100 bar MA on the 4-hour chart and the top of ceilings and floors come in at 1.1836 area.

The EURUSD has continued it's move higher on general dollar weakness. The greenback is ignoring what has been better data all around with higher durables and higher housing numbers. The estimates for 3Q GDP have also increased because of the better data (3Q data will be released on Friday), but don't tell that to the market.

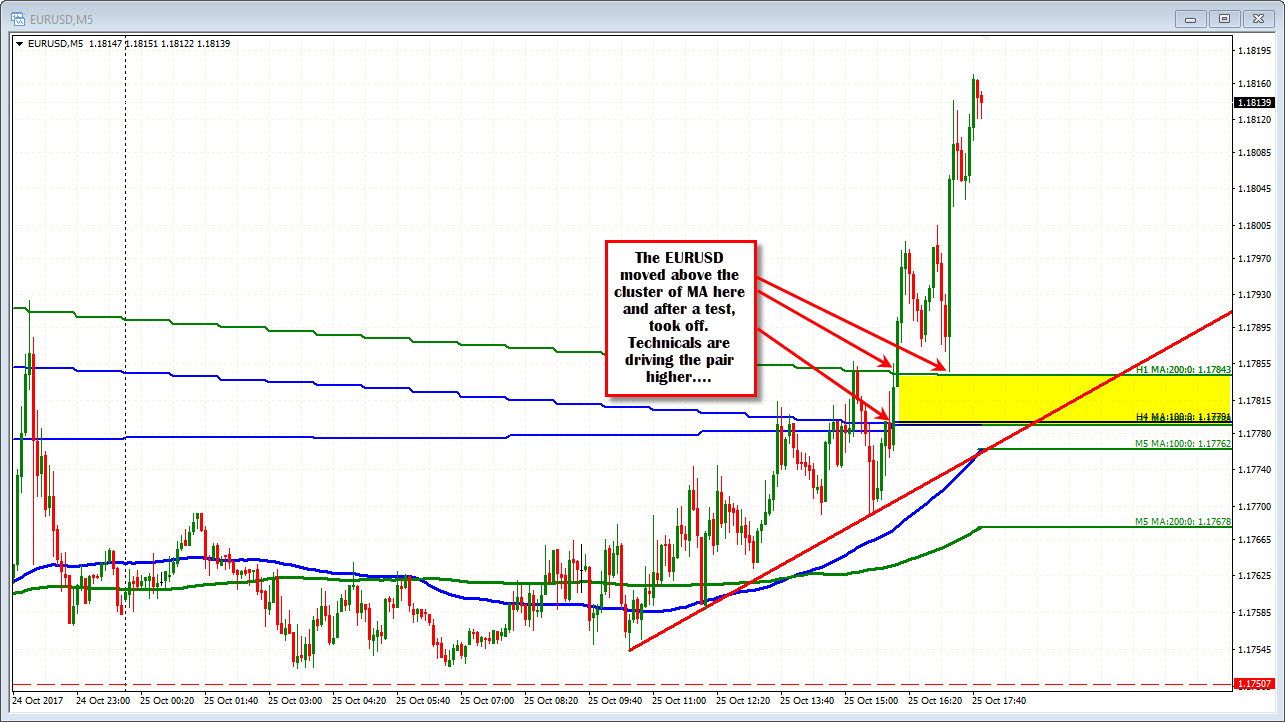

The pair today moved above the 100 bar MA on the 4-hour chart and the 100 hour MA at the 1.1779 area and then the 200 hour MA at 1.1784 and that has helped propel the price higher (see chart above).

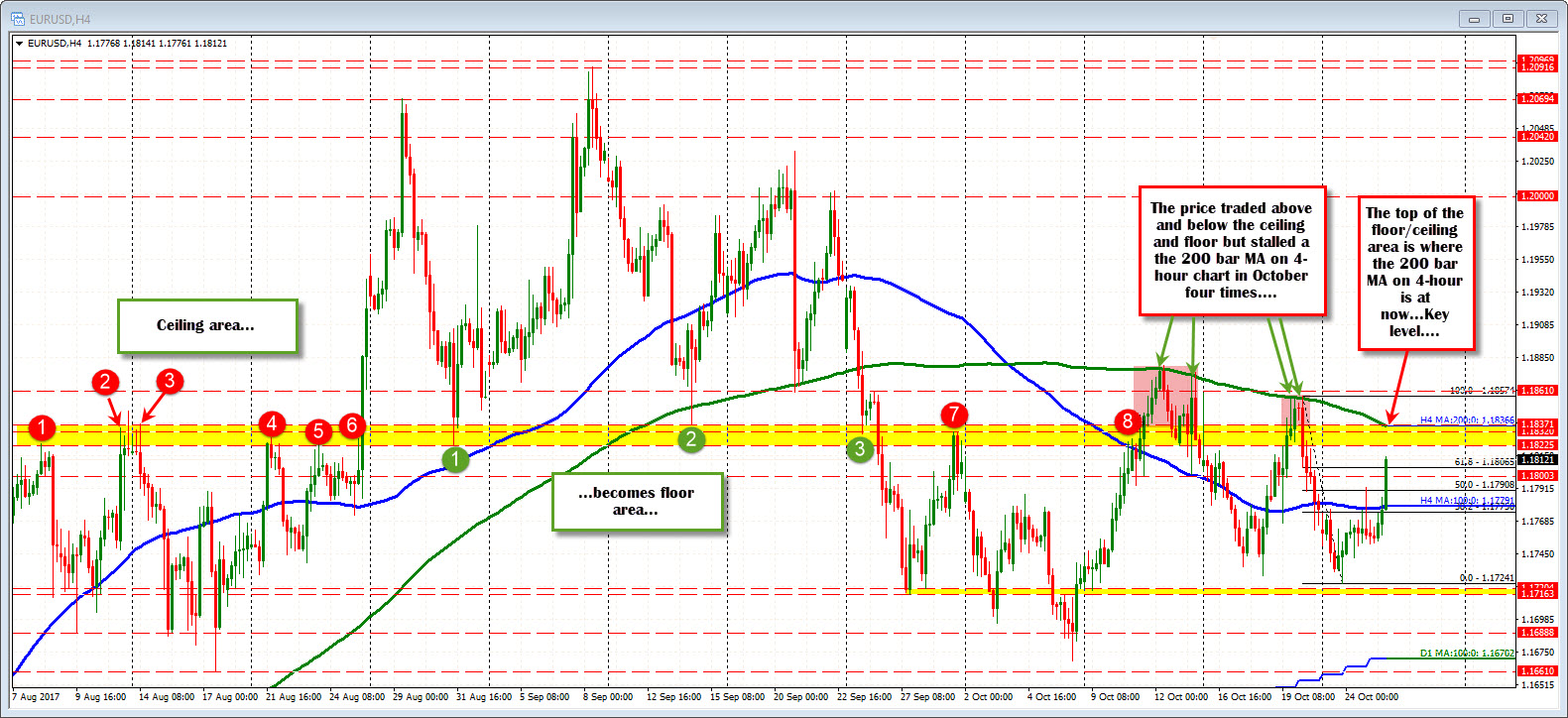

The price move higher is taking the pair to another key area. That area is defined by a ceiling (see red circles in the chart below), and then a floor (see green circles), and then the 200 bar MA on the 4-hour chart (see green line in the chart below).

The yellow area defines the ceiling/floor area between 1.1822-37. The 200 bar MA on the 4-hour chart comes in at 1.18366 currently. The high reached 1.1817 so far and backed off a bit (trades at 1.1808). Keep that key area in mind on continued upside momentum. I would expect it to attract sellers.

The ECB meets tomorrow and concerns about what they have to say might be contributing to the more bullish run today. That area will be key not only day but also through the decision tomorrow. So be aware.

Below are some previews: