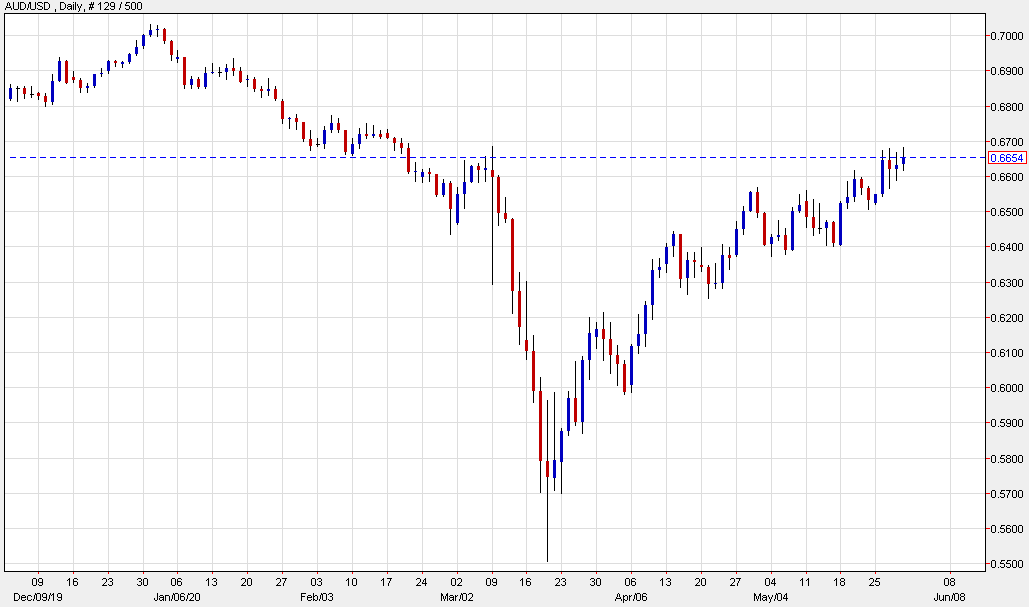

Australian dollar technical analysis

Credit Suisse discusses AUD/USD technical outlook and highlights the importance of the 0.6706 level for near-term direction.

"AUDUSD saw another concerted effort to break above the pivotal resistance zone composed of the 200-day average, the March high and 78.6% retracement at 6706. Although further consolidation should still be allowed for, in particular as a small bull 'triangle' is still in place, we still look for this level to cap and look for weakness to take over again in due course. With this in mind, we see support initially at .6568, then .6538, ahead of the late May lows and 21-day exponential average at .6520/06, where we would expect to see fresh buying at first. Beneath here on a closing basis would negate the bull 'triangle' and reinforce the swing lower, with next support at .6412/00," CS notes.

"A closing break above .6706 would in contrast mark a break of a major barrier and turn the medium-term risks to the upside, with resistance thereafter at .6745/50, ahead of the February high at .6774," CS adds.

For bank trade ideas, check out eFX Plus. Today is the final day to get a free week via this link.