The war of words continues to heat up

I'm usually the first one to dismiss sabre rattling but there is nothing wrong with being ready for anything.

Today the North Korean Foreign Minister Ri Yong Ho told reporters in New York that "Since the United States declared war on our country, we will have every right to make countermeasures, including the right to shoot down United States strategic bombers even when they are not inside the airspace border of our country."

On Friday, North Korean leader Kim Jong-In released a statement and called Donald Trump "mentally deranged" and that convinced him "that the path I chose is correct and that it is the one I have to follow to the last."

The foreign minister in New York said Pyongyang could launch a nuclear missile test in response. "This could probably mean the strongest hydrogen bomb test over the Pacific Ocean. Regarding which measures to take, I don't really know since it is what Kim Jong Un does."

That's not a promise to test the missile but combine it with comments where he said Trump would "pay dearly" for the threats, and that North Korea "will consider with seriousness exercising of a corresponding, highest level of hard-line countermeasure in history."

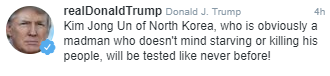

Trump responded via Twitter.

A US official cited by Reuters also said it would be a "game changer" if the test occurred but that the US was not giving the threat "too much credence" for now.

If these were any other two world leaders, the market would be in a full-on panic right now but because Kim and Trump have traded this kind of talk before, it's brushed aside.

"There's a certain amount of bluster that's taken for granted when you're dealing with North Korea," the official told Reuters.

There is no doubt that's how markets also feel, but there's a key question we should be asking: What if we're wrong? What if Kim tests a hydrogen bomb on the weekend?

Exploding H-bombs is a crazy gambit. I really don't think the US would launch a counter-attack but you never know.

Here's how I think markets would react. The caveat is that this is if markets are open at the time. If he tests the bomb on the weekend, markets would be less panicky the is no military response.

- Gold is a classic 'buy' on bombs in the air. I'd expect $1400 in a straight shot +$100.

- South Korea "sell everything". It would be a very bad day for the Kospi, at least down 7-8% and CDS would spike

- I don't care if the nukes are pointed at Japan. They nuked themselves at Fukushima and the yen still rose; it would be the same thing this time. Easily up close to 200 pips across the board.

- The dollar would be bid aside from the yen and franc

- Commodity currencies lower on worries about trade and global growth

- There would be some major worries about the US-China relationship and Chinese assets would slide

- US 10-year yields would get back down near 2%