The USD is mixed but a little higher overall

The CAD is up against all the major currencies with gains against the EUR and the GBP leading the way. The EUR is the weakest as Italy worries, and weaker core CPI weigh on the currency. The USD is a little higher overall, with nearly all the gains vs the EUR and GBP. Yesterday, the USD was the strongest currency of the day as post FOMC buying, bullish economic data, and bullish technicals sent the pair higher.

The EURUSD and GBPUSD are trading near the lows for the day (down -63 pips and -39 pips) as the move lower continues after the sharp fall yesterday. They have the largest trading ranges of the majors. The USDJPY, USDCHF, AUDUSD and NZDUSD have limited trading ranges (well below their 22 day average) and all trading within 5 pips of the unchanged line. IN the crosses, the EURJPY and GBPJPY are lower and trading at their session lows.

In other markets:

- Spot gold is up $0.36 or 0.03% at $1183.23

- WTI crude oil is unchanged at $72.12

- Bitcoin is down -$50 at $6644. The low today stalled at the 200 hour MA (green line in the chart below) and bounced. Stay above that line is more bullish. Move below and the downside becomes the bias once again.

In the US pre-market for stocks, futures imply:

- Dow down -90 points

- Nasdaq down -36 points

- S&P down 9.5 points

Elon Musk is in trouble with the SEC (sued) for his tweet about going private. That has the stock price down sharply in pre-market trading.

European shares are lower:

- German DAX down -1.7

- France's CAC down -1.25%

- UK's FTSE down -0.76%

- Spain's Ibex down -1.84%

- Italy's FTSE MIB tumbles -4.2%

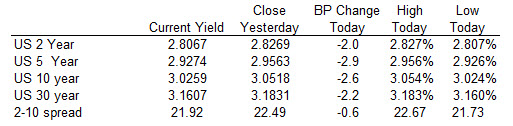

IN the US debt market yields are lower on some flight to safety bids:

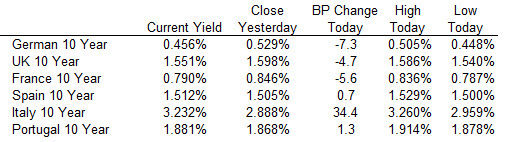

In Europe, the 10 year benchmark yields are mixed with a 34 bp rise in the Italy yields the driver. Investors are fleeing their debt as the battle on the budget with the EU (see Justin's post "October is going to be a long month for Italian bond investors (and the euro)"