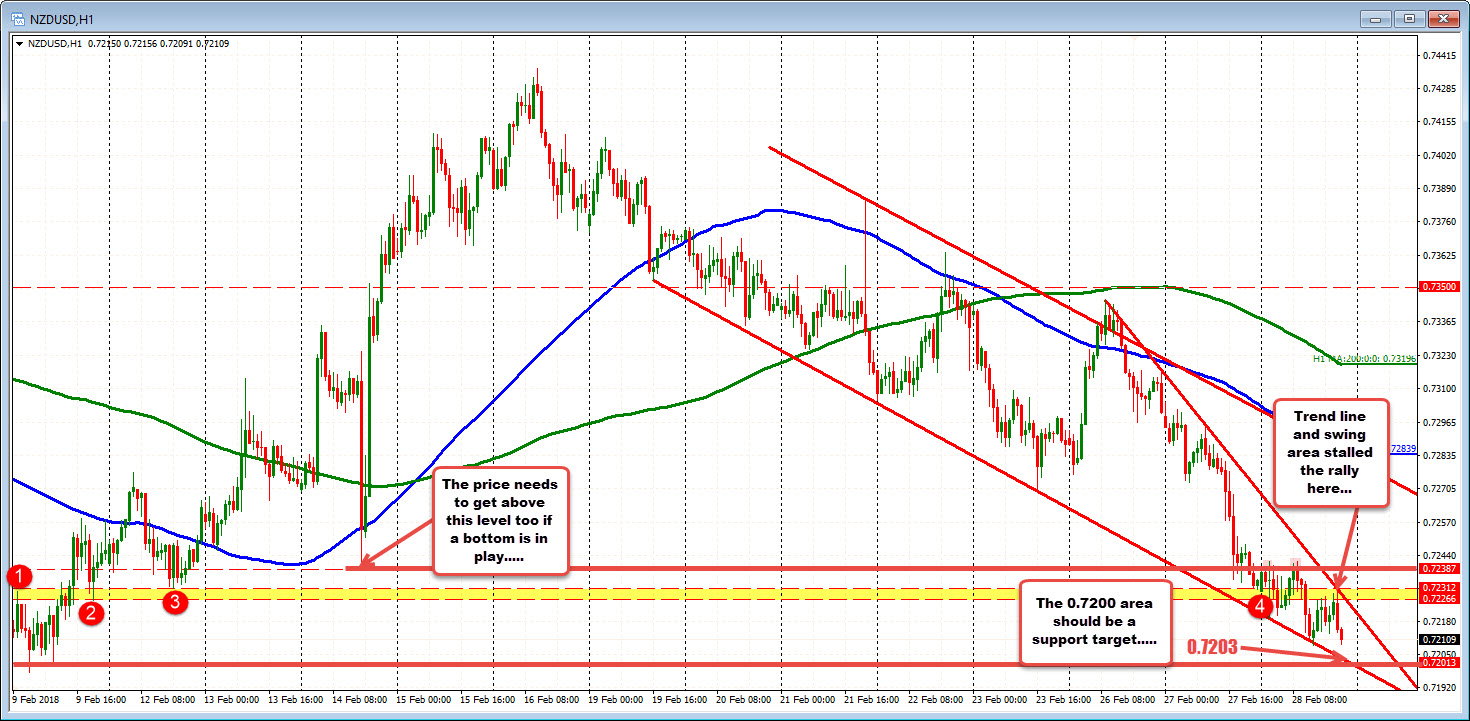

Key trend line on the hourly is being approached

The NZDUSD is keeping the bearish bias in a quiet-ish up and down price action. The NY session high just stalled at a higher trend line. The low today stalled near a lower trend line.

The price is moving back toward the lows but has that lower trend line support approaching at 0.7203 (and moving lower). If the pattern continues, there should be support buyers against the level.

What would hurt the bearish bias?

A steeper trend line connects recent highs this week. That trend line cuts across at 0.7229 currently and moving lower. A move above, takes some steam out of the downside momentum but there are other hurdles including the Feb 14 swing low at 0.72387. The Asian and early European sessions tried to get above but failed. The trend line and the 0.72387 are the minimum hurdles for the buyers now.

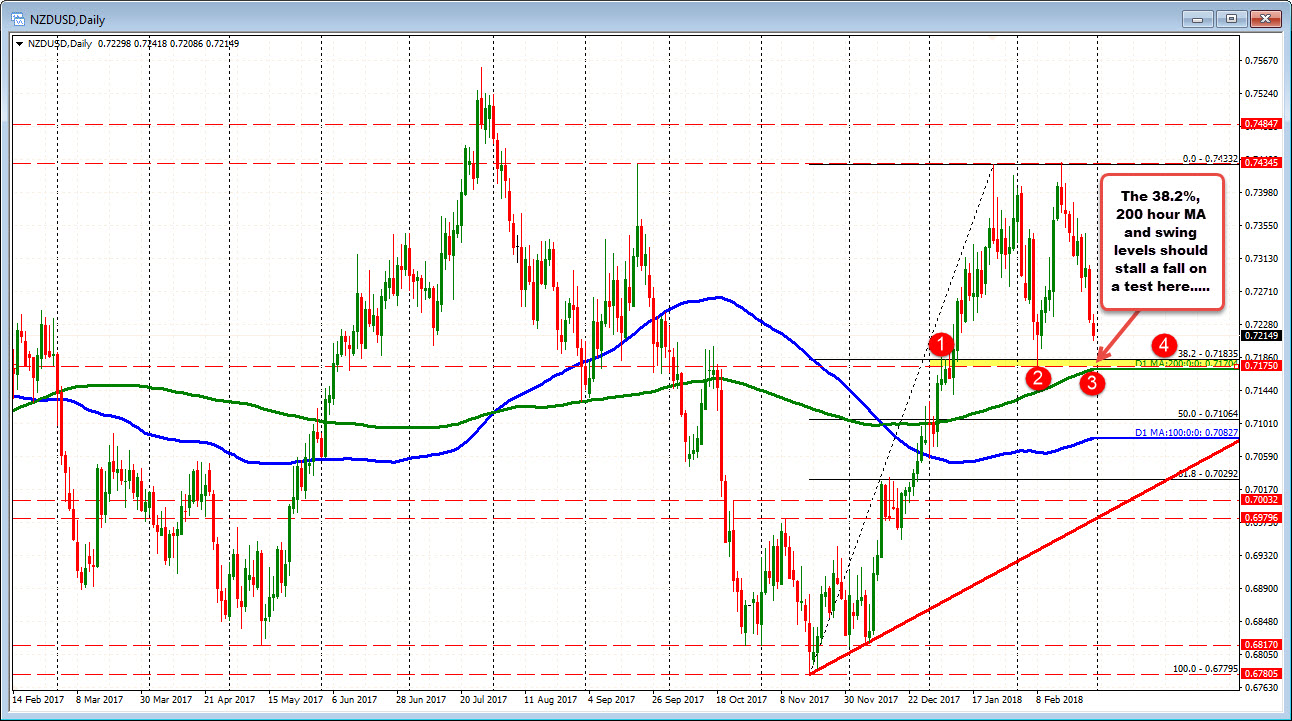

Taking a broader look at the daily chart, if the sellers keep the downside going, the 0.71835 is the 38.2% of the move up from the November low. Below that, the 200 day MA at 0.71704 will be key for sellers. The price moved above the 200 day MA in the first few trading days of 2018. In between is the Feb low at 0.7175.

That area - between 0.7170 and 0.71835 should give even the sellers/bears, some good reasons to stick a bid in the market. So remember the area.