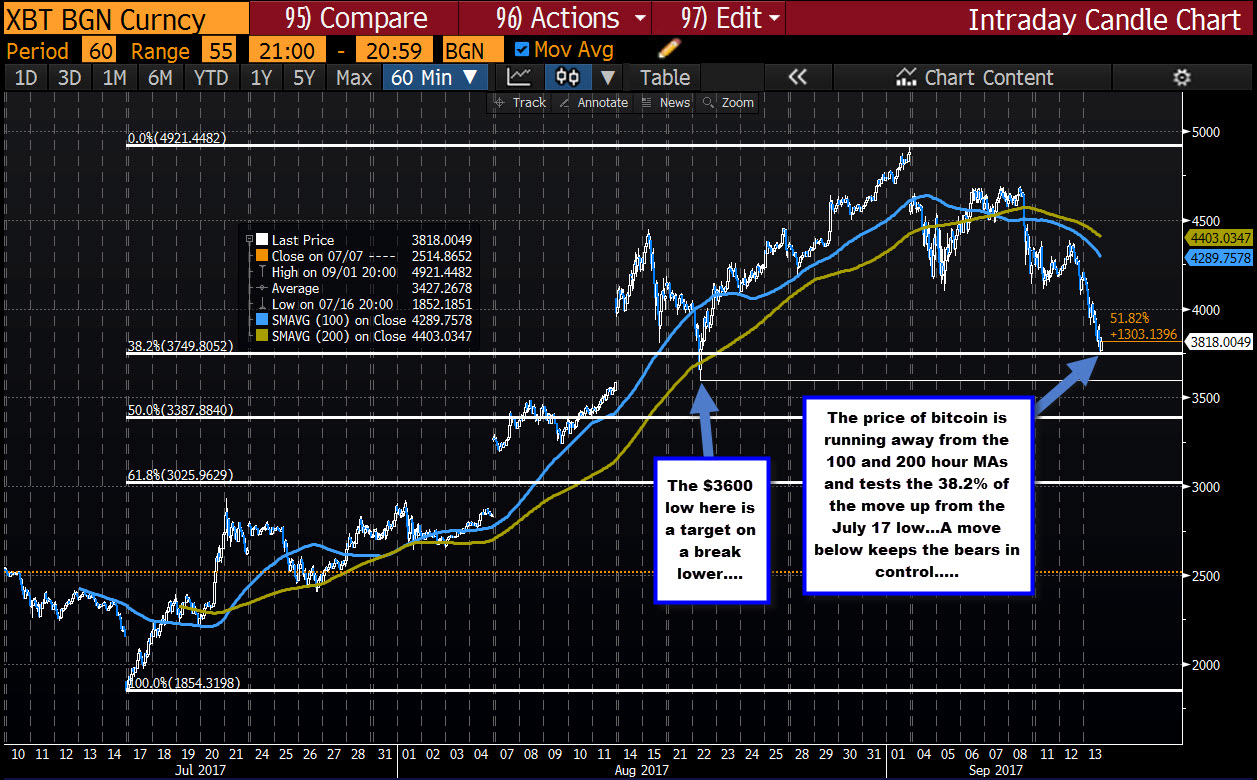

Cryptocurrency reaches the 38.2% retracement of move up from mid July low

Yesterday, JP Morgan's Jamie Dimon said that bitcoin was fraud among other things (see post from yesterday here). His comments sent the cryptocurrency sharply lower, and that move tested the lows from September at 4112 and 4098. The price dipped below that those levels on the momentum move lower but rebounded into the new trading day.

Looking the 5-minute chart above, that rebound stalled right at the 100 bar MA on the 5-minute chart. In the post yesterday, I commented:

"Where is risk for shorts?

Drilling to the 5-minute chart below, the 100 and 200 bar MAs are moving lower with the price back below those MA lines. They would be risk levels for shorts. Stay below more bearish. Move above and the words from Jamie Dimon will be just like the other naysayers."

The 100 bar MA stalled the rally (see chart above). The sellers remained in control.

That blue line (100 bar MA) continues to be the ceiling for the bitcoin and remains the close risk level for shorts. Stay below, more bearish. Move above, and we could see a move back higher.

We know the risk for the shorts, what about the targets to the downside?

Taking a look at the hourly chart below, if you put a Fibonacci on the move up from the mid-July low the 38.2% of the move higher comes in at 3749.805. That was a target from the post yesterday. The low today has reached 3736 and bounced quickly. The price currently trades above the 3800 level. Buyers are trying to make a play against the 38.2% retracement target.

SUMMARY:

The technicals are driving the price action (that would be the only way I would trade this instrument).

- The correction higher today stalled at the 100 bar MA (blue line on the top chart), and the price has tracked below that MA line since then. That is the risk level now for shorts. Stay below bears in control. Move above and the buyers are taking back control.

- On the downside, the next key target at the 38.2% retracement has been reached. That could be a bottom. The price did extend below that level but buyers quickly came in. That 38.2% level at 3749.80 will be eyed for clues. A move back below would be more bearish.

If there is a break, the next key target comes in at the low form August 22 at $3600. Below that and the 50% retracement at $3387.88 will be targeted (see hourly chart).

Follow the technicals.

PS If you have a second, participate in our survey below. It is just one simple question.