November 10, 2017. USD mixed.

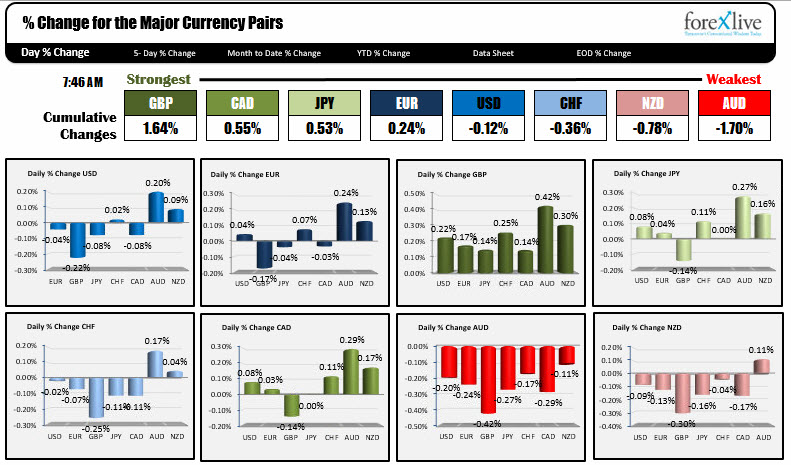

As the North American traders enter for the day, the GBP is the strongest, while the AUD is the weakest. The major currencies are relatively close together today. The USD is mixed with little gains or losses vs the EUR, JPY, CHF, CAD and NZD (all within 0.1% of the prior close). The dollar is weaker by -0.22% vs the GBP and higher vs the AUD by 0.20%.

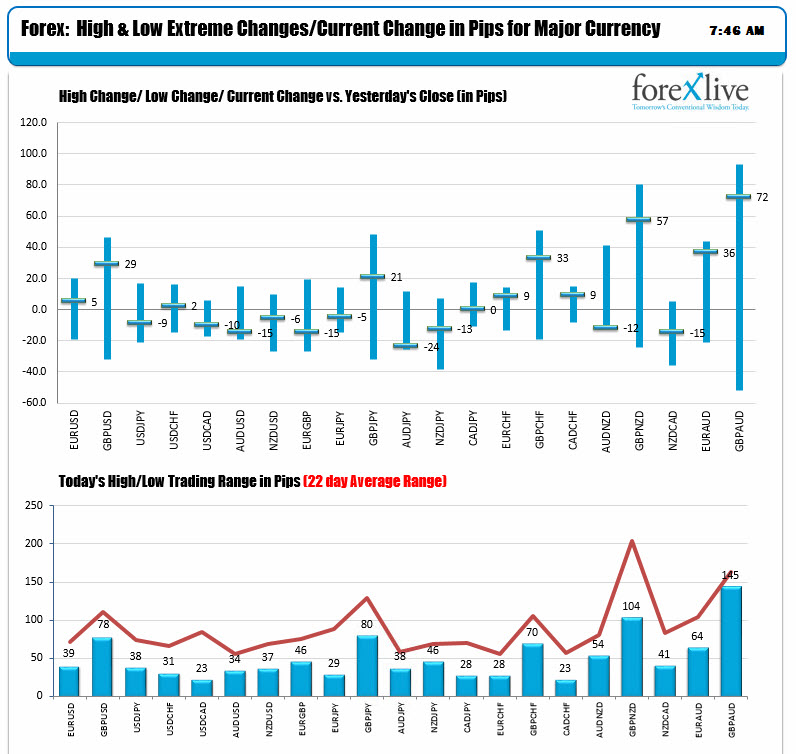

Looking at the changes and ranges (charts below), the narrow trading ranges (bottom chart below) shows the relative inactivity in trading this Friday. The GBPUSD is the largest trading range 78 pips, yet is still a good distance away from its 22 day average trading range average of 103 pips. The other major pairs vs the USD are all trading with less than a 40 pip trading range for the day. That ain't a lot. The major crosses are also well below the norm so far today. That could be a prelude to a move. However it could also about being Friday.

Today is the observance day for Veteran's Day today (Thanks to all who served for freedom) but the major banks are still open (they will be closed tomorrow instead). The US stock market and futures markets are open. State and local governments are closed. So that means no economic data out of the US government today. The Univ. of Michigan consumer confidence will be released at 10 AM ET as it is not calculated by the government. Got all that?

A snapshot of other markets shows:

- Spot gold of $.27 or 0.02% at $1285.42

- WTI crude oil futures are unchanged at $57.17

- US stock market futures in premarket trading are lower. S&P futures are down -8 points. Dow futures are down -42 points. NASDAQ futures are down -14 points.

- In the US debt market yields are higher. Two-year 1.6501%, +1.6 basis points. Five-year 2.0315%, +2 basis points. 10 year 2.366% +2.4 basis points. 30 year 2.848%, +3.2 basis points

- in European markets today: German DAX unchanged. France's CAC -0.2%. UK's FTSE -0.4%. Spain's Ibex -0.3%. Italy's FTSE MIB +0.1%

- in the European tenure debt sector: Germany 0.394%, +2 basis points. France 0.765%, +1.6 basis points. UK 1.312%, +5 basis points. Spain 1.518%, -1.6 basis points. Italy 1.807%, -1 basis point