Looks to test the next key targets at the 200 hour MA and the 100 hour MA

The USDJPY is trading higher after both Chicago PMI and the consumer confidence data impressed (big beats).

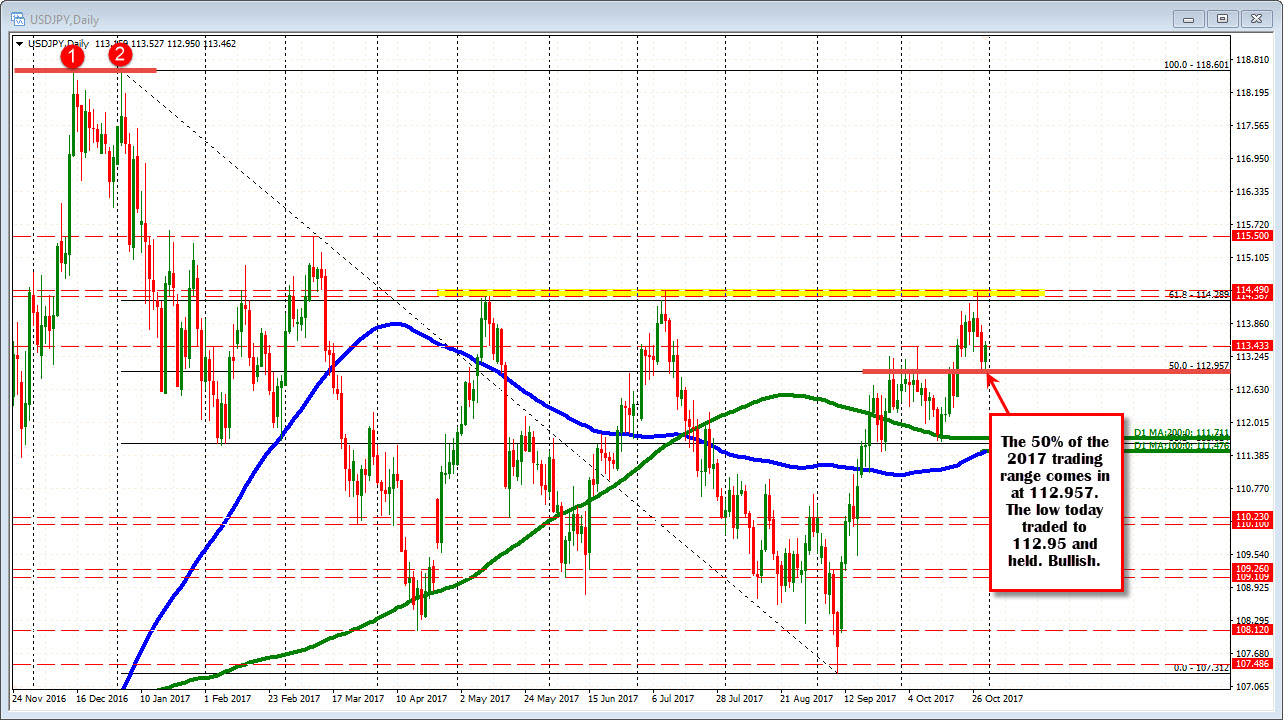

The pair got a push higher off the 50% of the 2017 range (at 112.957). That was more bullish and got the buyers going. The better data is helping to push even higher (good for the dip buyers...).

Looking at the hourly chart below, the pair did break below its 50% retracement at 113.04 but held at the daily 50% level. That failure helps the bullish run.

The price just pushed to within a few pips of the 200 hour MA at 113.549 (the high just reached 113.527). The 100 hour MA is at 113.649. That area is the next hurdle for buyers. Right now intraday sellers are leaning against the low risk area, hoping for a rotation back lower. I am not all that surprised.

However, if there is a break, look for the sellers to turn to buyers again and a further run higher.

The range today is 58 pips. The 22 day average is 69 pips. So there is a little more room to run to get to the average range (does it stall at the 100 hour MA?).

US yields are up marginally with the 2 year up 1 bp. The 10 year is off the low at 2.3558% and trades at 2.3703% - unchanged on the day. Getting back above 2.40% will be eyed.