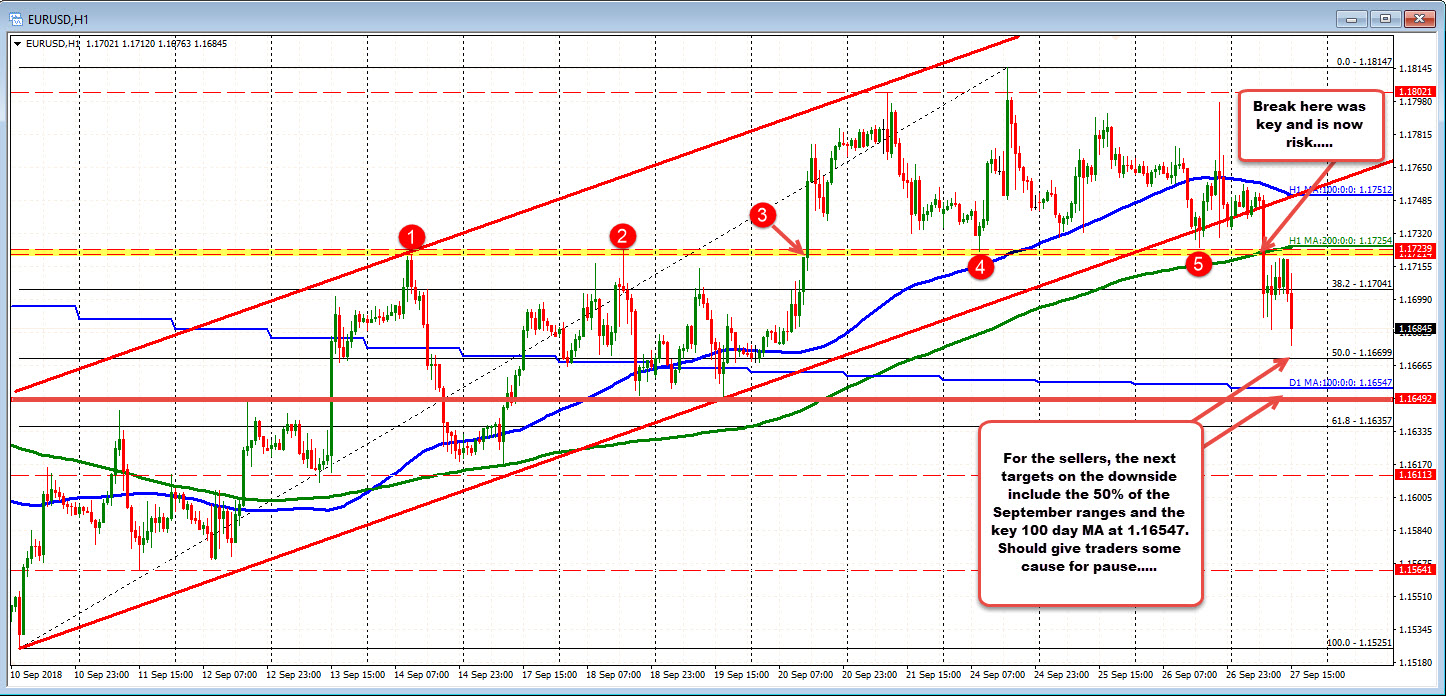

50% of September move the first target at 1.16699

The EURUSD today:

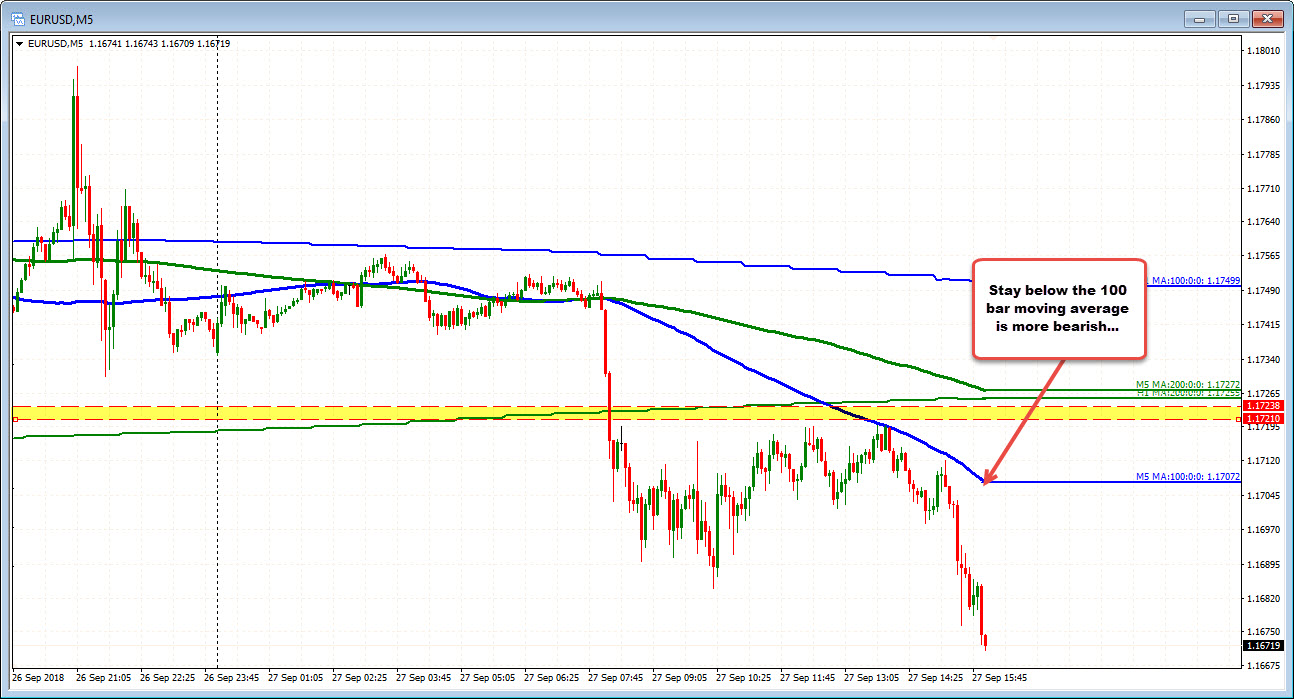

- Stayed below the 100 hour MA (blue line in the chart below). Bearish.

- Moved below the 200 hour MA (green line). Bearish.

- Moved below the swing area at the 1.1721-239 area (red numbered circle). Bearish

The correction off the London morning session low, stalled ahead of the 200 hour MA and swing area (Bearish). Sellers remain in control.

In the current hour, the price has moved to a new session lows as Durable goods headlines was good (the details may not have been great, but....).

The price moved to a new session low at 1.1676.

The next target is down at the 50% midpoint of the September trading range at 1.16699. Below that, traders will be eyeing the all-important 100 day moving average of 1.16547 and another swing area at 1.1649. I would expect the 100 day MA area to give traders a cause for pause (with stops on a break). Be aware.

The key risk level for shorts was 200 hour MA and swing area at the 1.1721-239. Closer risk might now be eyed at the broken 38.2% line.

Drilling down to the 5 minute chart, the 100 bar MA (blue line) held resistance on tests today. That moving average is lagging behind the price (currently at 1.17072). That MA can also be a risk level for shorts. Stay below is more bearish. Move above and the bearish waters are a little muddy.