Corective rally of tired market stalls at 50% retracement.

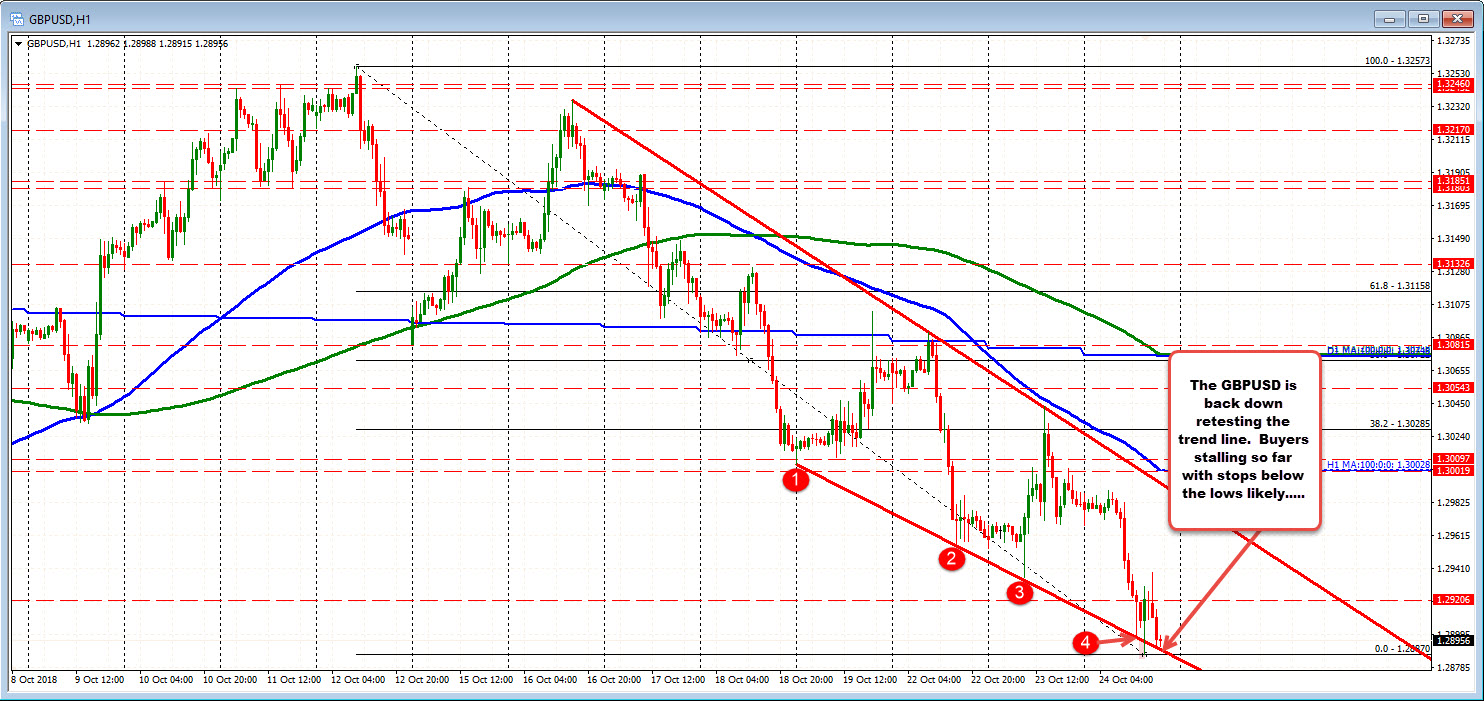

At the start of the NA session, the GBPUSD had moved below a lower trend line and failed. The market looked tired (see post HERE).

The price did indeed rally BUT it stalled right near the falling 100 bar MA on the 5-minute chart and the 50% retracement of the move down today. Those were the levels that needed to be broken to tip the scales more to the upside (a barometer for the bulls and bears). Instead sellers came in (see same post outlining the hurdle) and the price has wandered back lower.

What now?

The price is currently back down retesting the lower trend line off the daily chart. Buyers are leaning with stops likely on a break below the prior low for the day at 1.2887. We will see but that line is a key trend line at the lows. It represents the new barometer for both bulls and bears.