Forex news for NY trading on March 5, 2018

- Canada foreign minister comments on NAFTA, tariffs

- US stocks close with >1% gains today.

- Mexican economy minister remarks on NAFTA negotiations

- US Trade Rep Lighthizer: We haven't made progress that many had hoped

- Crude oil futures settle at $62.57

- AUDUSD stalls around daily MAs as market prepares for retail sales/RBA decision.

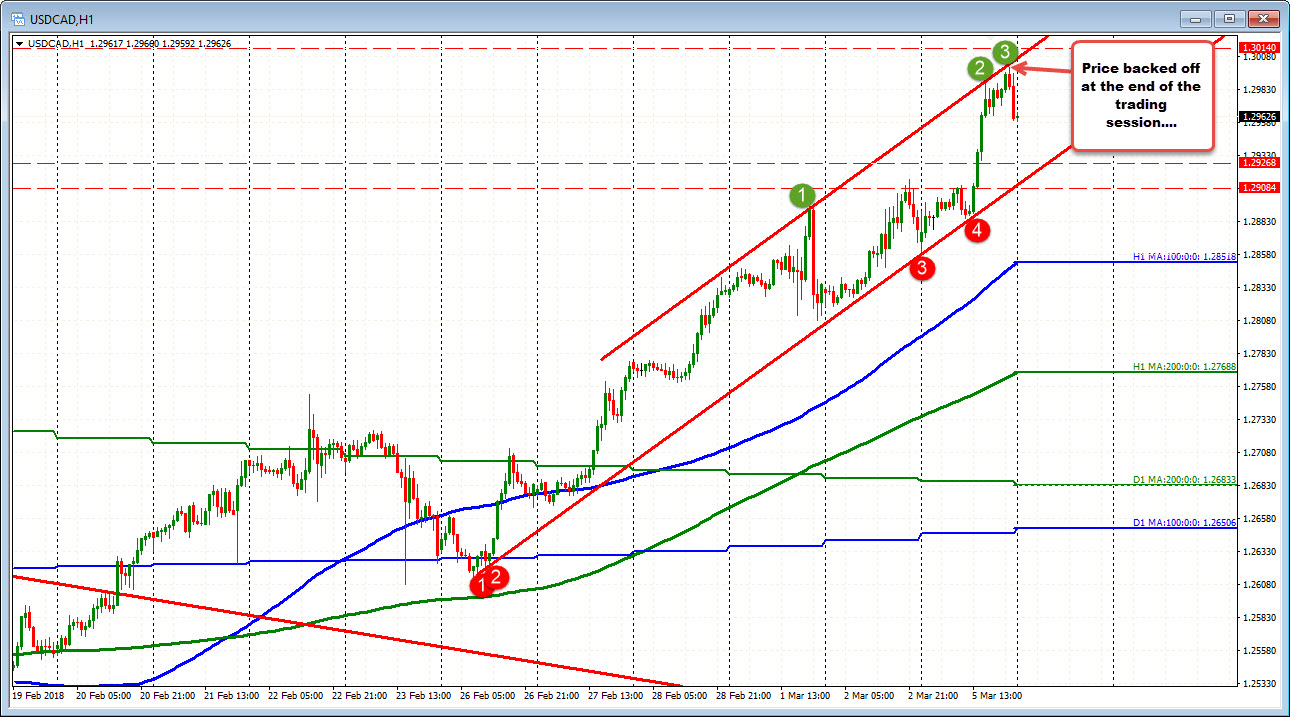

- USDCAD breaks out today, but stalls at topside trend line

- Fed's Quarles: US regulators are considering material changes to streamline Volcker Rule

- Audio recap: Pound soars, loonie flails

- Trump: The biggest problem on trade is China

- No surprise. Lots of countries express concern about US at WTO meeting. US reps not all that happy either.

- European stocks end the session higher

- UK PM May: There will be no 2nd referendum on Brexit

- Stocks erase declines. Major US major indices now positive on the day

- Canada's Morneau: We're negotiating with a partner that has changed the terms

- USD/CAD is in the midst of a major breakout

- February ISM non-manufacturing index 59.5 vs 59.0 expected

- US Markit Feb services PMI 55.9 vs 55.9 exp

- Beware of Bitcoin says Austrian regulator

- The next deflationary front: Amazon dips its toes into banking

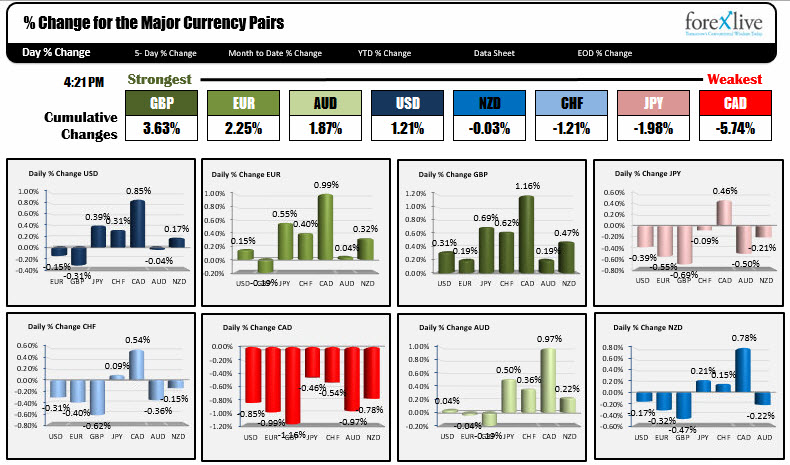

- The JPY is the strongest while the CAD is the weakest as NA traders enter

In other markets near the NY close:

- Spot gold fell $-2.95 or -0.22% at $1319.85

- WTI crude oil futures rose $1.36 or +2.22% at $60.61

- Bitcoin is trading higher by $154 to $11,543

In the US debt markets today, yields initially were lower, but moved back higher with a rising stock market and some decent economic data.

- 2-year 2.24%, unchanged

- 5 year 2.2645%, +1.7 basis points

- 10 year 2.882%, +1.8 basis points

- 30 year 3.155%, +1.5 basis points

The President tweeted over the weekend warnings of further tariffs on EU goods if they were to impose tariffs on US goods, and stuck to his guns of tariff on the aluminum and steel tariffs announced last week.

The stock market opened lower on the news, but by the end of the day, the major indices had not only erased the declines, but shot higher and closed the major indices up >1%. It seem that with the recent volatility, the US stocks either go up or down >1%.

From a fundamental standpoint, the US released ISM non manufacturing PMI data from Market and the ISM. Both were decent numbers with the ISM non-manufacturing (the most widely followed), rising to 59.5 vs 59.0 expected. That was the highest since August 2005. Good news fundamentally and that helped to contribute to the stocks rebound and also turn around the debt yields which were lower earlier but closed the session with higher yields.

In the forex market today, UK, PM May spoke positively about Brexit and that helped to push the GBP higher. The pound ended as the strongest currency of the day.

The "dog for the day" among the major currencies, was the CAD. Despite the stock and bond market recoveries, traders in the loonie were not all that confident about a tariff backtrack. The USDCAD traded to the highest level since July 5, 2017, and in the process pushed above swing levels in the 1.29079-1.2920 area AND the 50% retracement of the move down from the May 2017 high at 1.29268. That area - between 1.2908 and 1.29268 - is a key risk level for the longs in the new trading day. Stay above is more bullish for the USD/bearish for the CAD. Having said that, the pair did stall against a topside trend line on the hourly chart near the end of the trading day at the nice round 1.3000 level. The price rotated lower. Traders might use the hold against resistance, to go retest the 1.2926 area in the new trading day. Be on the lookout for sellers against the 1.3000 level.

In other pairs, the EURUSD opened higher and in the process moved above resistance int he 1.2352-62 swing area AND the 50% retracement at 1.23542. The high reached 1.2364, but quickly reversed. In the NY session, the price dipped to the 200 hour MA at 1.22809 and rotated back toward the 50% at 1.23542 area. Sellers stalled the pair before reaching the level. In the new day, I would look for sellers to continue to keep a lid on the price against 1.2354, with stops above 1.2362. ON the downside, moving below 1.2300 and then the 200 hour MA at 1.22809 would likely see selling intensify.

Below is the near end of day look at the winners and losers today. Wishing everyone a good night/day (wherever you are in the world).