Back in the middle of the range after swing area holds

The EURUSD technicals have pivoted back to the upside today.

The sources report of an ECB pivot has helped the climb recently (see post here). Before that run up, there were some other signs.

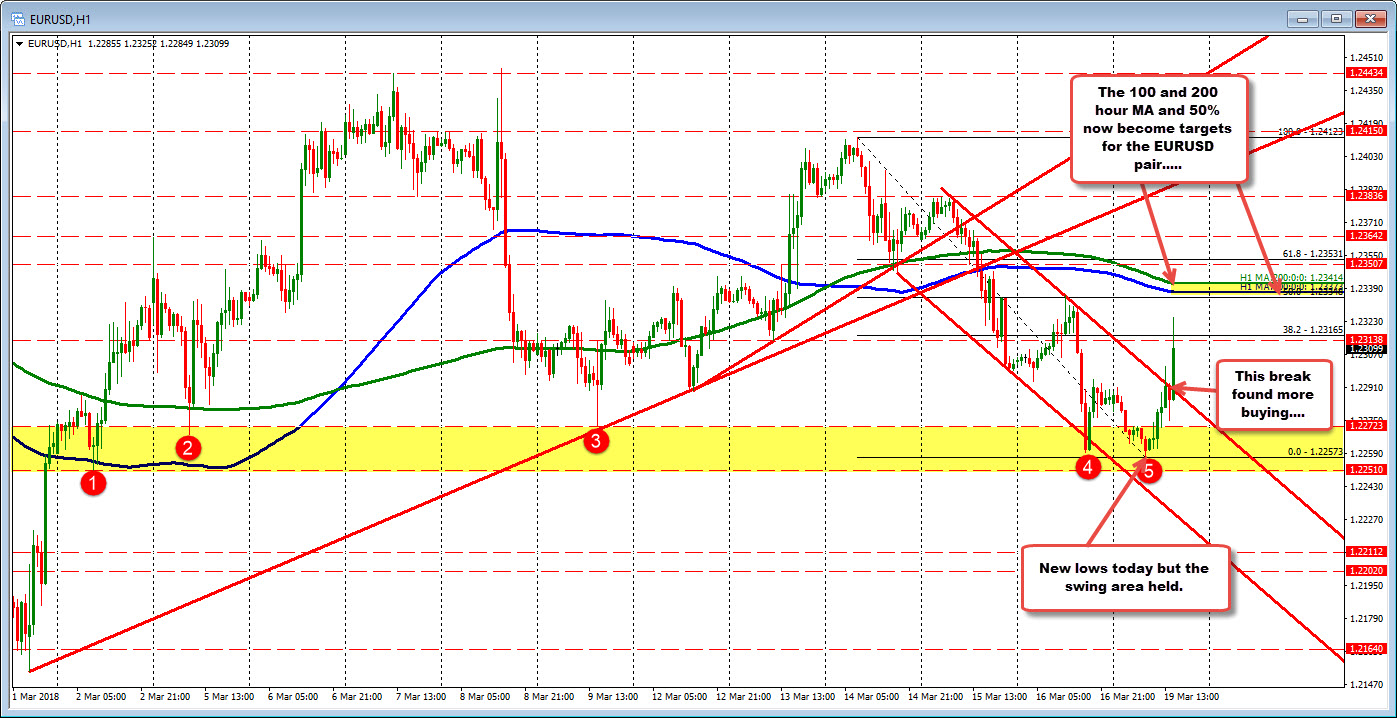

- The pair made a new low going back to March 2nd - taking out the low from Friday by a few pips (Friday low 1.2259 and today's low reached 1.2257). That should have opened up the downside for more losses. It did not. Sellers gave up and started to lean against the low

- The pair could not take out the swing area low at 1.2251. The March 2nd low came in at 1.2251. Since then there have been 4 other swing lows in the 1.2251-72 area. It is a wide swing area but it showed a desire to buy by the market.

- A channel trend line was broken at 1.22909. Earlier in the day, the price did break the topside trend line and failed. The 2nd run.....ran.

There is a pivot from the bearishness seen last week.

What next?

- The broken channel trend line is now risk. Stay above and the pivot higher is still in place.

- The price did break above the 38.2% at 1.23165 but is back below. That worries me and could hurt the pivot if it is not retaken in trading this morning.

- The 50% , 100 hour MA, and 200 hour MA (blue and green lines) at 1.22348-414 create a tough cluster to get through on a continuation higher today. Expect trouble up there.

The pivot today is really off the inability to break below the swing area and the breaking of the channel trend line. That is the good news for the bullish tide. What will keep that bullish tide, is the progress the pair makes in reaching new targets, and staying above the broken targets. We are back in "the meat" of the range going back to March 2 (at least away from the swing area). It is a start. Can the momentum continue? The battle lines are drawn technically.