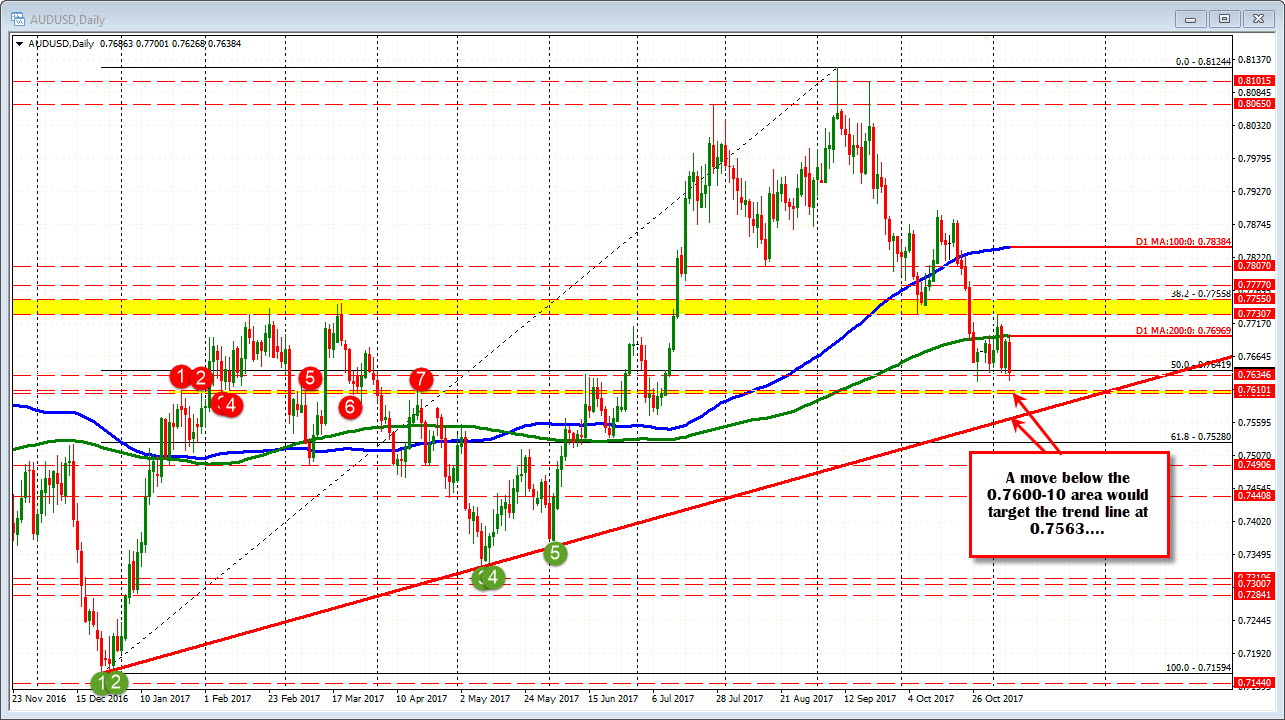

200 day MA/0.7700 stalled the pair earlier in the day.

The RBA kept rates unchanged earlier in the day. The pair moved higher on the neutral statement but ran into technical resistance at the 200 day MA (at 0.76969 today) AND the natural 0.7700 level (the high price reached 0.77001).

When the price rotated back below the 100 and then 200 hour MAs at 0.7676 and 0.76719 respectively, selling intensified. The fall took the price toward the lows from October and November.

The low in October reached 0.7624.

The low from yesterday (November low) reached 0.76377.

The low today bottomed between the two at 0.7627.

We currently trade at 0.7636.

If the bottom is in, the buyers need to take the price back above the 0.76377 area (there are 3 lows there going back to October 31 - see green circles). If it can't start developing value above that level, a break of the lows at 0.7624 is inevitable. Expect stops on a break, with further momentum toward 0.7600 and then a trend line on the daily at 0.7563.