This via an overnight note from Société Générale. Its a long and detailed note covering various currency pairs, but just pulling this bit out on DXY

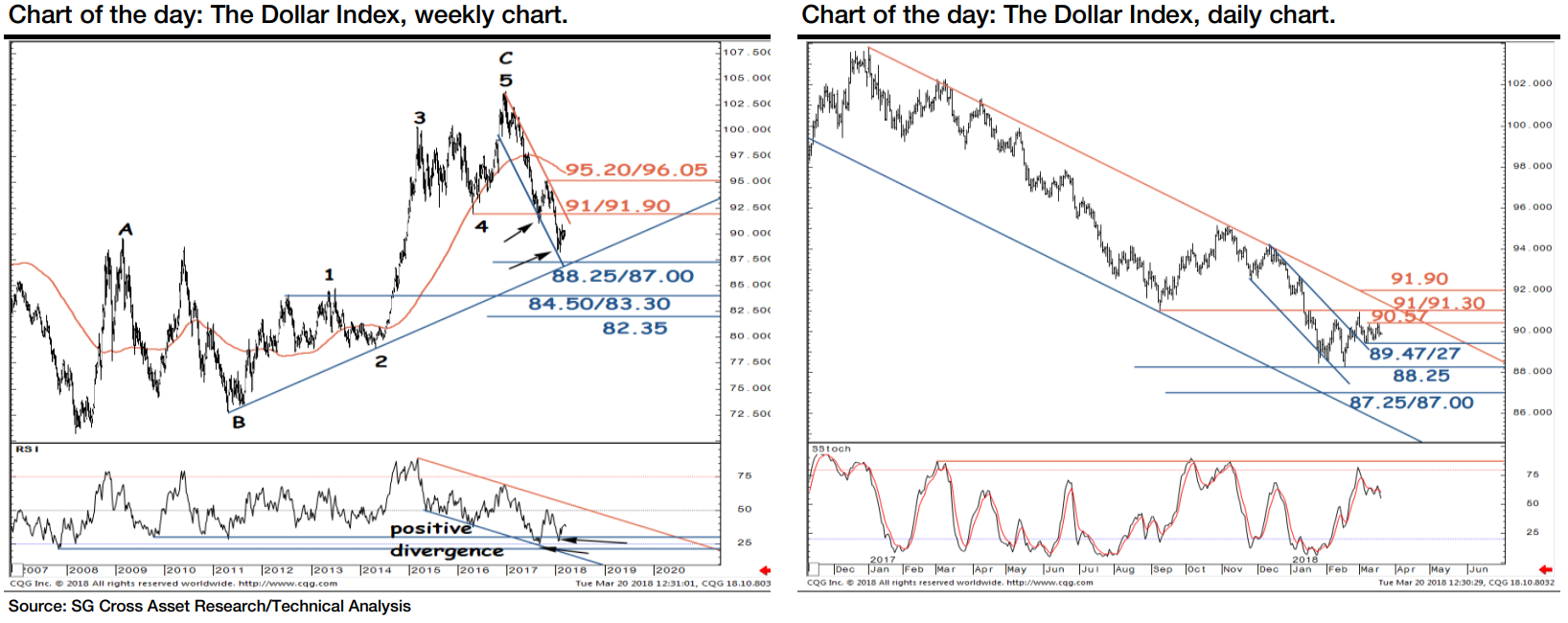

The Dollar Index .... remains structurally weak but has now almost reached its first significant support at 88.25/87.00 which represents the 7-year upward trend.

- If this gives way, it will mean an accentuated down move.

- Weekly indicators have started posting positive divergence denoting fatigue in the last bout of correction and possible stabilization to come.

- Shorter term, the Dollar Index hit 88.25 and has seen an initial recovery. It did cross above a steep daily channel but now remains constricted within a narrow range of 89.47/27 and 90.57. Previous lows of 91/91.90 should be a key resistance.

---

SG's USD view informs many of their views on other currencies against the big buck, as you'd expect. They are bearish AUD/USD, though ....

- likely to head towards 0.7650 with next support near the multi month trend at 0.7570/0.748