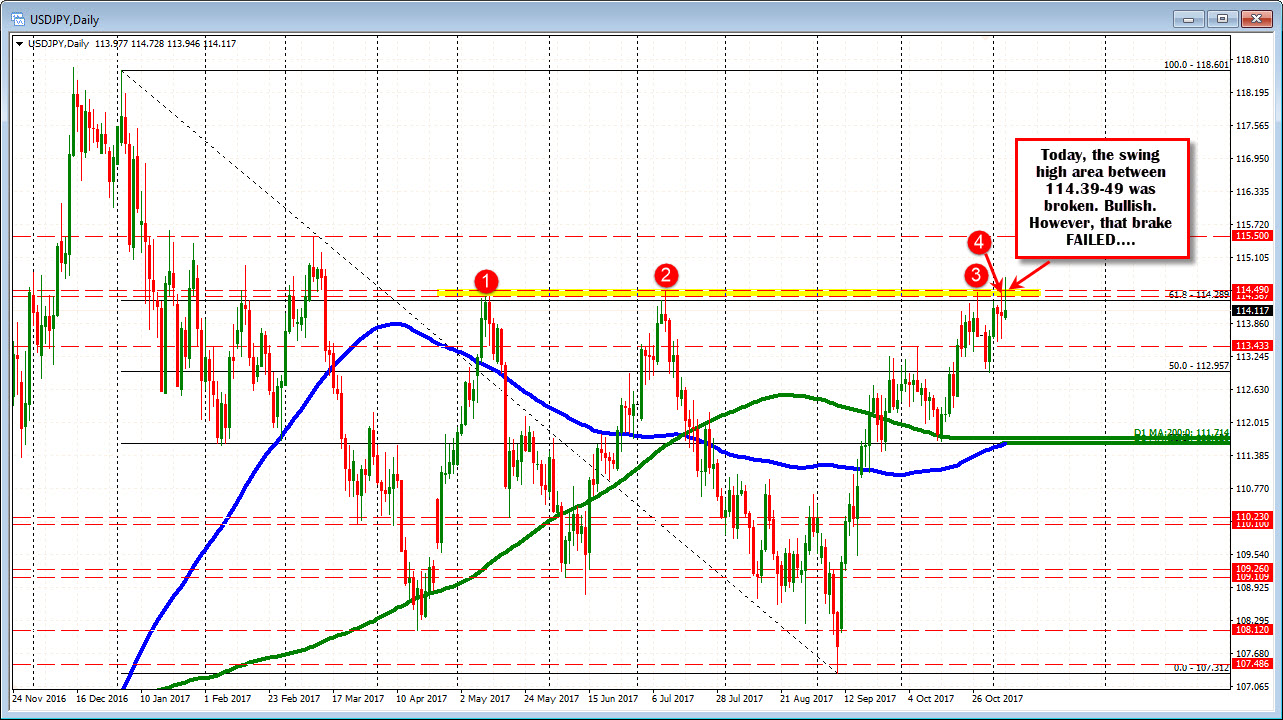

The break of the quadruple top (area) failed.

Last week, traders added November to the swing high months that stalled in the 114.39-49 area (May, July, October and November). That ceiling for November only lasted one day, as today we saw the price break above, move to a high of 114.728, BUT fail....Not good news for the buyers.

You can see the disappointment in the 5-minute price action. Stops were triggered on the way through 114.49 and the price moved higher. The fall back below the 114.49 and then 114.39 turned buyers to sellers (the high corrective price once through 114.39 stalled at Friday's high = SELLERS).

The fall lower has stalled at the 100 hour MA below (blue line on the hourly chart below. We are seeing a modest bounce off that support level.

What now?

The 100 hour MA, and then the 200 hour MA at 113.838 (green line in the hourly chart above), are the levels to get below to turn the tide more negative for the pair. By the way, the 50% of the move up from last weeks low comes in at 113.838 as well (home to the 200 hour MA). So the sledding is a bit tough on the downside.

On the topside, the buyers had a chance on the break of the quadruple top. I can't say, it won't be broken again going forward, but traders will lean again on any tests toward that level. I would expect patient traders to keep a lid at the area....once again.

PS If the selling is able to pick up some steam, the 113.43 is the swing high from early October (see daily chart) and the 112.957 is the 50% of the 2017 trading range. That level did stall the fall last week.