...but stalls at a technical target

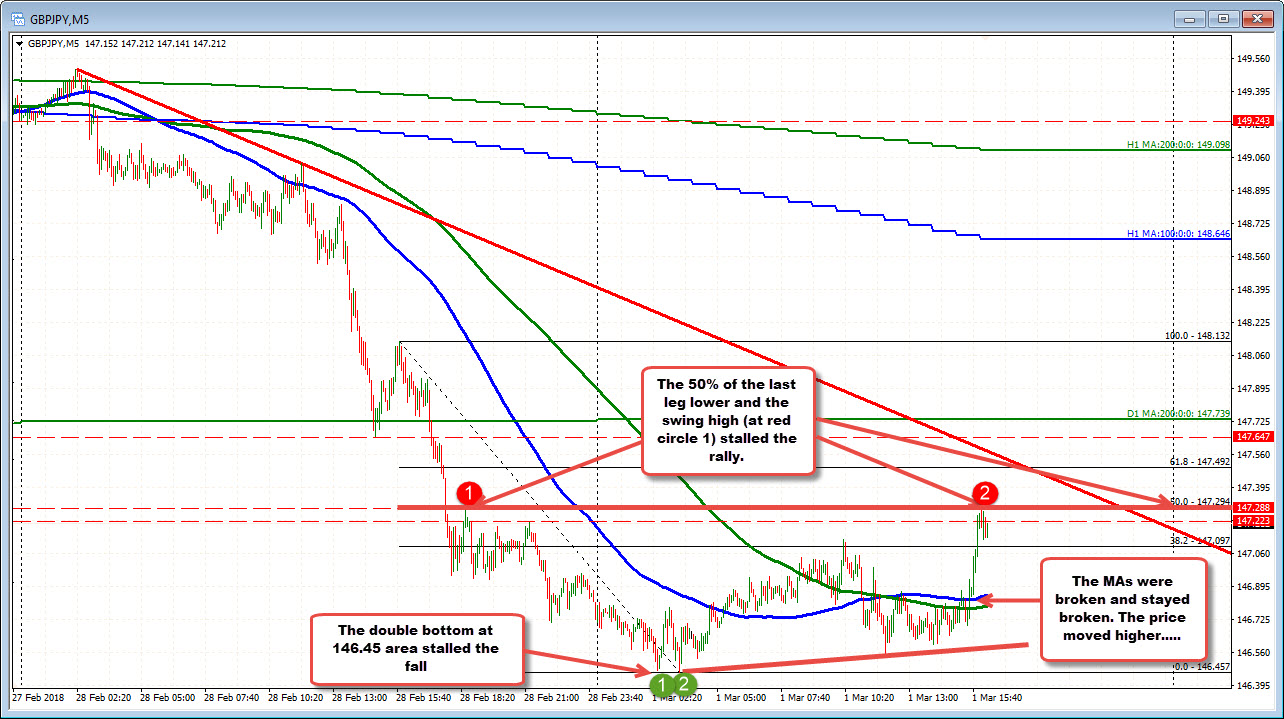

The GBPJPY was the biggest decliner in trading yesterday. It trended lower and lower with not much of a correction (see 5-minute chart below).

The last leg lower took the price from 148.13 corrective high to the double bottom in the Asian session today at 146.45. Since then, the price moved above the MA lines (blue and green line), fell back below in the London late morning session, and has now moved back above those MAs with more momentum over the last hour or so (they come in at 146.85 and 146.78 respectively now). Some of the sellers seem to be covering before Powell. The technical break above MAs were a catalyst.

The corrective move higher did have a limit so far. The price is testing the 50% of the last leg lower and a corrective swing high from yesterday at 147.294 area. Be aware.

As Powell approaches, it would be better if that level holds and the market settles between that level at 147.29 and the 100 and 200 bar MAs below at 146.78-85. His comments can then give the pair the push one way or the other..

I would think, the more hawkish, the more bearish for the pair. If he dials it back a bit, a move higher and above the 147.294 would be eyed.

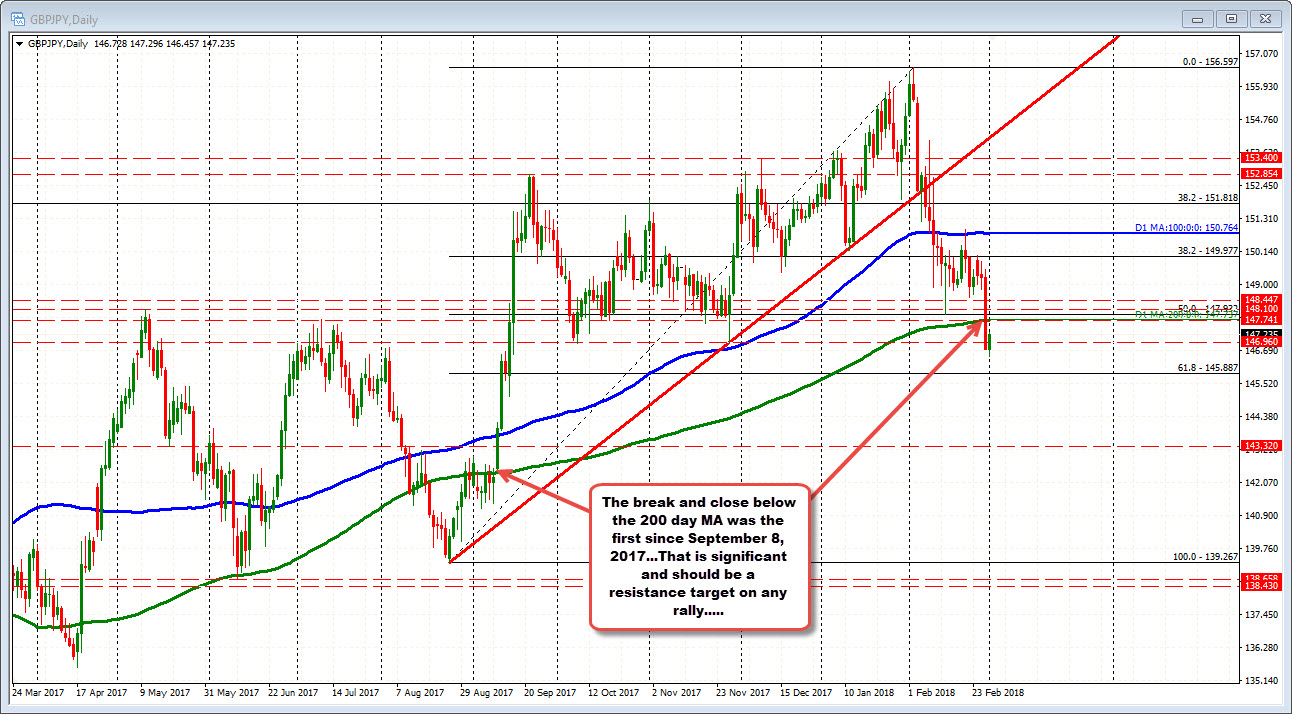

NOTE, however, that on a move higher the 200 day MA comes in at 147.74. That will be a key upside level to eye. The break lower yesterday and close below the MA was the first close since September 8th, 2017. Technically, that type of break is not given up easily by the market. Expect a tough battle if the price does test.