AUD/JPY broke out earlier today

AUD/JPY climbed above the July highs today in a break to the best levels since December 2015. The pair is up a half-cent to 89.90 today and has gained for four straight days.

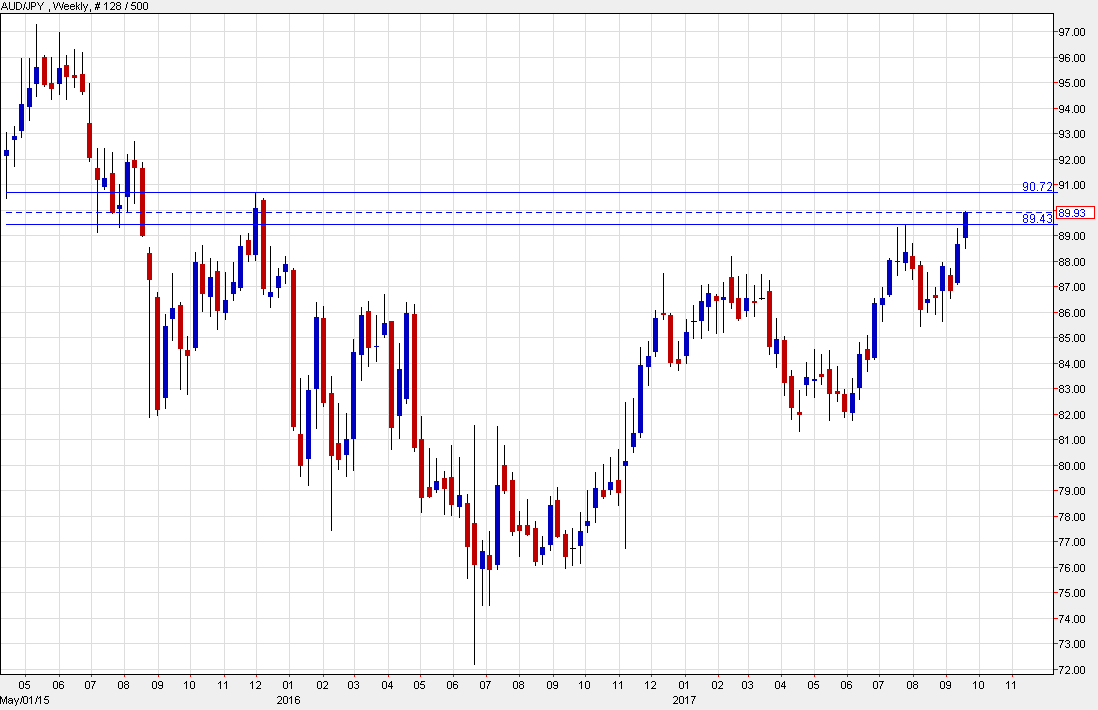

You need to scale out to the weekly chart to see the breakout in progress.

The big story is global policy tightening. The hike from the Bank of Canada along with the hawkish commentary from the BOE and the more-optimistic talk from the RBA is a signal that central bankers truly believe inflation is coming.

Except for in Japan, of course, where the BOJ continues to pin rates to the floor with no genuine expectations for lasting, or rising inflation.

As a result, AUD/JPY has been in a sustained uptrend. The bigger picture is an inverted head & shoulders pattern that targets a rise to the 105-107 zone -- a whopping 2500-2700 pips.

But first, the November 2015 highs present a significant band of resistance. The top is at 90.72 and that will need to break (and perhaps be retested) before the rally is truly confirmed. But if that's combined with the start of a hiking cycle from Lowe, it could be a steady trip to 100.00 and beyond.