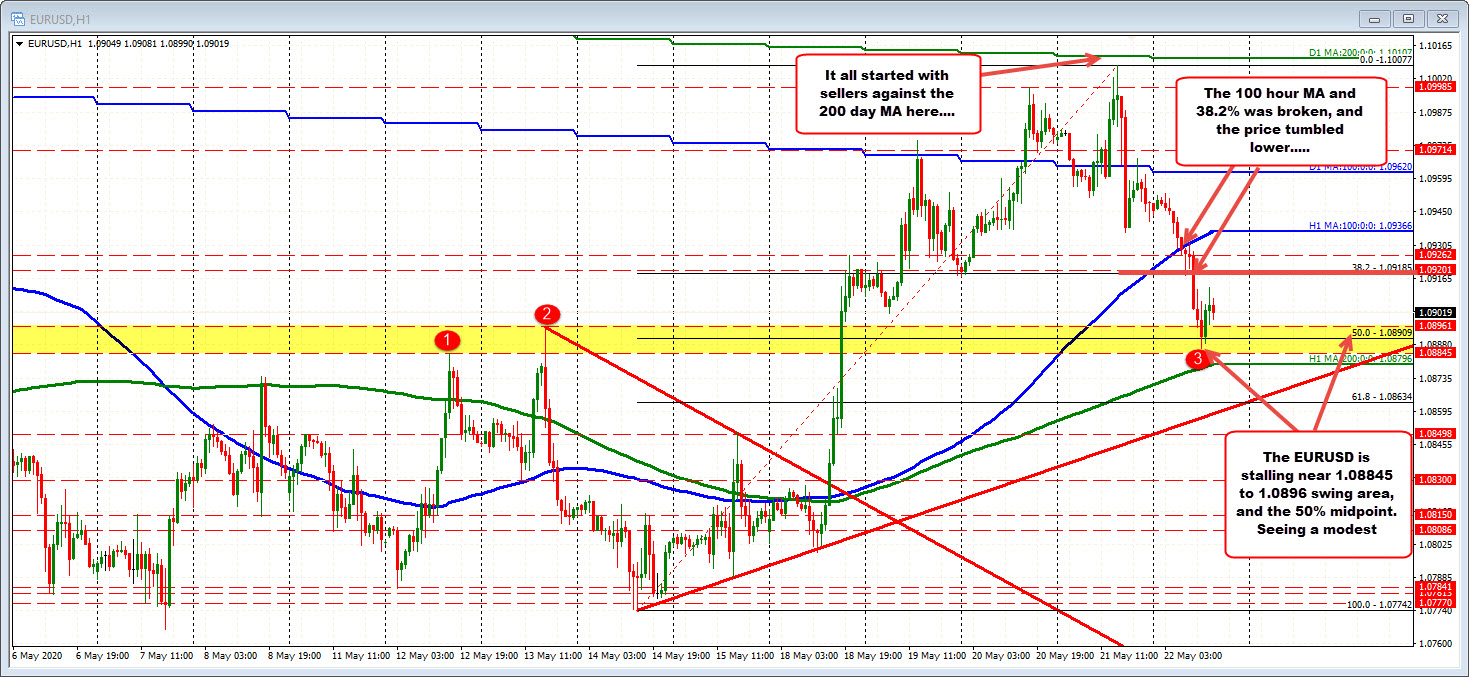

Swing area and rising 200 hour MA

The EURUSD has continued the run lower today after failing above the 100 day MA on Wednesday and Thursday and stalling just ahead of the 200 day MA yesterday.

Today's fall gathered more downside momentum on a break below the 100 hour MA, and then the 38.2% retracement. The fall, however, has stalled over the last 4 or so hours as the price tested the 50% retracement at 1.08909, the swing area at 1.0884 to 1.0896 (yellow area). The rising 200 hour MA is moving toward that area as well. Selling stalled and the price has rebounded modestly.

Sellers took more control on the failure above the 100 day MA and subsequent move lower yesterday. The continuation of a deteriorating technicals has the sellers even more in control today. If the downside is to continue, staying below the 38.2% (and swing low from May 19/20) is a risk level (stay below is more bearish). On the downside, the aforementioned 50%, swing area and then 200 hour MA are the next key targets (get below is more bearish).

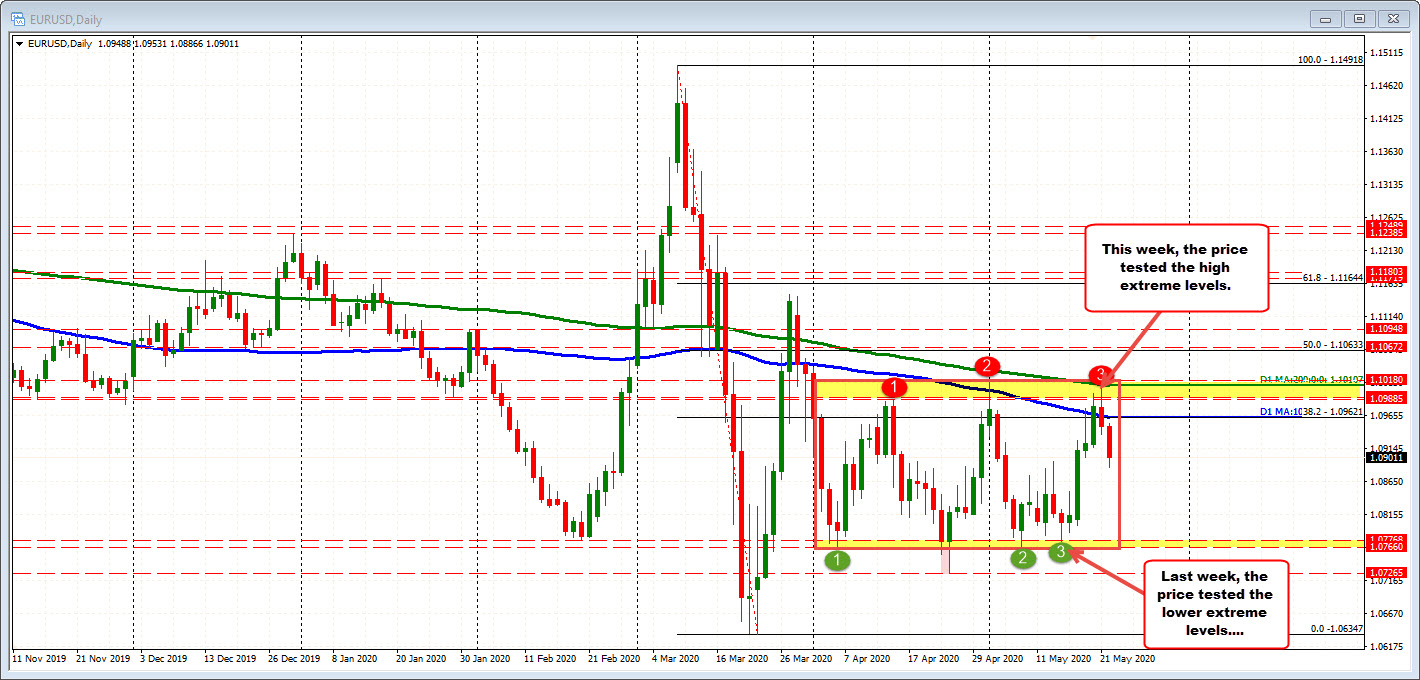

Taking a broader look at the daily chart, the move higher this week, was good enough to sniff the recent range high (after basing near the May swing lows last week). The pair still sits in the up and down range. What happens at the support area tested today from the hourly chart will tell the story on what happens next. Break below and traders will be more focused on going toward the low extreme. Hold and getting out of the two month box will be the focus.