CFTC Commitments of Traders highlights for the week ending Oct 24, 2017:

- EUR long 84K vs 90K long last week.

- GBP short 1K vs 5K long last week.

- JPY short 116K vs 101K short last week.

- CHF short 12K vs 5K short last week.

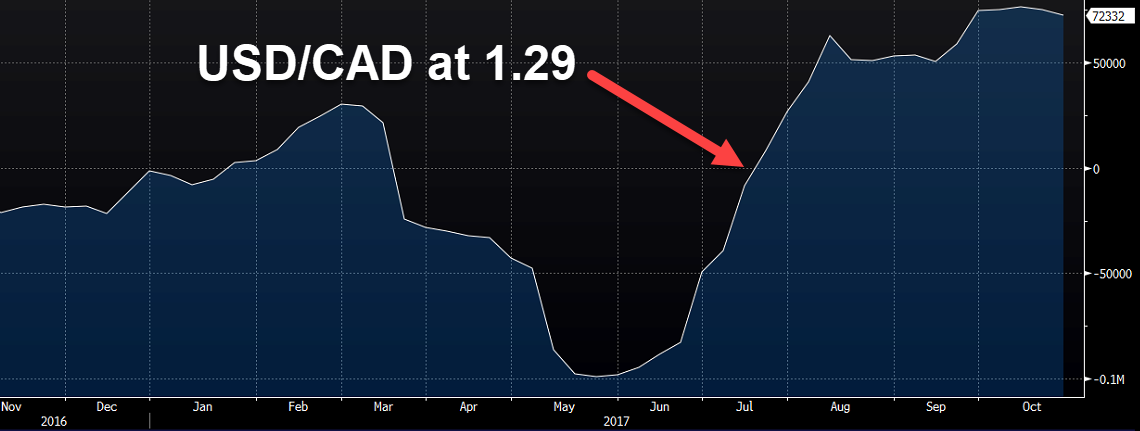

- CAD long 72K vs 75K long last week

- AUD long 57k vs 62K last week.

- NZD long 1K vs 7K long last week.

- Last week's data

The net cable position switched to long for a few weeks but the market has had a quick change of heart (enforced by a spill in GBP) that has sent positioning back to flat.

The NZD position was cleaned out on the political worries.

Finally, that long-CAD position looks very vulnerable. It's trading where it was in mid-July when the net position was flat, which means the entire +72K net long is underwater.