Trying to move away from neckline/100 day MA

The EURUSD is trading near the 3+ month lows (the October low came in at 1.1573 and last week's low reached 1.1593). The low today just reached 1.15818. That was the low for the trading day. The price action has been choppy, but the price is lower on the day (closed at 1.1600 area on Friday) and the price is moving away from the 100 hour MA (blue line on the hourly chart below) at 1.16347. More recently we have also moved below the low from last week at 1.1593 and the swing low from Wednesday at 1.1605. They are close risk for traders now.

Choppy or not, the price action is moving away from the overhead levels.

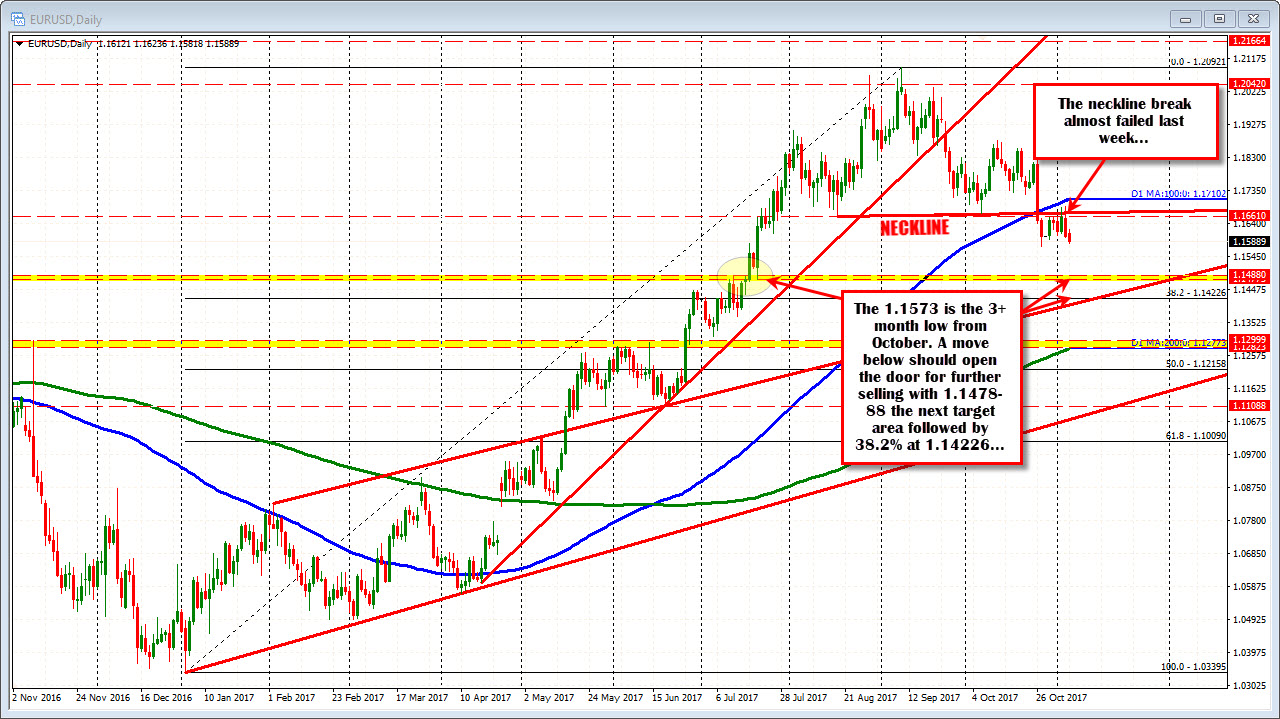

Of most importance for the technical traders is on the daily the neckline of a head and shoulders was broken back on October 26th. That neckline break was in danger of failing last week (see chart below), but the price moved lower on Friday, saving the day for the bears.

The lower level today is moving away from that line. Bearish.

The price is also moving further away from the 100 day MA which is moving higher (blue line in the chart below), at 1.1710 today. That too gives more of a bearish bias.

The bears are trying to get the engine started on the downside. A move below the October low at 1.1573 should open the door for more momentum with 1.1478-88 a target area on further weakness. The 38.2% comes in at 1.14226. That too will be targets.

Close risk now is if the price were to take back some of the swing levels from last week including the low from the week at 1.1593 and the swing low from Wednesday's trade at 1.1605. Ultimately though, a moved back above the 100 hour moving average at 1.16342 currently would need to be busted to give more sellers a cause for pause.