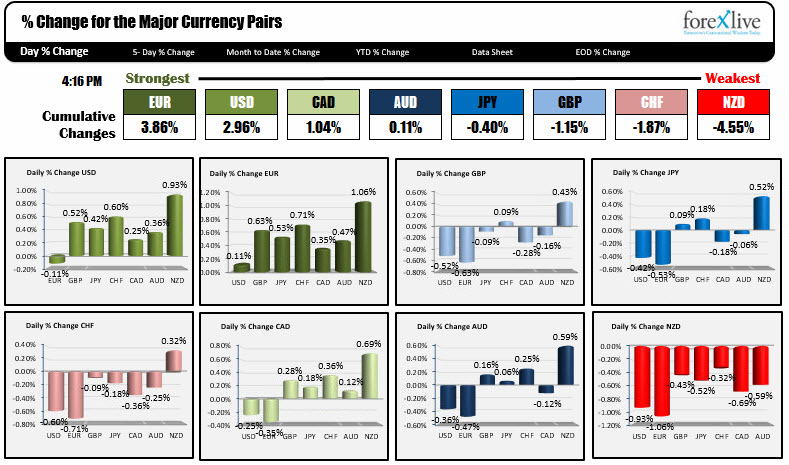

A snapshot of the winners and losers for the day - October 24th, 2017

As the North American session comes to a close, the EUR is the strongest of the major currencies, while the NZD is the weakest.

The USD was stronger as well, rising against all the major currencies with the exception of the EUR (-0.11% vs the EUR). The USD was buoyed by a run higher in rates. The 2 year was up 2 bp on the day to 1.5851%, but the real mover was the 10 year yield which climbed 5.8 bp on the day to 2.4244%. In addition to helping the dollar, the bank stocks were also the beneficiary today.

- JP Morgan rose $1.58 or 1.59%. It closed above $100 on the day at $100.92

- Citigroup also rose sharply. It rose $0.71 or 0.97% on the day

There gains outpaced the major indices.

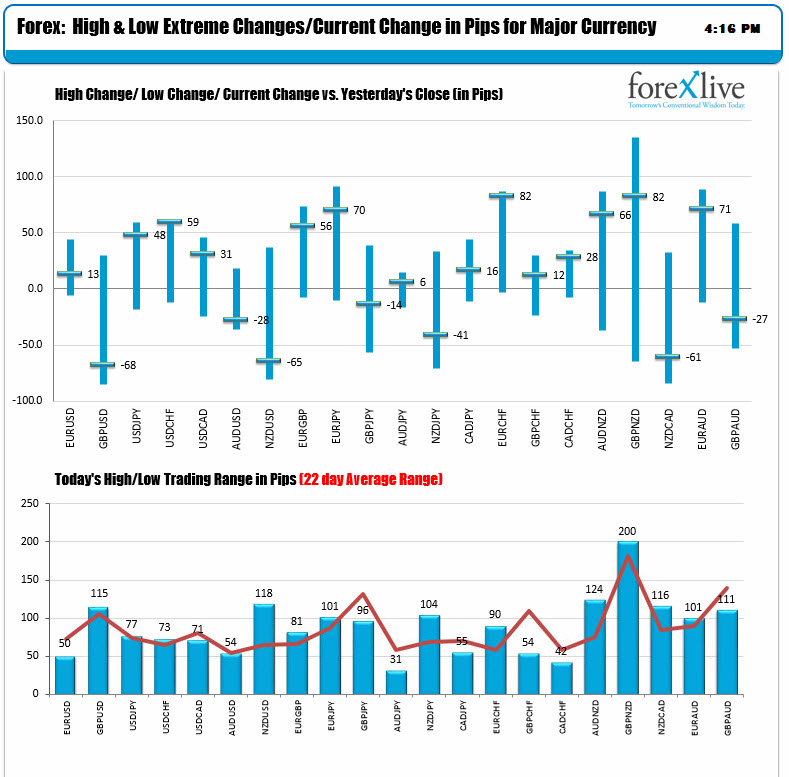

The ranges were about normal for the major pairs vs the dollar (vs 22 day averages) with the exception of the EURUSD which was confined to a 50 pip trading range (vs 72 pip average). The NZDUSD range was above normal with 118 pips vs a 22-day average of only 69 pips.

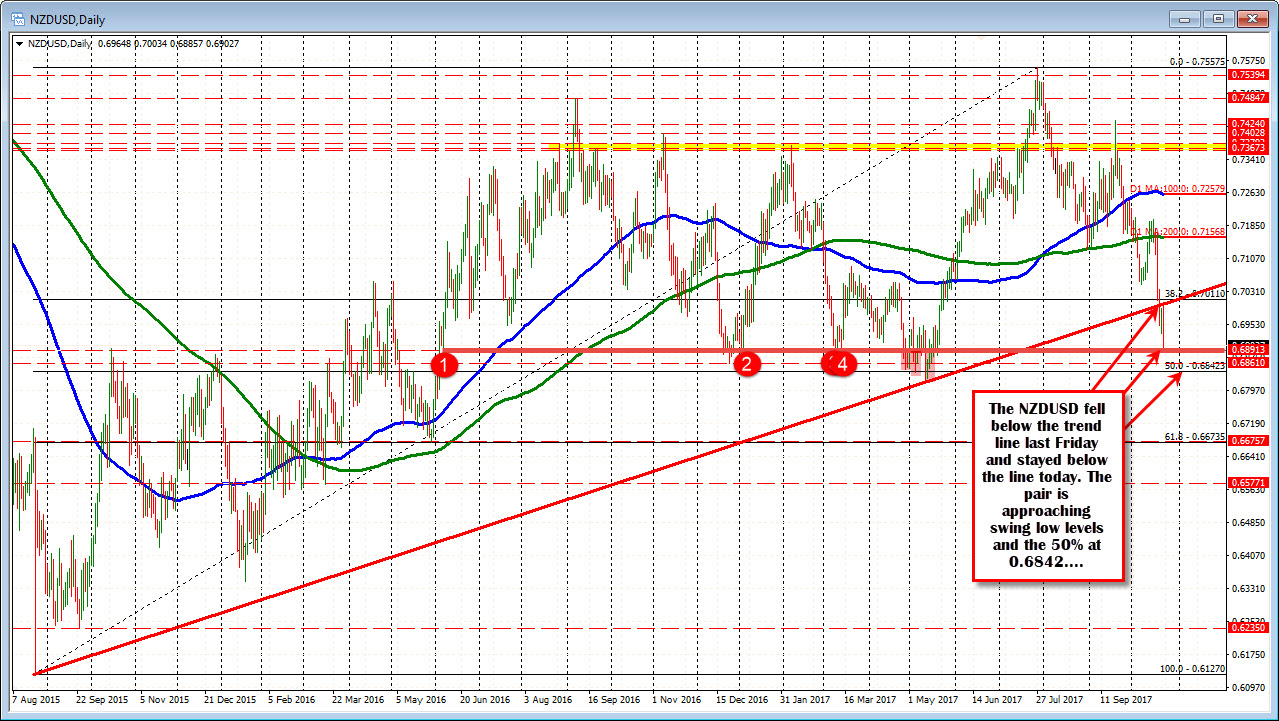

Technically, the pair fell below trend line support on the daily chart on Friday. The high today stall against the underside of that trendline before trending back to the downside. The pair is approaching swing low levels going back to June and the 50% retracement of the move up from the August 2015 low back 0.68423 (see chart below).