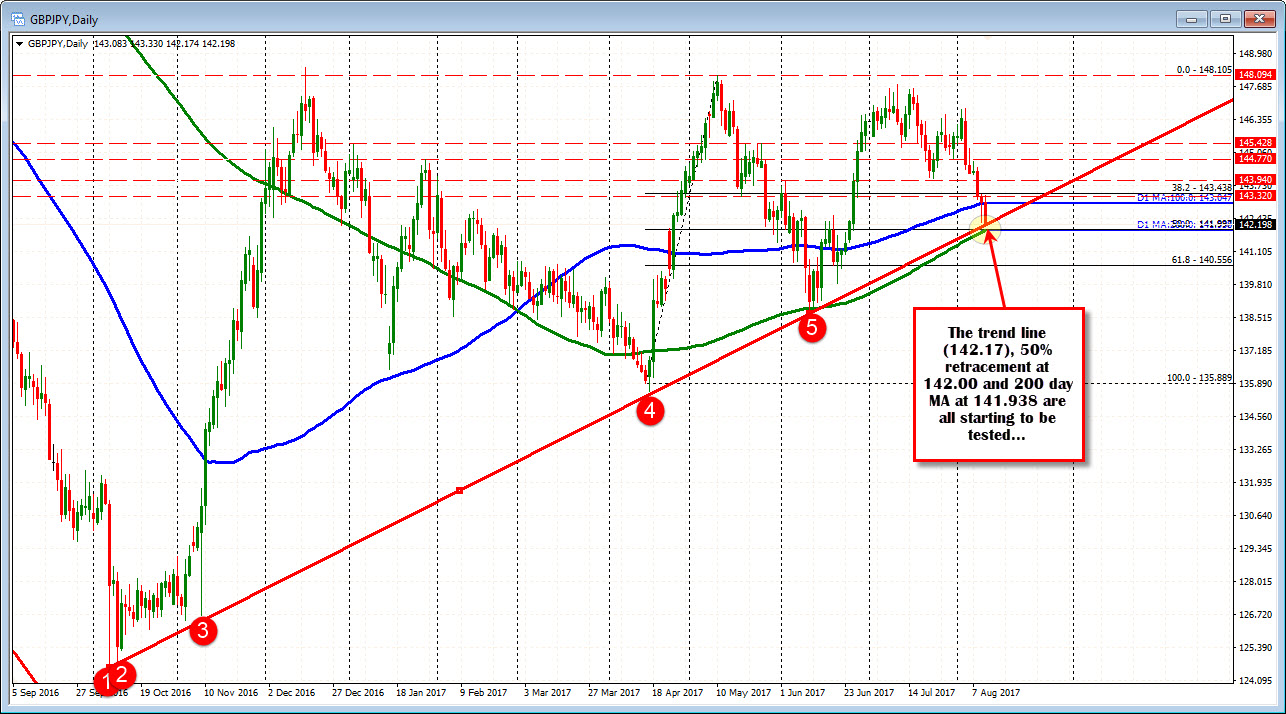

Approaches key downside targets

The major stock indices are getting hammered and that has the JPY pairs crashing lower.

The GBPJPY has moved to new session lows (lowest levels since June 27) and in the process is looking to test some key downside targets.

Looking at the daily chart, a trend line cuts across at 142.17. The price has moved below that level. The next target is the 50% retracement of the move up from the April low at 142.00. Finally, the 200 day MA comes in at 141.938. Back in June the 200 day MA was breached, but the price quickly rebounded. Of course that MA was at a much lower level.

Traders will tend to give support to the 200 bar MA and 50% retracement level (or at least give cause for pause). The reason is risk can be defined and limited and both tools are good defining points for bullish/bearish bias. Dip buyers will look for a quick rebound but they also will be quick to exit if things don't go their way.

On a rebound, watch for a move above the 142.27 level and then the 142.41 level (50% of the last leg lower). If the price can take back those levels, the bias might turn a little more higher. Failure (and it should be tough) or sellers against those levels and the key cluster of support could all be taken out.

The US S&P is down -19 points or -0.78%. The Nasdaq is down -74 points ro -1.16%. The Dow is down -122 points or -0.55%.