Citi trade of the week

Adam points out that CitiFX trade of the week is to buy NZD/JPY around 79.08 with a target of 80.75, and a stop of 78.00. What does it look like technically from my persepctive?

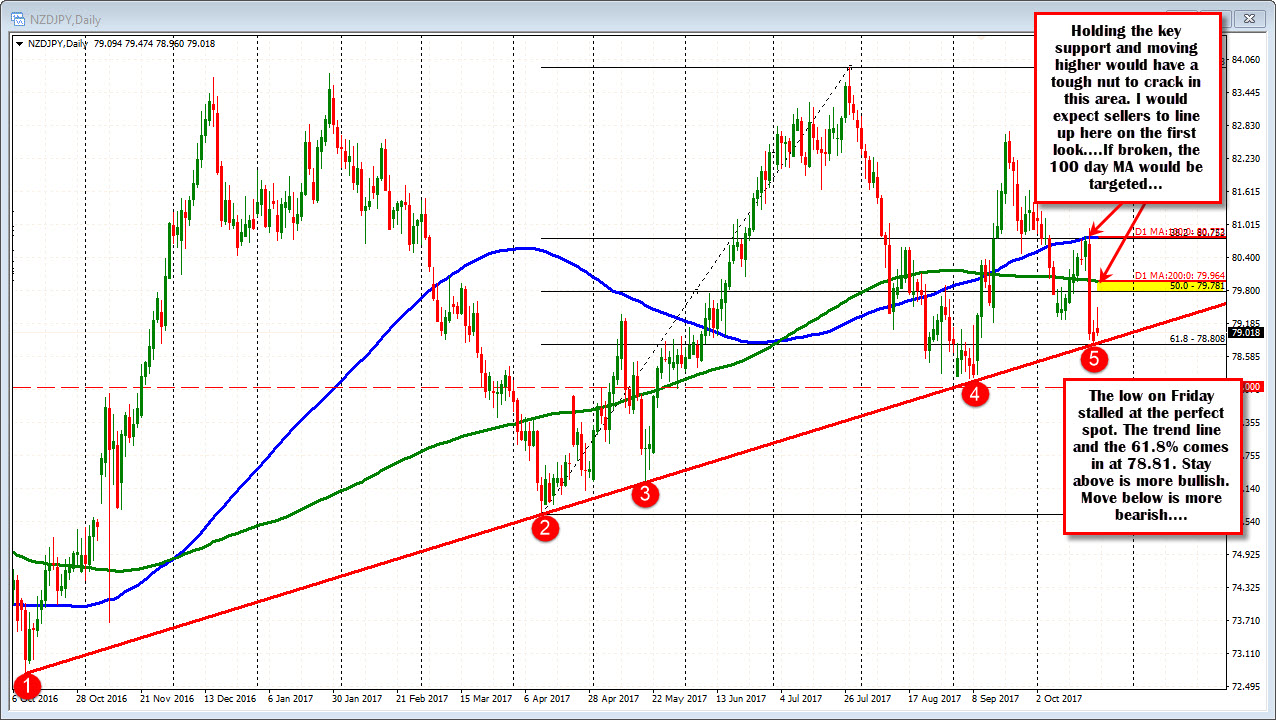

Looking at the daily chart, the low from Friday did stall near a trend line and the 61.8% of the move up from the April (and 2017) low. The trend line cuts across at 78.81. The 61.8% is at the same level (at 78.808). The low on Friday reached 78.811. That is a pretty good bottom/level to lean against for buyers.

So off that daily chart, I like the buy idea at 79.08. It makes sense.

What I don't like is the stop at 78.00.

Looking at the daily chart, I see why CitiFX put the stop at 78.00. The low from September came in at 78.18. If the price goes to 78.00, the price would be below that level. The pair would be trading at the lowest level since May 2017. That would be definitely be bearish.

But my apprehension is if the price moves below a well tested trend line AND the 61.8% AND the low from last week, is that bearish enough?

Since the trade is trying to pick a bottom in what was a quick trend move lower, I would say "Yes".

So for me, a break below 0.78.70 (11 pips below the trend line and the 61.8% would be enough for me.

Now, if that area holds, the momentum can easily turn around, and there can be an expectations for a corrective rally. So the potential does exist for a rebound. The risk applied is just too much for my liking.

What about the take profit?

Since I would be risking less (about 39 pips vs CitiFX 108 pips), I don't need to target as much.

For me, the 50% of the 2017 range at 79.78 and the 200 day MA at 79.96 should be a tough nut to crack on any move higher. I would be more inclined to target the 79.90 area expecting sellers to line up there on the first look. That would be about a 80 pip gain. Risk is 39 pips. Reward to risk is 2.05x

CitiFX has the TP up at the 100 day MA at 80.75. That is a great level to sell too, but it will be tougher to get to. Remember you have to go through the 50%, the 200 day MA and then get to the 100 day MA level.

If it gets there, CitiFX would have risked 108 pips on the trade, to make 167 pips - a reward to risk ratio of 1.59x.

I understand that my risk level stands a greater chance of getting stopped out, but for me, this is a trade that is trying to catch a falling knife. I don't want to risk a lot on that type of trade (I typically prefer risking as small as possible anyway). Since risking less, I can use that tighter stop to target a closer take profit level and still get around 2:1 reward to risk.

I like the idea. I just think the risk is a bit too much for me.

What do you think?