Trading ranges are narrow

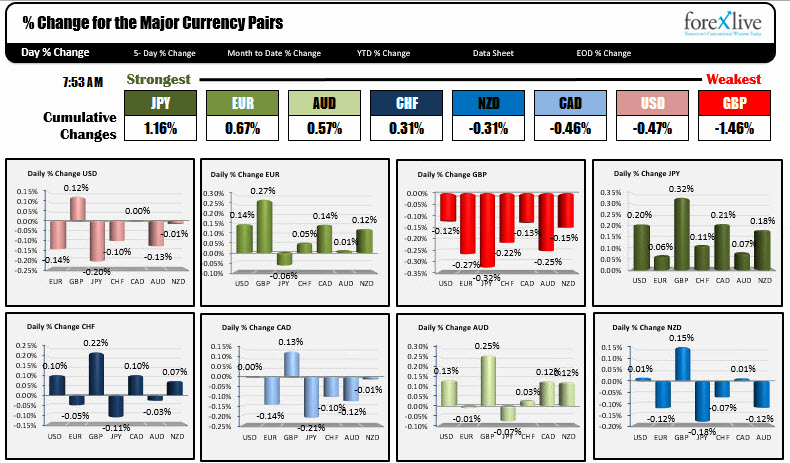

The North American traders enter with the dollar mixed, the ranges narrow with the JPY up against all the major currencies. It is the strongest currency so far today. The GBP is down against all the majors and that makes it the the weakest currency today.

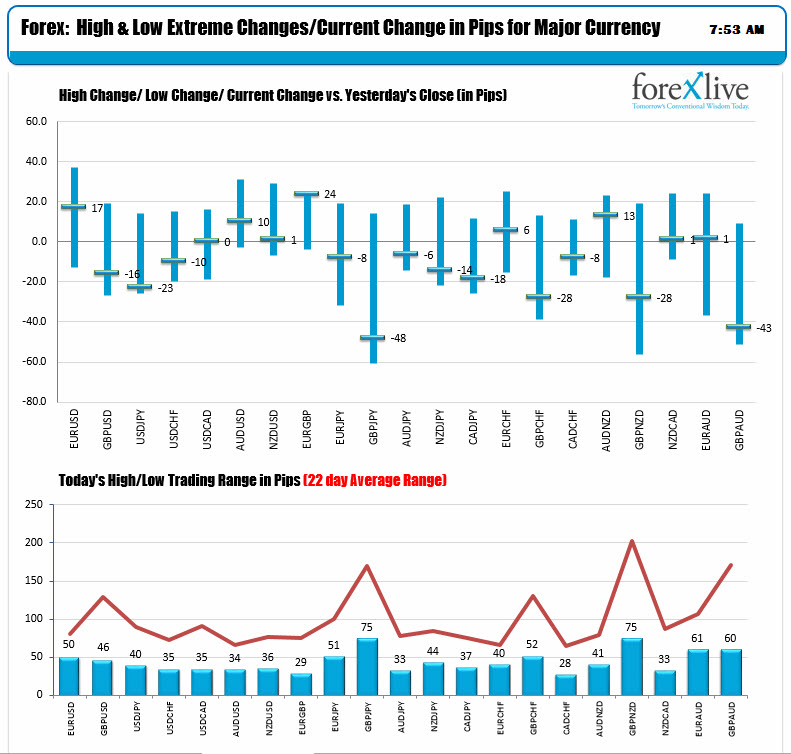

The ranges? The lower chart below shows the high to low trading ranges vs the 22 day average range (red line). There is 9 hours left in the trading day but the pairs are all trading well below their averages.

Apathy? Uncertainty? All priced in for now?

The economic calendar has been very light today. In the NY session, the JOLTS job openings will be released at 10 AM ET/1400 GMT. There is a 10 year bond auction and the FOMC meeting minutes will be released at 2:00 PM ET/1800 GMT. That's not a lot. So we may be in for more ups and downs. I will be searching for break points for technical momentum.

In other markets today:

- Spot gold is up $2.15 or 0.17% to 1290.20

- WTI crude is little changed at 50.91. Yesterday it moved sharply higher and in the process moved above the 200 hour MA at $50.54. The low today could only get to $50.81. The high extended to $51.42, but has backed off a bit.

- US pre-market stocks are a bit lower. S&P futures are down -2.75 points. Nasdaq futures are down -8.25 points. Dow futures are down -10.0 points.

- US rates are a little lower. 2 year unchanged at 1.512%. 5 year 1.9529%, down -0.6 bp. 10 year 2.3499%, down -1.0 bp. 30 year 2.8840%, down -1.1 bp

- European stocks are mixed. German Dax unchanged. France's CAC down -0.4%. UK FTSE down -0.2%. Spain's Ibex up 1.23%. Italy's FTSE MIB up 0.1%. Portugal PSI20 up 0.3%

- 10 year yields in Europe are mixed. Germany 0.457%, up 1.5 bp. France 0.886%, up 16.9 bp. UK 1.382%, up 1.9 bp. Spain 1.662%, down -3.2 bp. Italy 2.179%, up 5.2 bp. Portugal 2.355%, down 3.7 bp

- Overnight the Nikkei closed at the highest level in 21 years.