Bears trying to push the downside, but fall stalls

As Powell Q&A begins, the price of GBPUSD has moved to new session lows. The better ISM is a help to the dollar. Markets are awaiting on more clues from the chair. So far, the focus is not on the economy/policy.

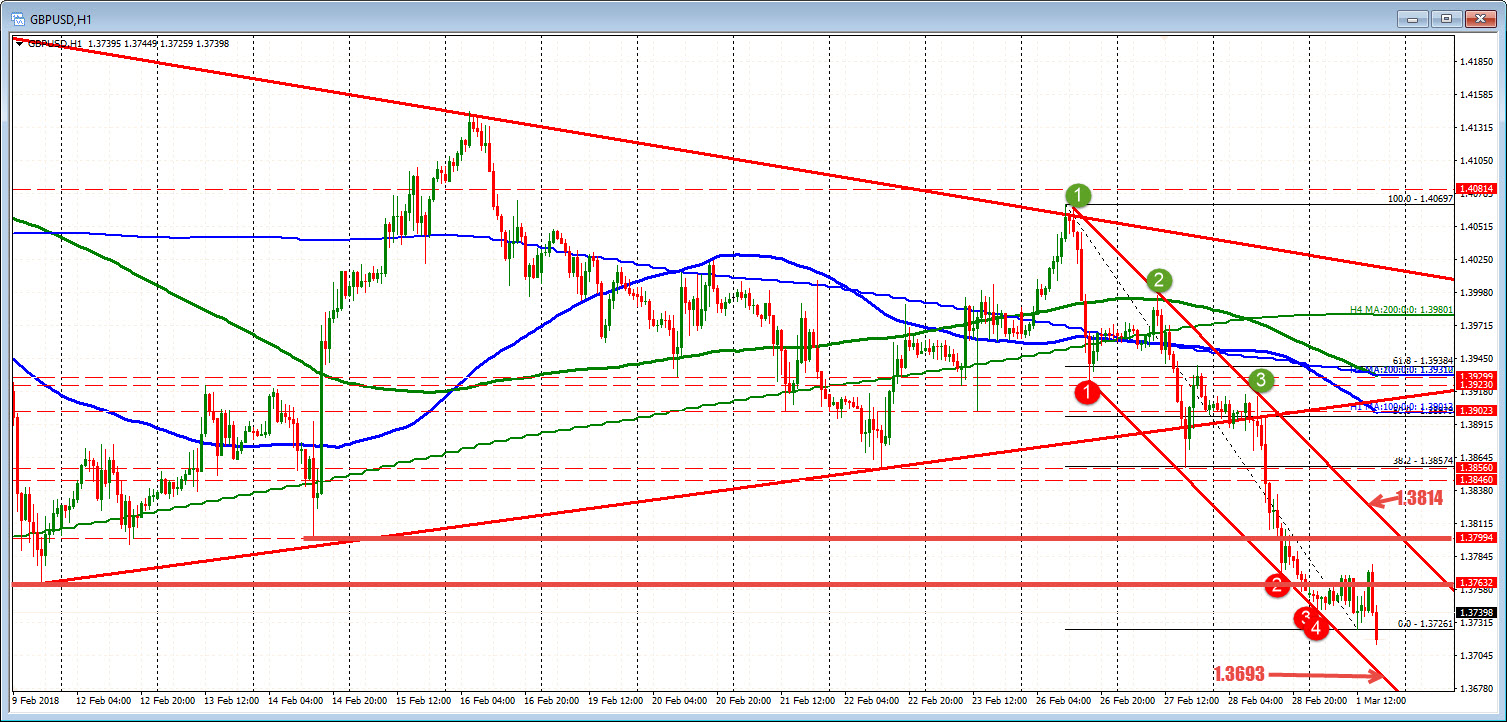

Technically, looking at the hourly chart, the price accelerated from a topside trend line yesterday (see green circle 3). The fall took the price to a lower channel trend line (see red circles 2, 3 and 4), and the momentum slowed.

Today has seen sideways to down price action, but it is up and down. The last hour made new day highs, but the current bar reached to new lows. Overall the range for the day is narrow at 65 pips even with the extensions. There is room to roam.

The "guardrails" for the channel come in at 1.3693 on the downside. ON the topside it is at 1.3814 (and going lower).

The price is rebounding as I type and is back above the earlier low.

If the break lower is to fail, taking out the 1.3763 would be an upside target. That was the low from Feb 9 and would be step 1 for a recovery.

Step 2 would be a move above the swing low from Feb 14 at 1.3799 (call it 1.3800) and then the topside channel trend line at 1.3814 (and moving lower). Those are not going to be too easy given the run lower and bearish bias.

A break back below the 1.3726 will target the lower trend line at 1.3693.

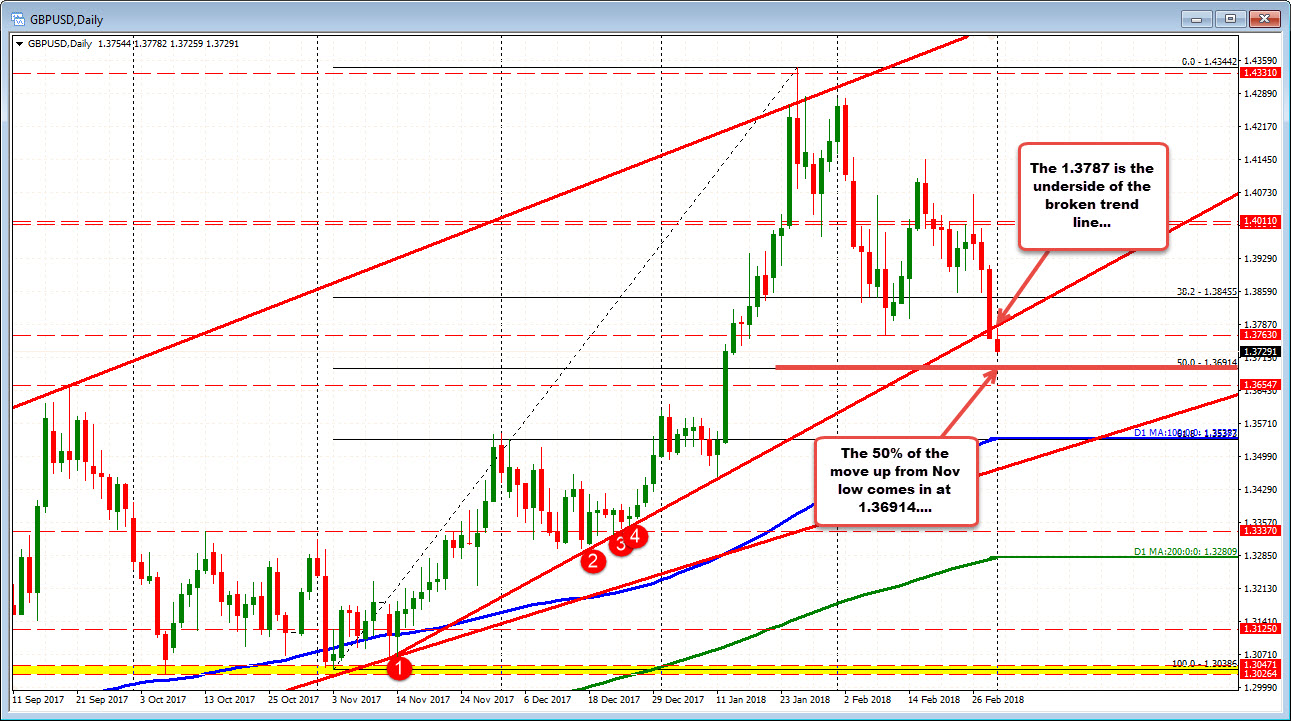

Looking at the daily chart below, the 50% of the move up from he November 2017 low comes in right around that hourly lower trend line at 1.36914. The combination should solicit some stall at least, on a test (with stops on a break).

On the topside from the daily chart, the 1.3787 level will be eyed. That is the underside of the broken trend line. Yesterday that trend line was broken. It should be defended on a test today.