Retail sales. Trade. AIG construction data all due out in the new day

In Australia in the new trading day, they have a bunch of data which will be released.

- AIG performance of construction will be released at 7:30 PM ET/2330 GMT. In July the index reached 60.5. There is no estimate

- Retail sales for July will be released at 9:30 PM ET/0130 GMT. The expectations is for a 0.2% increase after a 0.3% rise in June

- Trade balance data will also be released at 9:30 PM ET/0130 GMT. The estimate is for a surplus of A$1000M vs A$856M last month.

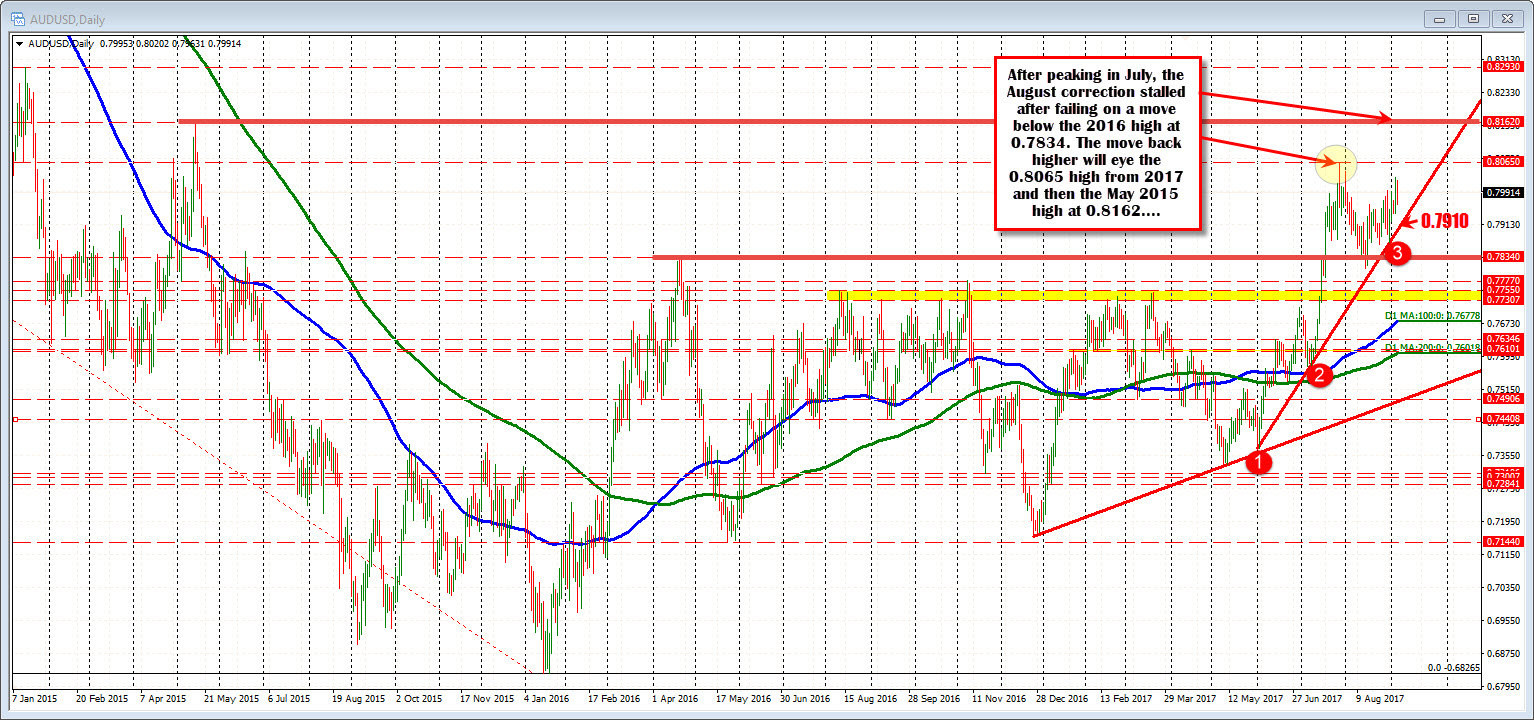

Technically, the AUDUSD is trading near high levels going back to 2015. The current price is trading at 0.7992. The highest close in 2017 comes in at 0.8002. A move above that is more bullish

The high price for all of 2017 came on July 27th at 0.8065. That high was the highest going back to May 2015.

On a move above the 0.8065, I would expect more upside momentum (on stronger data) with the next major target being 0.8162. That price is the high from May 14, 2015.

Staying on the daily chart, the 0.7910 is a trend line with 3 points on it. At the beginning of September, that trend line was tested and held (red circle 3).

Drilling to the hourly chart, a close downside target that traders will eye comes in at 0.7966-68 area. The upward slopoing trend line and 100 hour MA come in at that level. The 100 hour MA held at the low today. It also held on Monday and into Tuesday's trading. So there is a recent history of traders leaning against that level.

A move below would have the 200 hour MA and 50% retracement at 0.7950-51 would be eyed. Below that and the 0.7910 trend line from the daily will be targeted.

So the pair is positioned more for a bullish run with the price near the highest close for the year (and the highest since 2015). However, there are key levels above that still need to be busted. On the downside, the hourly MAs are key targets. Followed by a tested trend line on the daily. A move below those levels will be needed to start to turn the bias around a bit for this pair.