Up and down consolidation over the last 3 trading days

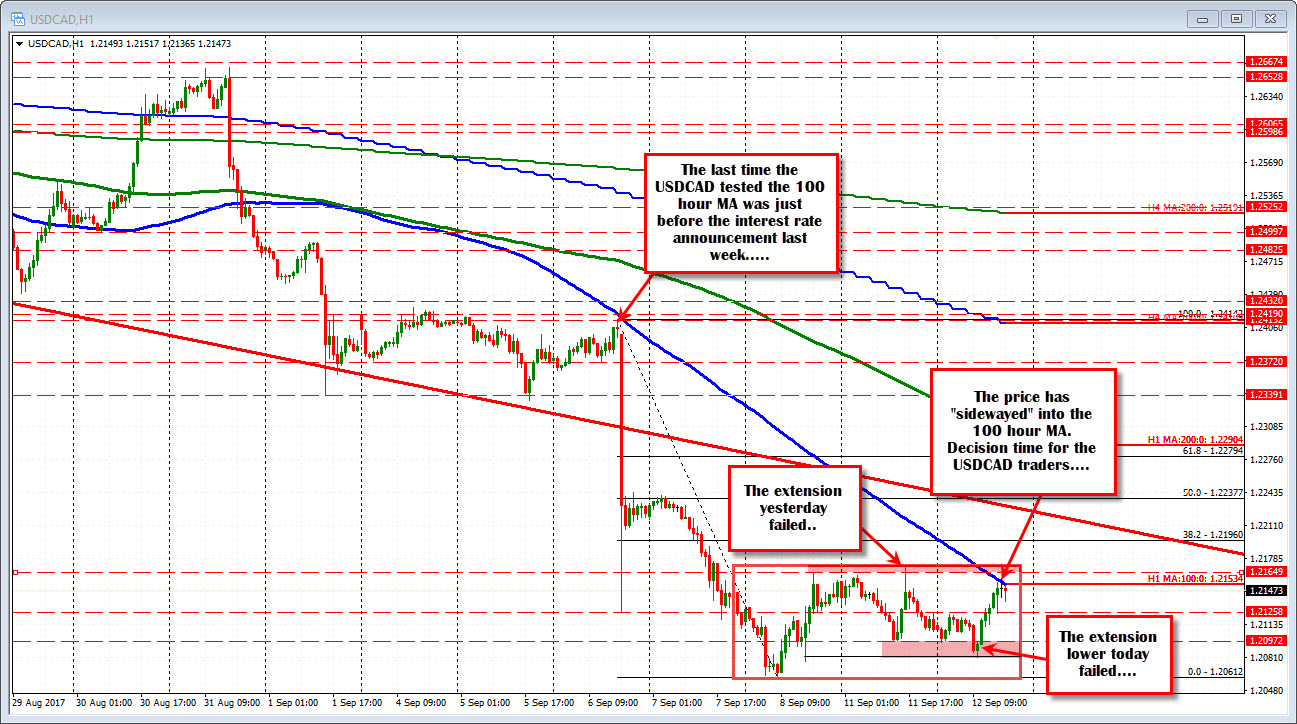

The USDCAD has been "sidewaying" over the last three trading days. After bottoming on Friday at 1.20612 (lowest low since May 2015), the pair has been moving up and down. The high yesterday did take out Friday's high (1.21649) by about 5 pips (high reached 1.21695), but that move failed. The low today, took out the low from yesterday (low was 1.2097). The low today reached 1.2081, but that break stalled and failed too.

So there is a little hesitation to the upside and to the downside too.

The consolidation has allowed for the 100 hour MA to catch up with the price. That MA comes in at 1.21534 currently. The price has been banging against that MA over the last 3 hourly bars. Even though the price is "sidewaying" its way to the declining MA line, the line nevertheless tends to define bullish above and bearish below. Look for a move away. The last time the price tested that MA was back on September 6th before the rate announcement. . At that time the price rotated back to the downside. Today, the MA is much lower though and there is no rate decision. Nevertheless, it still represents a decision time for the market. Go higher and above the MA, or go lower and look to retest the lows.

Decision time for the market.