the risks with the GBP is getting lesser by the day but this wasn't a stellar report by any means - it's another dent towards consumer patterns in the UK.

The reason cable has been surging recently has subtly been the weakness in the dollar. While EUR/GBP has been consolidating over the last two months, GBP/USD has surged from 1.3500 to 1.3900.

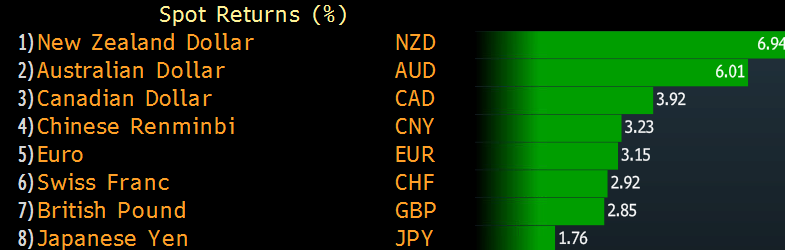

Since the end of November, GBP has only outperformed two currencies on the major bloc. The dollar and the yen. That's enough to tell you what exactly is going on with cable and what's affecting it in recent times.

The next risk event for the dollar is the US government shutdown. At this point, it looks imminent - but it's another opportunity for the market to fade fear.