Fall stalls at the 100 day MA

Adam point out that the USDJPY is seeing a rebound as bond yields give the pair some life (see post here).

The 10 year is moving away from the 2.4% level and trades at the high yield for the day at 2.4597% - up 5.2 basis points.

There is a technical reason to give the pair a boost too.

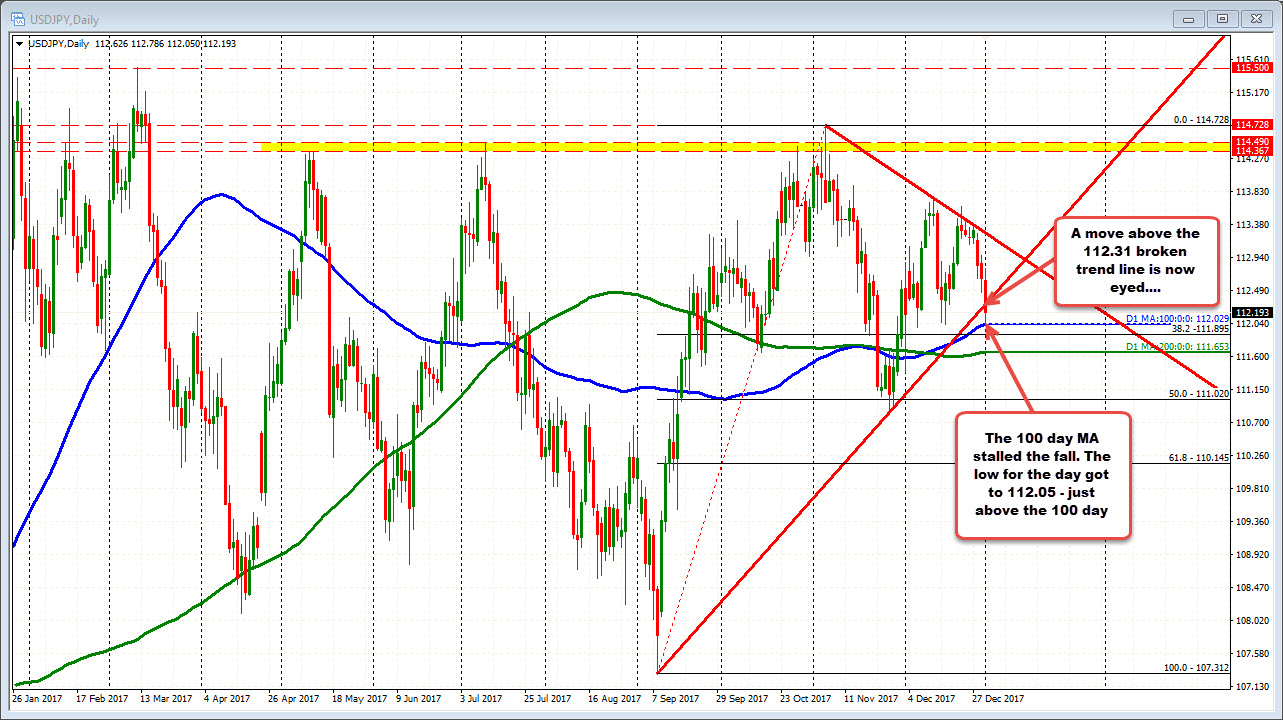

Looking at the daily chart above, the 100 day MA comes in today at 112.029. The low price today stalled at 112.05. Buyers showed up against the key MA level as risk was defined and limited. We currently trade at 112.211.

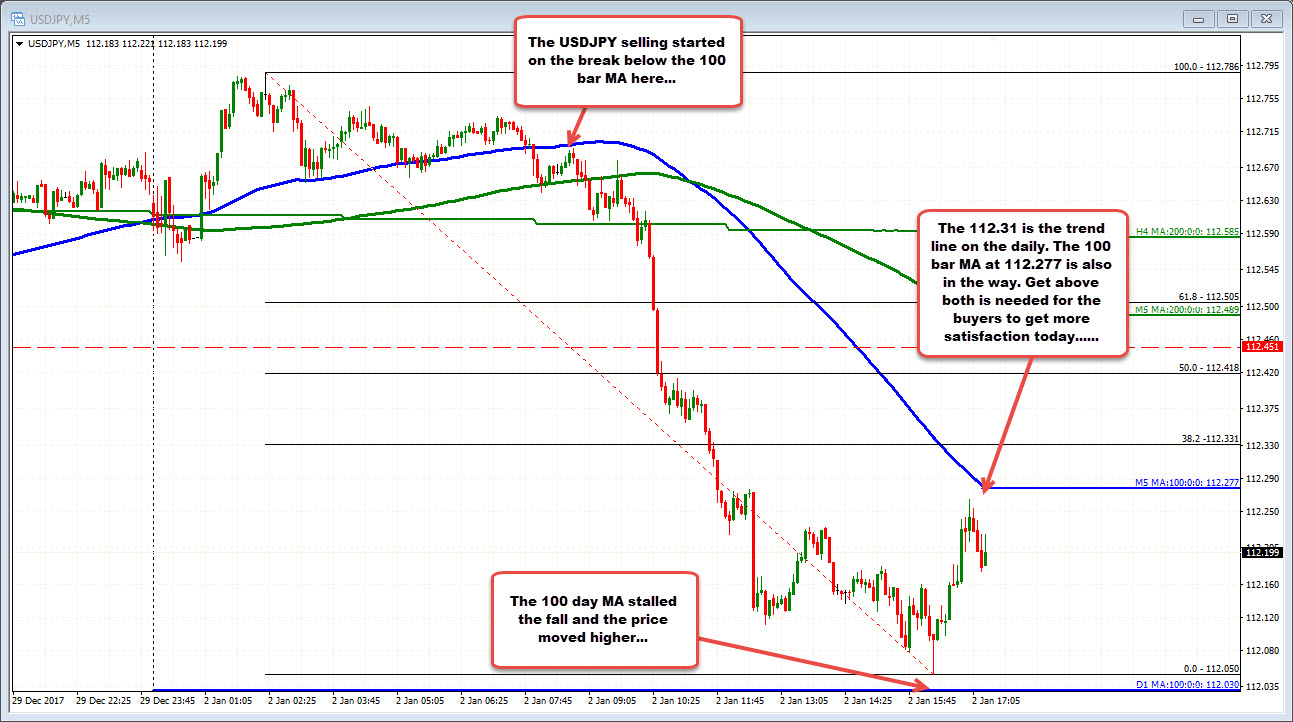

Those dip buyers are now looking for a move back above a broken trend line on the daily chart at 112.31. A move above that line should give the longs some needed relief and force some shorts to think about covering. The corrective high has so far reached 112.26. So the buyers are not out of the wood just yet (see 5-minute chart below). The 100 bar MA on the 5-minute chart (blue line in the chart below) comes in at 112.277 currently (and moving lower). A move above is also a step in a corrective bullish direction for the day.