Price remains in the months up and downs trading range

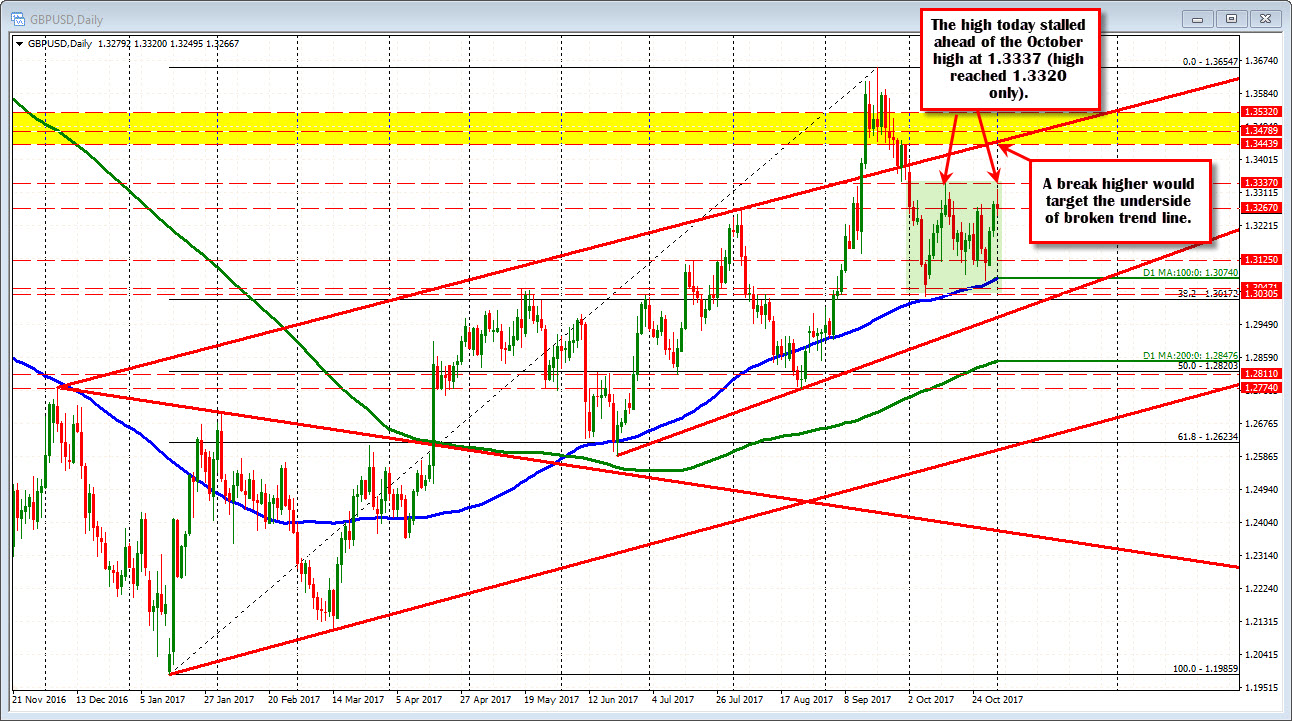

The GBPUSD moved higher and traded at the highest level since October 13th (high on that day reached 1.3337). The high today got to 1.3720 before rotating back lower. So, the price remains within the confines of the month long up and down trading range ((see green shade area in the daily chart below)..

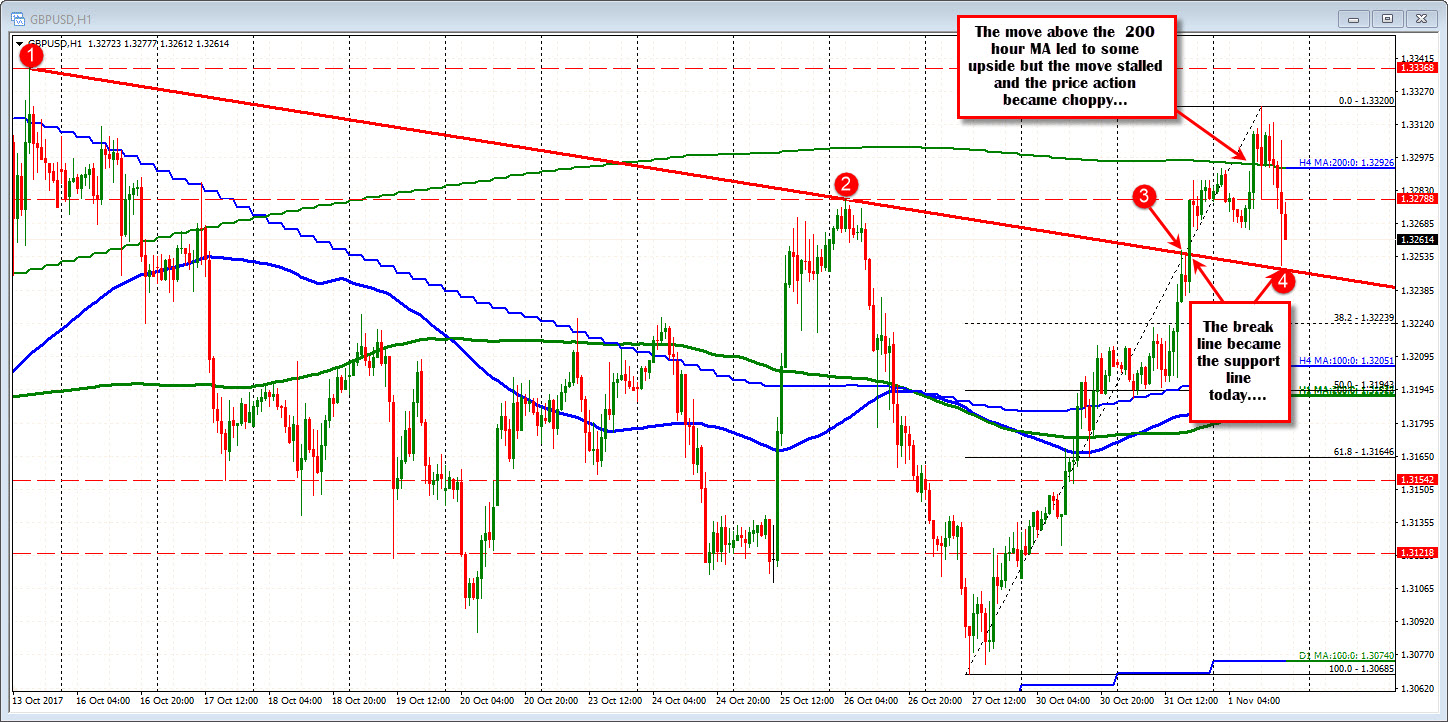

The move higher today took the price above the pairs 100 hour MA (see green line in the hourly chart below), but it has not been a clean, momentum break. In fact, if you bought the break, there was a 28 pip move higher, but since then, the price action then became more choppy.

In the NY session the pair moved even lower BUT, I will say, the broken trend line that propelled the pair higher yesterday, was "remembered" today, and the price bounced off that level (see red circle 4 in the chart below). That trend line will be eyed for bullish/bearish clues going forward. A move below would be more bearish and should lead to further downside price momentum. Staying above continues to give the nod more to the bulls (as long as it holds).

Taking a broader view from the weekly chart below, the post-Brexit swing highs in June, July and September 2016, come in between 1.3443 to 1.3532. In between is a swing high at 1.3478.

In September 2017, the price moved above those levels but the price came back down. Keep that area in mind going forward (see weekly chart above). There are two central bank decisions with the Fed and the BOE later today and tomorrow. The BOE is expected to hike for the first time in over a year. The Fed is expected to continue to look toward December for their next hike.

Also of importance on the weekly chart is the fall took the price back below the 100 week MA at 1.3262. We trade around that level now. It can be a barometer for bullish and bearish for the rest of the week.

Fundamentally, with the Fed today and the BOE tomorrow there is the potential for whipsaw price action. The Fed is not expected to do anything today but the market will react to statement changes. The numbers have been better. The stock market is buoyant and the government is working toward some tax reform. Does that change their mind a little or do they ignore the things like tax reform until they see the "whites of its eyes"? We will see what the words say.

The BOE is nearly a lock for a hike tomorrow. Is it one and pause or the start of something more. PS Brexit is still quite sloppy.