A few people have pointed this one out today

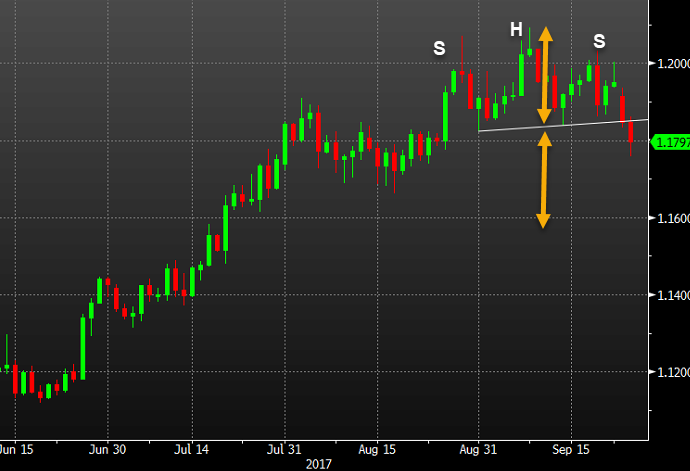

There isn't anything to like about the EUR/USD chart right now. There's a clear head-and-shoulders top (something I warmed about yesterday) and there are three shooting stars at the most-recent highs.

The market has a bit of a catalyst with the German election and USD optimism because of a potential tax cut. In addition, the euro is overbought on the longer-term metrics.

The mid-August low of 1.1662 is definitely in range but a dip down to 1.1600 or lower (maybe even 1.14) would make for a nice trade, especially with positioning data showing the market betting heavily on the euro.

I'm not even sure I'd buy it down there, depends on what happens to US taxes and with the PCE data later this week.