EUR/USD is trading near the lows as the 1.1600 handle caps gains once again

And that has been the case for the euro over the last three trading days against the greenback. Any moves to get above the 1.1600 handle is met with offers and the pair just heads lower thereafter. Right now, price is leaning on the 100-hour MA (red line) but as long as buyers hold above that then the near-term bias remains more bullish.

However, the continued failure to break and stay above the 1.1600 handle is quite concerning. Of note, the 100-day MA sits at 1.1628 and that remains a key resistance level in trading for EUR/USD at this juncture.

Although the dollar is unable to gather meaningful bids so far this week, there are headwinds keeping the single currency from rallying too strongly as well. The most obvious point being Italy's budget worries but there's also small data points like these that add up to weigh on the Eurozone economic outlook.

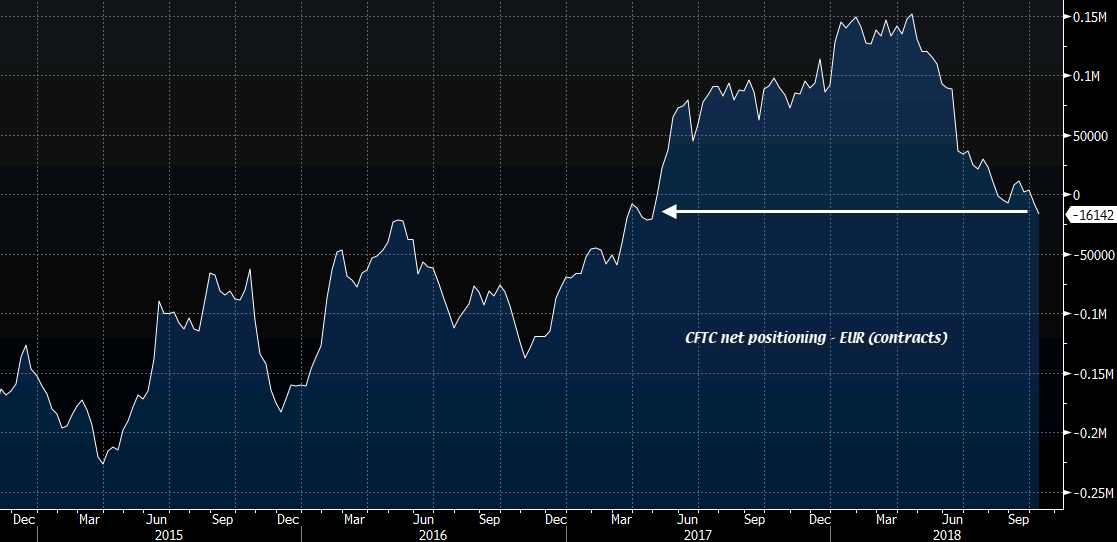

As we have been looking at positioning in the pound and aussie earlier in the day, here's what positioning in the euro is telling us:

Despite net positioning being short and the most short since May 2017, it comes after a brief period of unwinding and squaring seen in September. That gives the opportunity for sellers to reload in shorts and that's likely what we're seeing now.

It's hard to make a case for excessive euro strength at this juncture but if the pair is to get a lift higher, it will need some helping hand from the dollar's own recent worries. But as long as price holds below the 100-day MA @ 1.1628, the factors above is still suggestive that there is some more downside still to be had for the pair.