Traders go "risk on" again

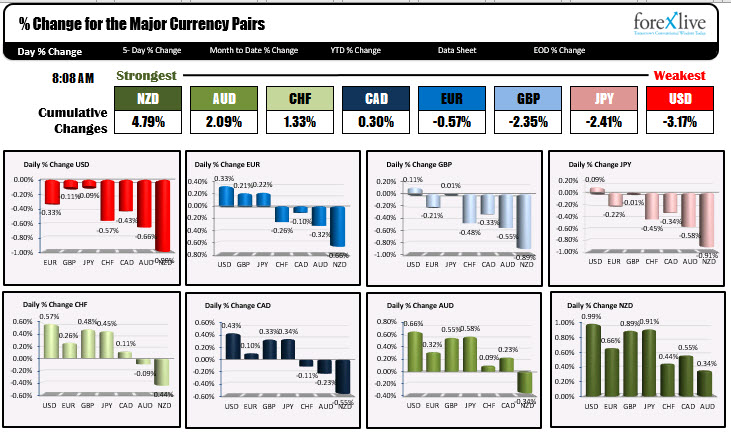

As the North American traders enter for the day, the NZD is the strongest and the USD is the weakest (with the JPY weaker as well) as traders go "risk on" again. US stocks have risen once again in premarket trading with the Dow industrial average around 300 points in premarket trading.

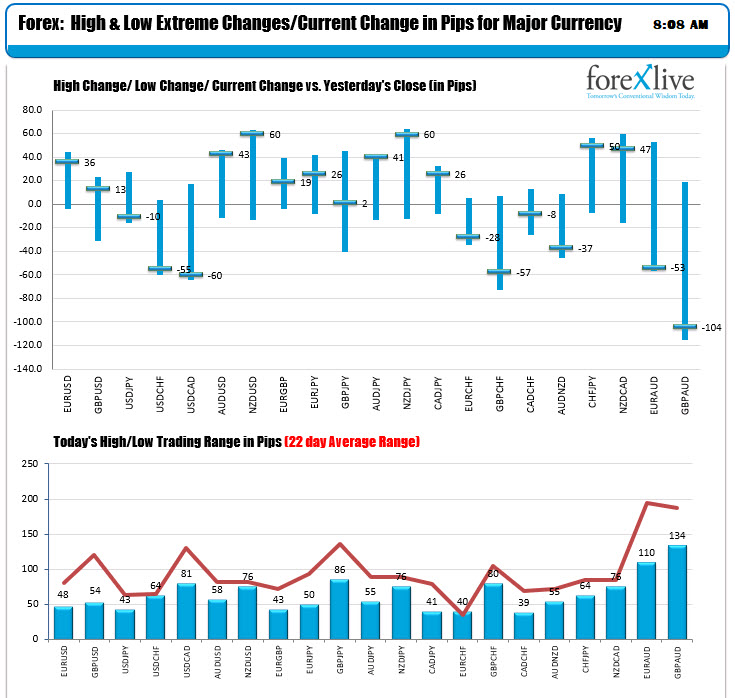

The ranges and changes are showing runs lower in the USDCAD and USDCHF and runs higher in the NZDUSD and AUDUSD as NA traders enter. The GBPUSD has had a down and up day, but is currently higher on the day. The EURUSD has moved higher but is running into resistance at the 100 day MA at 1.09667 level so far today (which is capping the pair).

In other markets:

- Spot gold is trading up $6.50 or 0.38% at $1751.68

- WTI crude oil futures are trading up $0.73 at $32.69. There was a surprise draw in the private API data near the close of trading yesterday

In the premarket for US stocks the futures are implying a higher opening after the late day sell off on the back of negative comments from STAT on the Moderna test results. The futures currently imply:

- Dow, was 330 points points

- NASDAQ index +114 points

- S&P index +37 points

In the European equity markets, the major indices are trading with mixed results

- German DAX, +0.4%

- France's CAC, -0.4%

- UK's FTSE 100, +0.3%

- Spain's Ibex, -0.3%

- Italy's FTSE MIB, -0.4%

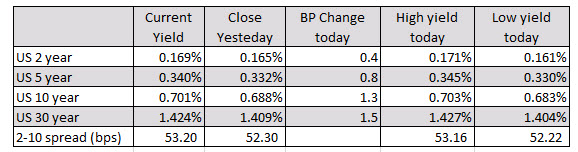

In the US debt market yields are marginally higher with the yield curve marginally steeper as well.

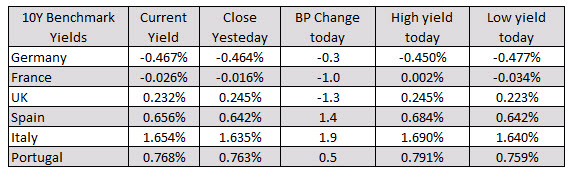

In the European debt market the benchmark 10 year yields are mixed with flows today more into the less risky countries like Germany, France and UK and out of the more risky countries like Spain, Italy and Portugal.