The euro leads gains ahead of European trading

The single currency spiked higher on the back of a report by Corriere stating that Italy may cut its budget deficit to 2% in 2021. The thing about a report like that and the reaction seen here is that it tells you a lot about market positioning.

Let's get this out of the way first. Italy's populist government doesn't look like they will back down from a 2.4% deficit target next year. To talk about a deficit target three years out is very much conjecture at this point when we don't even have a firm grasp of what will come next year. As I have mentioned before, a deficit target is at the end of the day just a target. The fiscal plans need to match that in order for the deficit next year to fall within the "target".

So, despite that the euro spiked higher in what for me is very much a relief rally for buyers. Just on the back of Italy's political woes since last week, EUR/USD fell from 1.1750 to 1.1800 levels to yesterday's low near 1.1500.

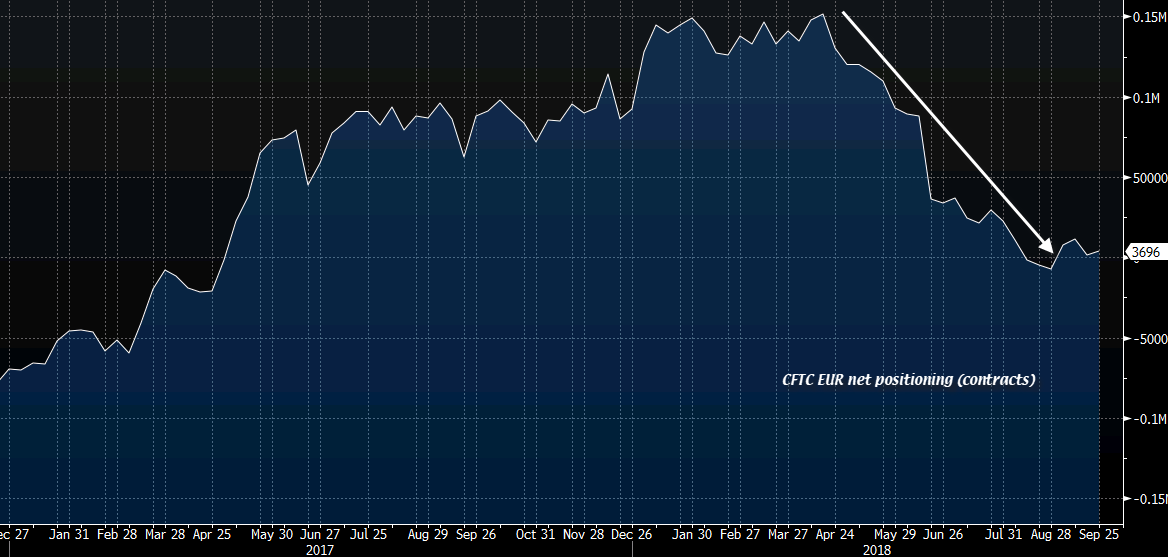

And with market movement, nothing ever moves in a straight line so despite the Italian budget backdrop there is very much potential squeezes to be had. More so when you factor in that EUR longs have been flushed out to their lowest levels since May last year:

I wouldn't rule out a follow through move in European trading later but the key for buyers to break above in the near-term is the 100-hour MA (red line) @ 1.1605. Hold a break above that and the near-term bearish bias will be eliminated.

There is further resistance around 1.1630 but the next key resistance level will be that 200-hour MA (blue line) @ 1.1682. If buyers can sustain a rally above that, then the near-term bias turns more bullish.

However, be wary that headline risks remain very much the name of the game at this point. If Di Maio or Salvini comes out to quash the earlier report, it'll no doubt dampen the spirits of euro buyers a little. And as long as price doesn't hold a move above the 100-hour MA, this is still pretty much bearish territory for EUR/USD.