Well so far

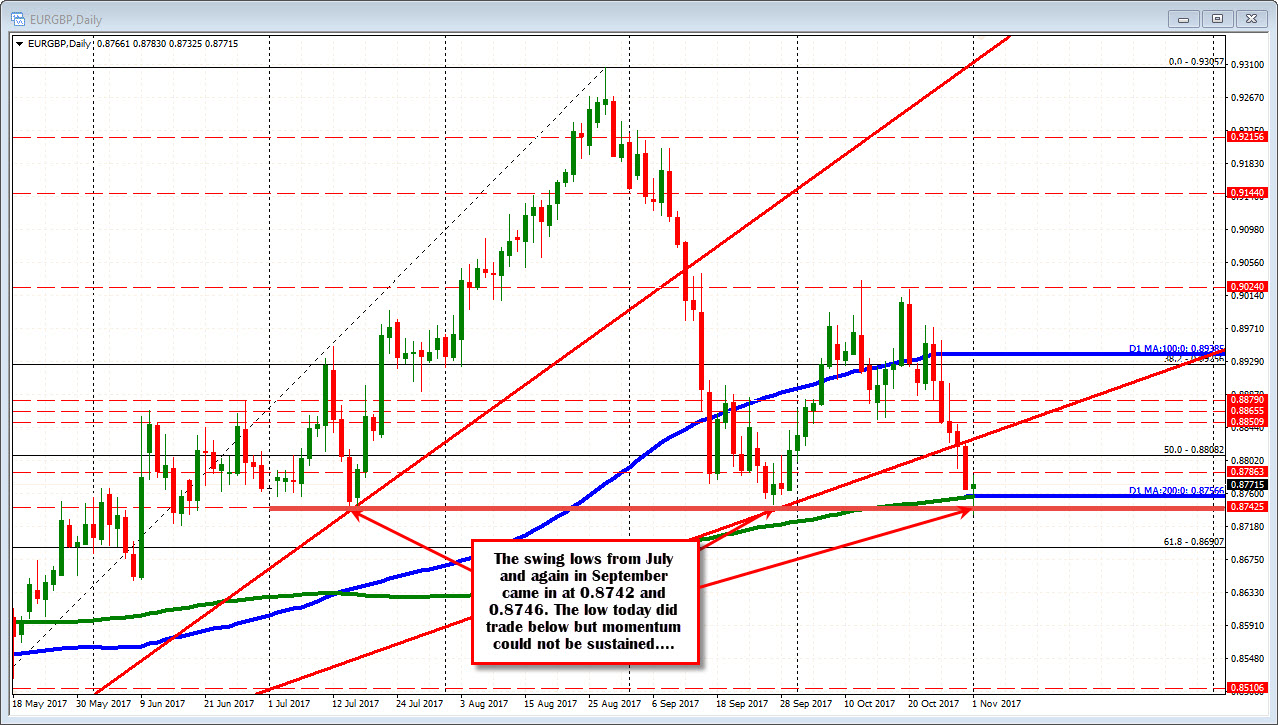

The EURGBP fell below the key 200 day MA in trading today at 0.87566 and moved to a low of 0.8732. The low took a look below a lower trend line at 0.8735 but it could not increase the momentum.

As a result, we saw a pop higher and the last 6 trading hours have been able to find support and stay above that key MA line. We are also staying above a topside trend line.

Now we do have the BOE hike tomorrow, which will impact anything that has GBP in the name, but traders who want to see what happens between now and the rate hike time, can use that 200 day MA as a risk defining level. Stay above and the bulls are more in control. Move back below, and the bears are more in control.

Right now the last 6 hours are showing more leaning toward the dip buyers. Maybe there is a continuation run up to toward the 100 hour MA at 0.88134 (and moving lower). The 38.2% comes in at 0.8825. That is also home to swing lows/highs from October 27 and October 30.

If the price moves back below the 200 day MA, the lower trend line will be eyed as a lower target. Also watch 0.8742-46. The swing low from July came in at 0.8742. The swing low from September came in at 0.8746. A move back below those lows (and the 200 day MA) should be bearish....