The USD is weaker as "risk on" flows send the CAD, AUD and NZD higher

The AUD is the strongest. The GBP, on Brexit worries, is the weakest as traders move into the "risk on" trade as long as it is not Brexit risk. The USD is mostly lower with most of the declines vs the CAD, AUD and NZD. The EUR is weaker too vs the greenback, but well off highs. The GBPUSD has had an up and down day.

Looking at the ranges and changes, there is decent volatility after the G20 meeting led to a truce (at least for now) with the US and China. The JPY pair gapped and moved higher on the opening but, the gains have retraced some of the advances and for the GBPJPY, the GBP weakness has taken that pair into the negative territory. Note that the gaps are not inclusive in the day's trading ranges. So pairs like the AUDUSD's range of 45 pips for the day is below the 22-day average, the range from the Friday close is 85 pips

In other markets,

- Spot gold is up $7.10 or 58%at $1229.59

- WTI crude oil is up $1.90 or 3.73% at $52.83

- Bitcoin on Coinbase is down $160 at $3986.60

In the premarket for US equities, stocks are trading much higher on the US/China news:

- S&P index, up 40 points

- NASDAQ, up 150 points

- Dow industrial average, up 448 points

In European markets, they too are up strongly on less global trade tension:

- German DAX, +2.19%

- France's CAC, +1.0%

- UK's FTSE, +1.67%

- Spain's Ibex, +1.0%

- Italy's FTSE MIB, +1.84%

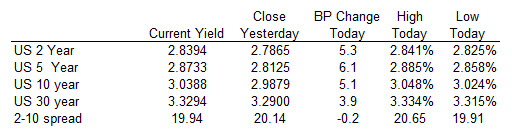

In the US debt market, yields are higher by about 4- 6 bps

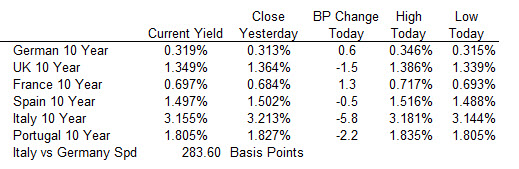

For the European debt market, the yields are mixed. Italy yields are lower on the back of lower budget concerns.