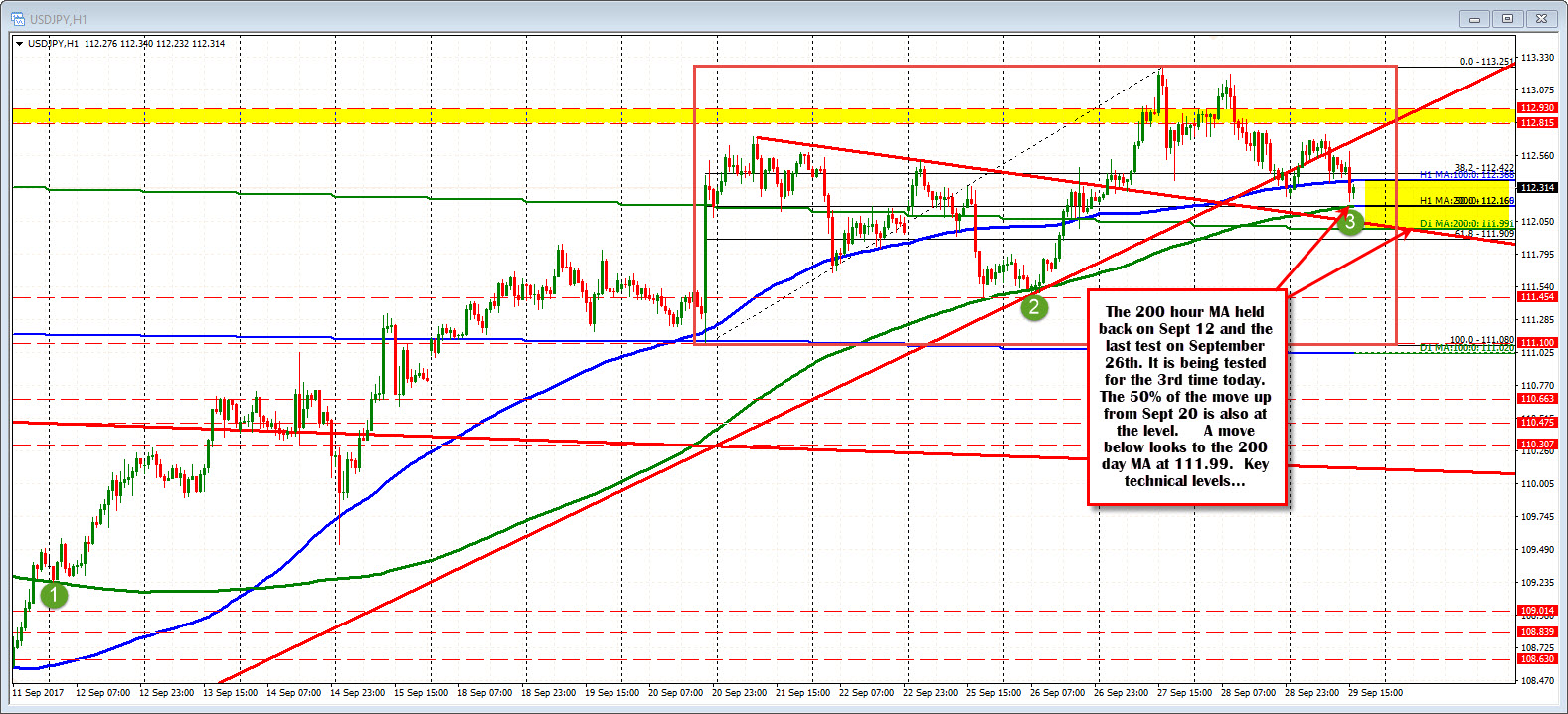

Stepped below trend line and 100 hour MA.

The USDJPY is flirting with a bunch of technical levels as it trades at session lows.

Looking at the hourly chart above,

- the pair had a trend line coming up from the September 8th low. The price traded below and above and back below yesterday and today.

- The price moved tested then fell below the 100 hour MA (blue line at 112.368)

- The price tested the 200 hour MA at 112.17 (low reached 112.206). The 50% of the move up from the September 20 low is also at the level. The last two tests of the 200 hour MA (see green circles) stalled at the 200 hour MA. Today is the 3rd test.

So sellers are trying to take control technically on the first two breaks but is finding the 200 hour MA a tough nut to crack.

Making things more difficult even on a break, is that the 200 day MA at 111.991 is also on the downside horizon.

So the downside sledding is a tough one.

One thing that might help the sellers if a ceiling can be held, is the range is only 52 pips today. The 22 day average is 102 pips. So the range is light. There is room to roam.

Sellers will like to see the 100 hour MA to hold any rally now. That would give more confidence to the move lower today.

Looking at the yields, the changes are less than 1 bp, but closer to the lows in quiet trading. A move lower, helps the sellers cause.