USDJPY trades to yet another low. EURUSD moves back to 1.1800

The dollar has moved lower. The moves corresponds with some concerns about the tax legislation vote. Republican Senators Lee and Rubio have expressed they may vote "no" as a result of the child tax credit proposal.

In addition, the Obama net neutrality has been repealed. The implications could lead to a "less free" internet, and lead to higher cost/a degradation of services.

Stocks are now negative across the board with the S&P down -0.1%, the Nasdaq down -0.03% and the Dow down -0.02%. Admittedly, the indices are only down a little but they were higher much higher. The S&P reached a high of 2668.09. It trades at 2659.64. The Nasdaq was up 25 points at the high. The Dow was up about 90 points at the highs.

The US yield curve continues to flatten. The 2 year is up 3.2 bp while the 30 year is unchanged.

The EURUSD has moved back up toward the 1.1800 level and a retest of the 100 day MA at 1.1801.

The USDJPY, moved to a new low of 112.08 and below the 50% at 112.29.

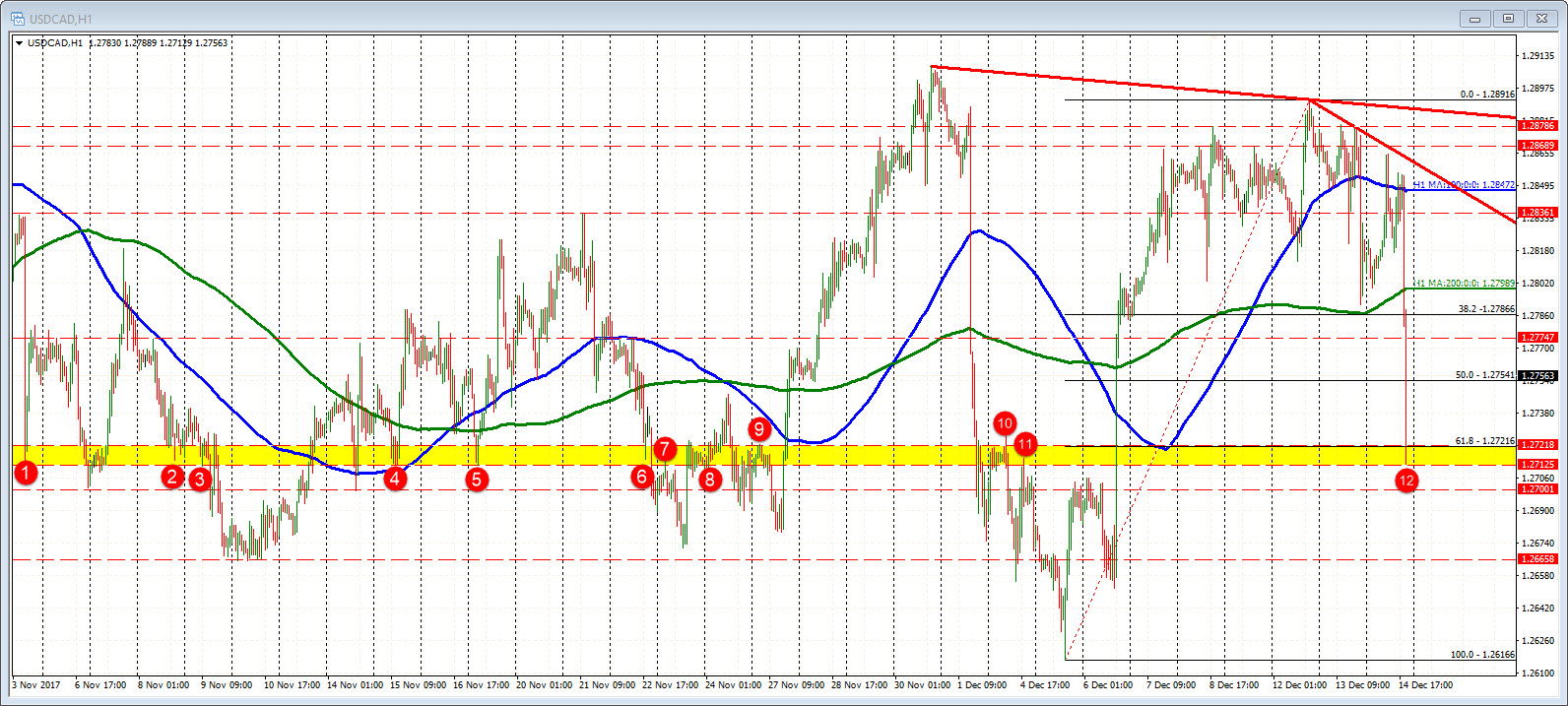

The USDCAD gave up on life above the 200 hour MA. It fell below that MA line and the 50% and tumbles all the way to the 61.8% and old swing area in the 1.2712-21 area. The price has already bounced off the level.