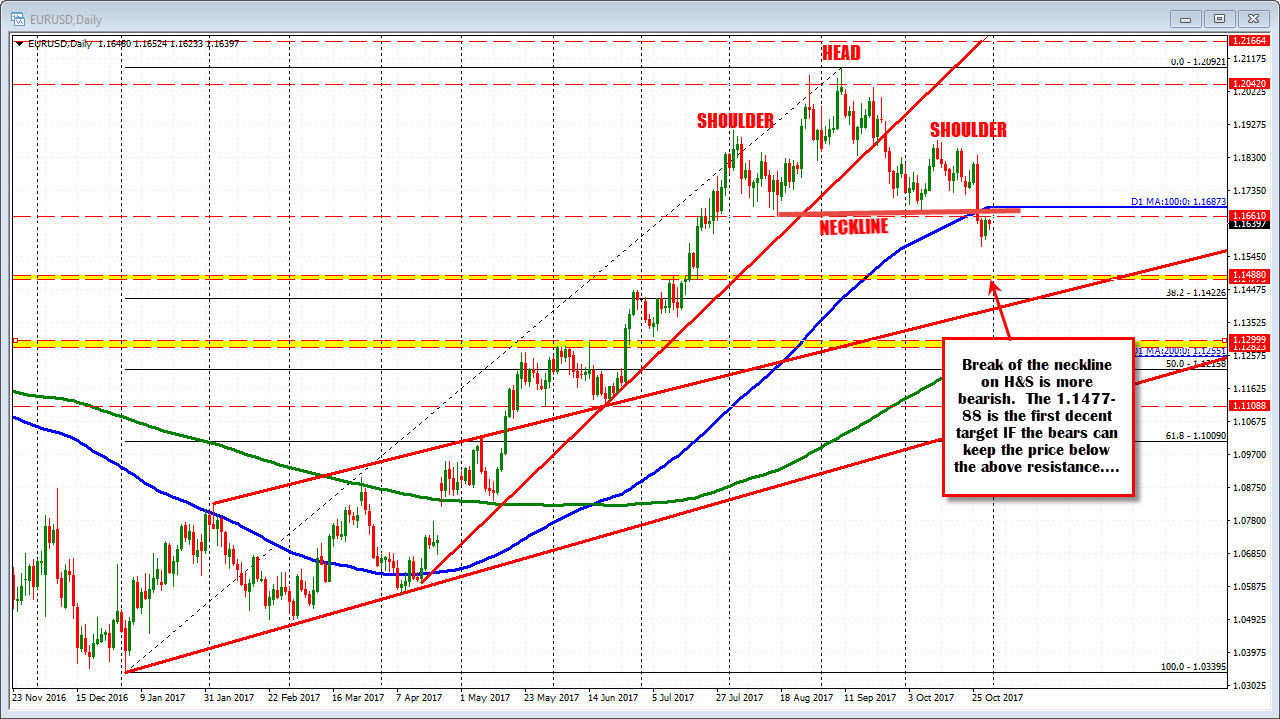

Cracked lower below key levels last week. Corrective action so far this week.

Last week, the EURUSD cracked below:

- 100 day MA (currently at 1.16873)

- The low from October 6th at 1.16689

- 200 week MA also at 1.1668 this week.

- Neckline from the daily chart head and shoulder pattern

All of that is bearish, bearish, bearish. Stay below that area is paramount for the bears to remain in control. A move above those levels, would certainly disappoint the shorts on the failure. KEY....KEY...area.

The price chopped higher yesterday with the pair moving up to a high of 1.16577 - -within 11 pips of the lower levels of topside resistance area. Today the price is mostly lower but going no where. The range is only 29 pips. The average range over the last month has been 73 pips. There is room to roam if the pair can get a push.

Drilling further to the 5-minute chart, the price is chopping around the 100 and 200 bar MA (blue and green lines and is below a topside trend line at 1.1645, and above a lower trend line at 1.1627. Those trend lines are converging closer and closer together. The market is non-trending. We can look for a break and run at some point.

Sellers in control below the key upside resistance. Can the pair get a bigger push outside the confined range? At some point we will. Look for the break and run.