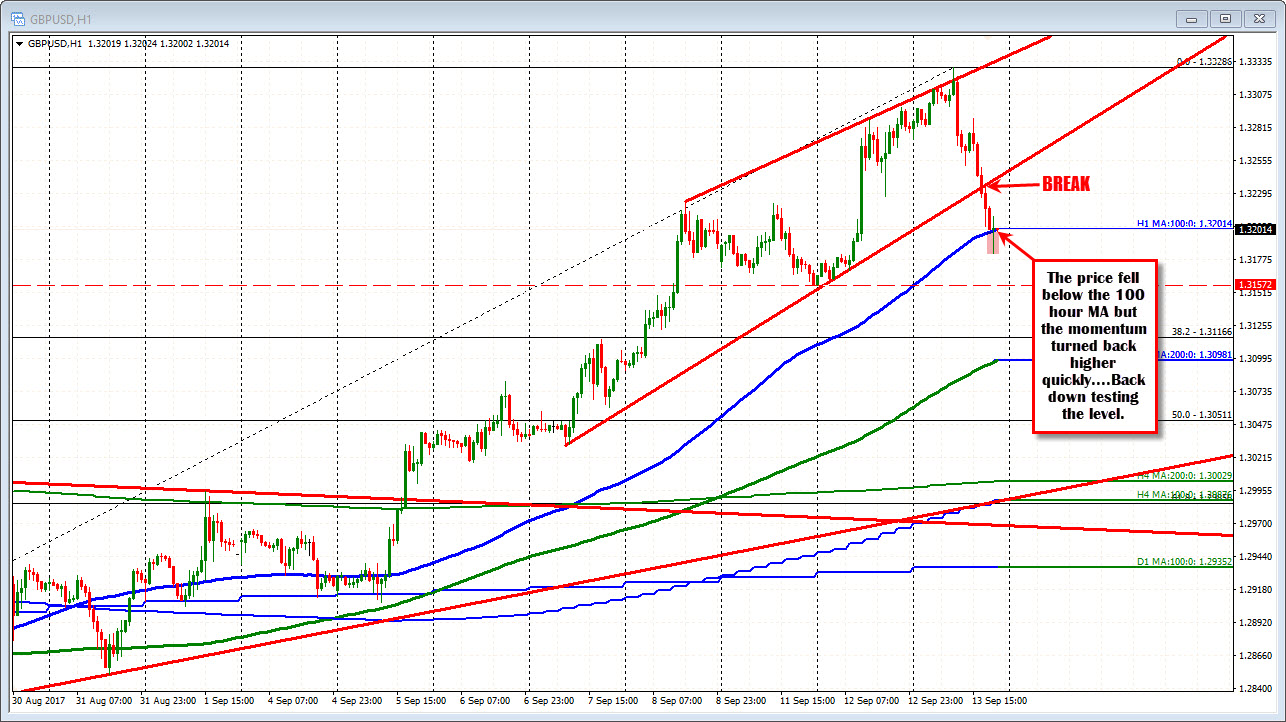

100 hour MA being tested

The GBPUSD fell below trend line support and then the 100 hour MA at 1.32014. The low extended to 1.3182 but quickly rebounded back above the 100 hour MA.

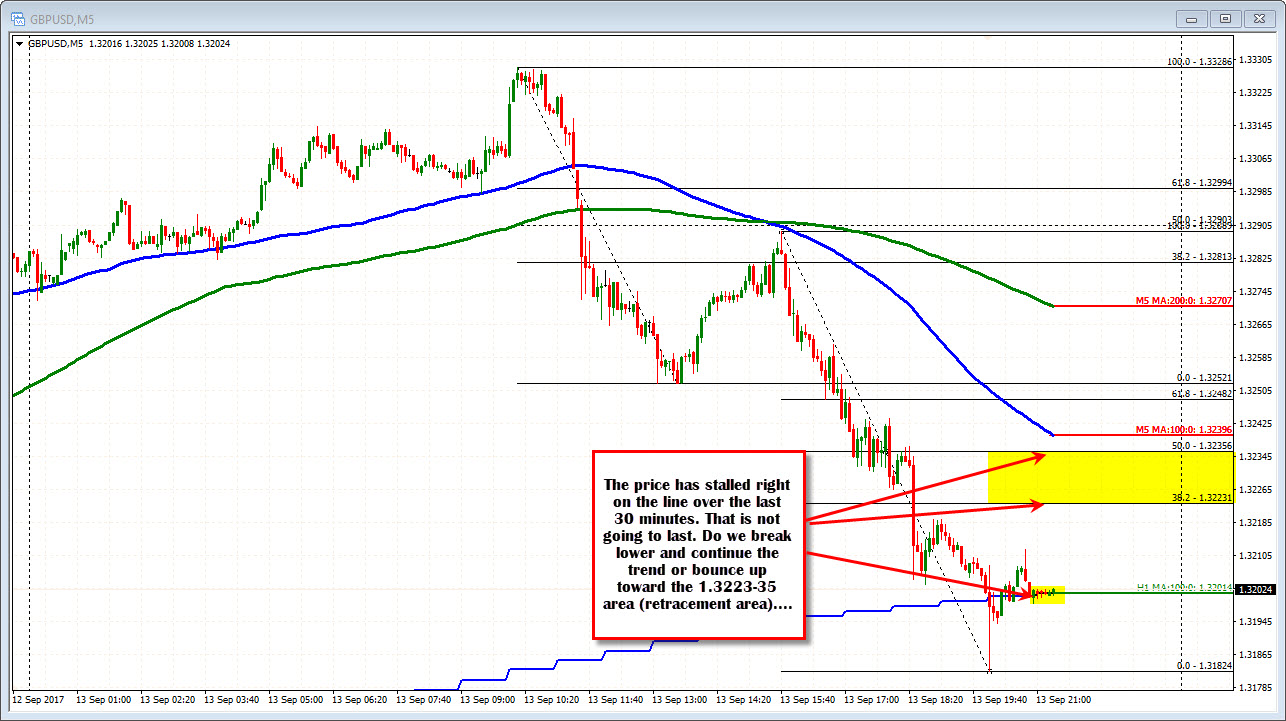

Looking at the 5 minute chart you can see the break and the quick rebound around the 100 hour MA (overlayed on the chart). In fact, the last 30 minutes have pretty much stopped trading right around the MA line. That is not going to remain. The market is going to make a break.

Do we fall and continue the run toward the low for the week at 1.3157, then the 38.2% and 200 hour MAs at 1.31166 and 1.3098 respectively, or do we correct higher and test the 38.2%-50% of last leg lower at 1.3223-35?

The seller have been in control today and they remain in control. The 100 hour MA is a key test for both bulls and bears and the price has rebounded a little bit above the MA line, but the buyers have to show me more. If not, the nibbling here against the 100 hour MA will give up and sell what they just bought.