European stocks up too

The markets are a bit random today.

There is not much in the way of economic data, but the stock indices in the US are higher. Yields are a bit higher in the US as well. Those markets are cheering the tax reform bills expectation of a passing this week.

Last week the Fed scheduled 3 tightenings. The ECB penciled in zero. That should keep the USD bid relatively.

Yet the dollar moved lower today, and in fact is down against all the major currencies.

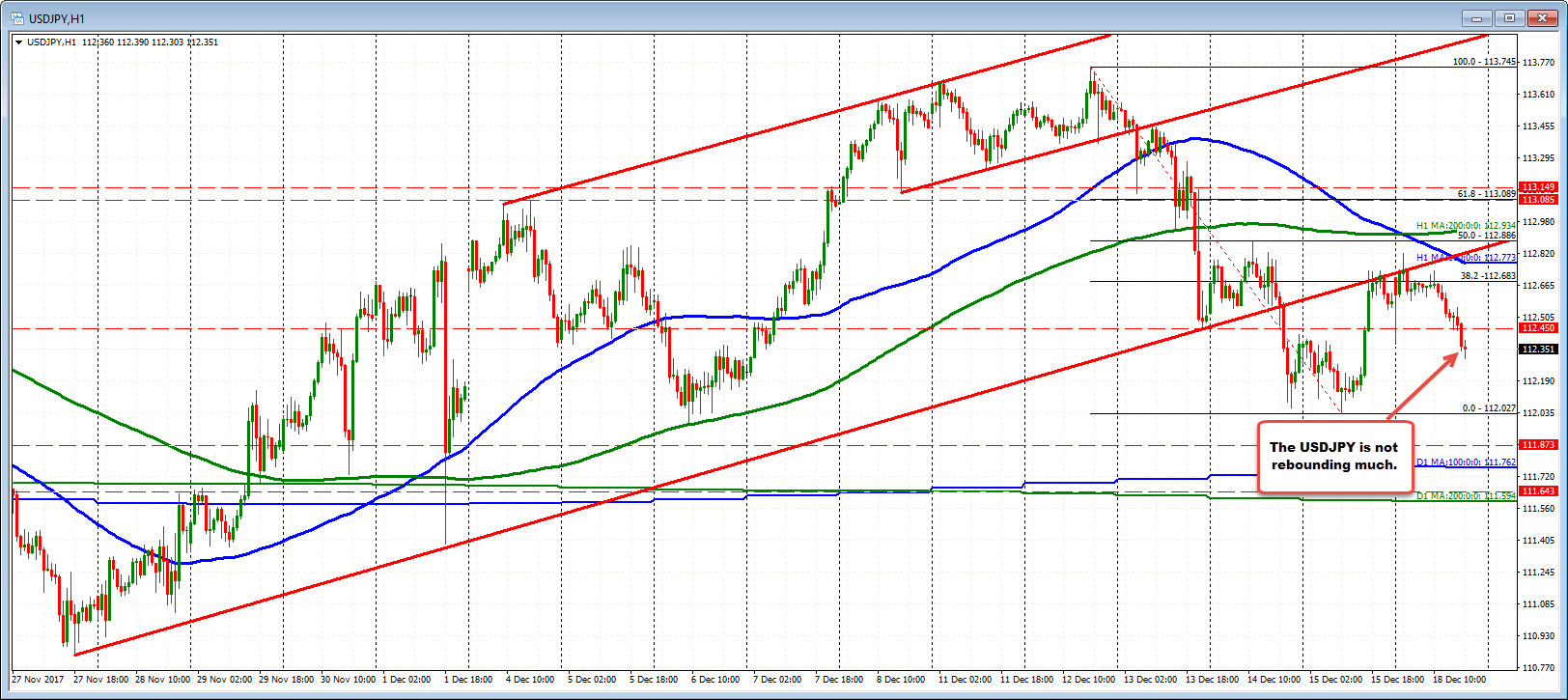

As I type, the green back has moved back higher against the EURUSD moving back through a broken trend line and back toward the 100 day MA. However, the USDJPY remains near the lows.

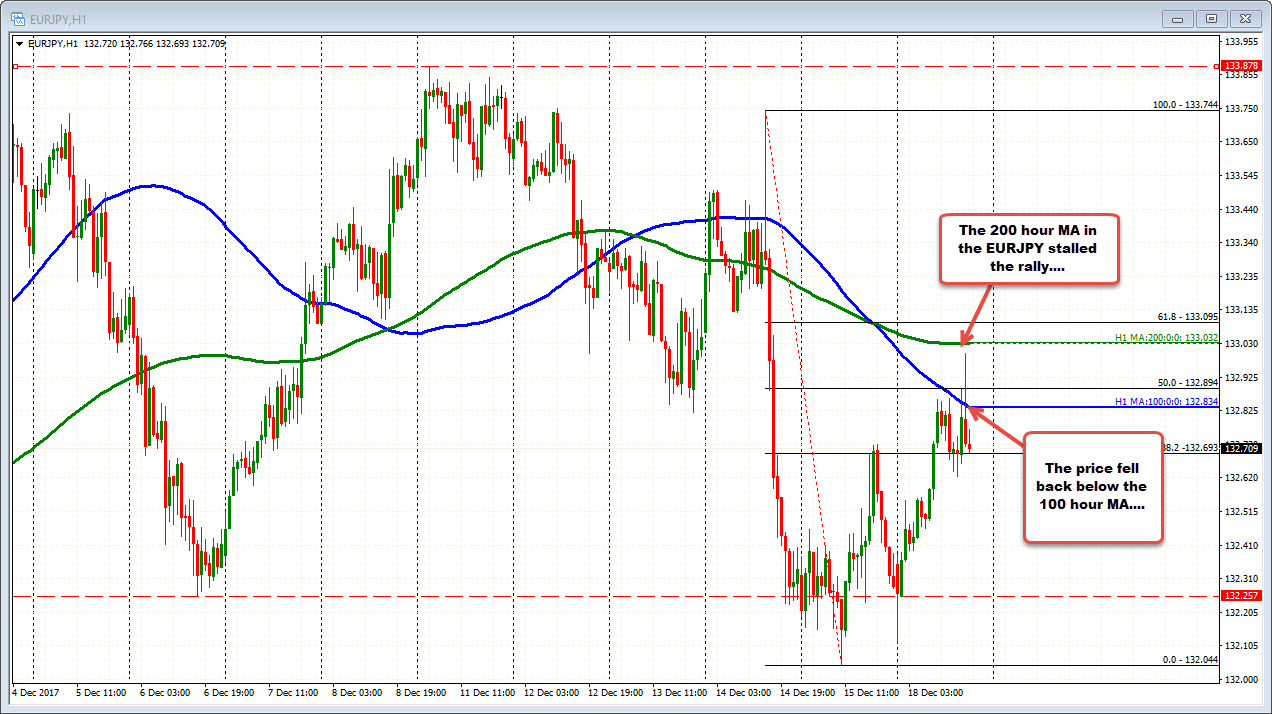

The EURJPY (the combination of the two pairs), did test the 200 hour MA at 133.032 but stalled (reached 133.00), and headed back below the 100 hour MA. That certainly is wagging the dog (i.e., the EURUSD and the USDJPY price action).

As mentioned earlier, this time of year can make markets more tricky. Traders can be sitting on the sidelines, so when orders do come in, they can have a bigger impact. So be aware. The forex markets have that holiday trading feeling.