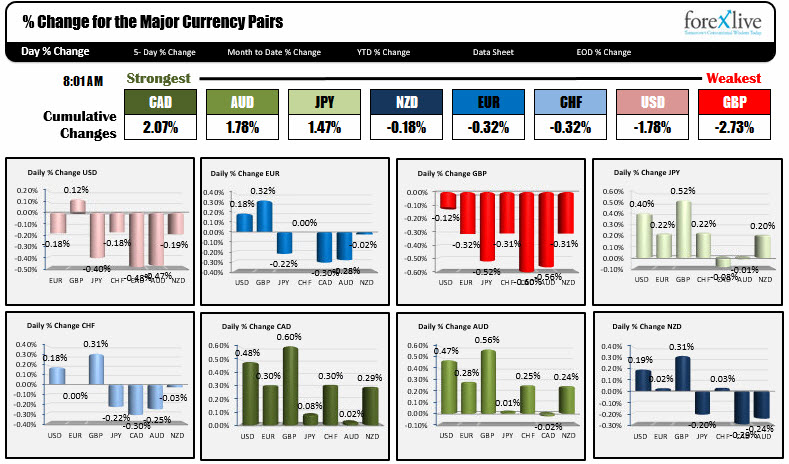

September 22, 2017 winners and losers on the day

As North American traders enter for the trading day, the CAD is strongest while the GBP is the weakest. The USD is mostly weaker with the greenback down against currencies the exception of the GBP.

There is a lot of stuff going on with two national elections, N. Korea/US threats, Apple 8s, Apple Watch, Apple TV launch, there is the ongoing Brexit risk and a number of economic releases. Moreover most of those event risks extend into the weekend which spells trouble for traders focused on risk. It is hard to hedge risk, when the markets are closed. That can lead to volatile price action as traders square or position hedges. There are good times and bad times. Friday's with lots of weekend risk are not easy times.

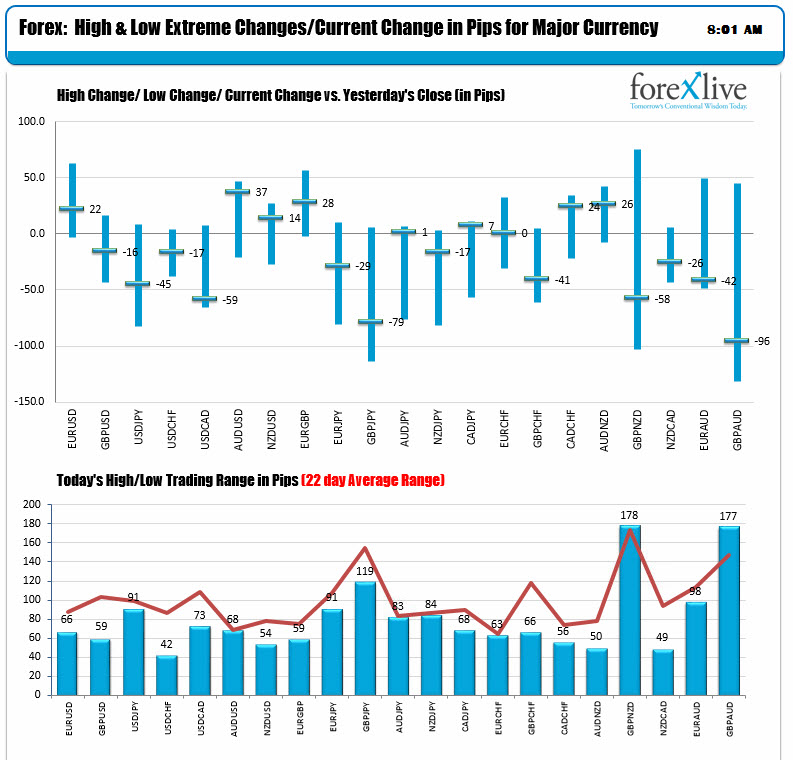

Looking at the changes (from yesterday) and ranges (low to high trading range vs 22 day average), most of the pairs have low to high ranges below the 22 day averages. The USDCAD and AUDUSD are trading near extreme levels. The USDCAD is trending lower ahead of CPI and retail sales at the bottom of the hour. The JPY crosses are mixed with GBPJPY lower and at an extreme. EURJPY in the middle of the range but lower. The AUDJPY, NZDJPY and CADJPY are trading near highs for the day after tumbles lower in the Asian session. The markets are a bit messy.

A snapshot of other markets shows:

- Spot Gold is up $4 to -$1295 $.14

- WTI Crude oil is trading down $.18 to $50.39

- US yields are lower. 2-year yield 1.431%, -0.8 BP. 5-year 1.8614%, down 2.5 basis points. 10 year 2.2534%, down 2.3 basis points. 30-year 2.7894%, down 1.5 basis

- US the market stocks are trading lower.