December 15, 2017

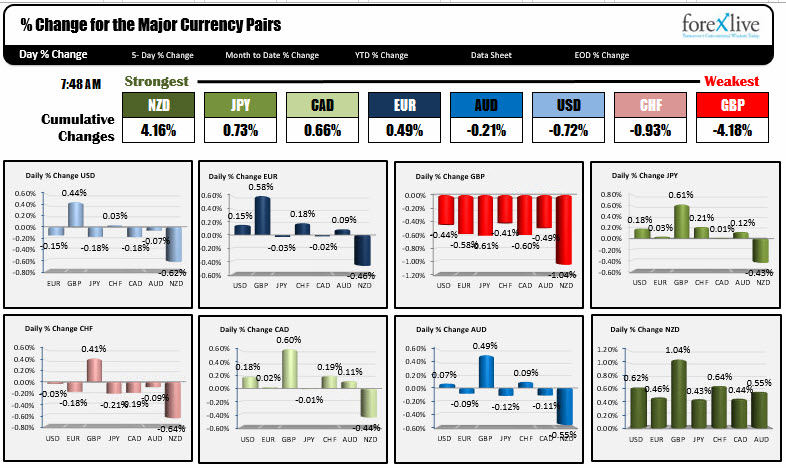

As the North American traders enter for the day, the NZD is a strongest currency, while the GBP is the weakest.

Yesterday the NZD was the weakest, falling from the 38.2% retracement at 0.7029 back down to the swing high going back to November 9. Today, the market bottomed against that old level and took back yesterday's fall. It now retests the 38.2% at 0.7029. A move above will be eyed in the NY session.

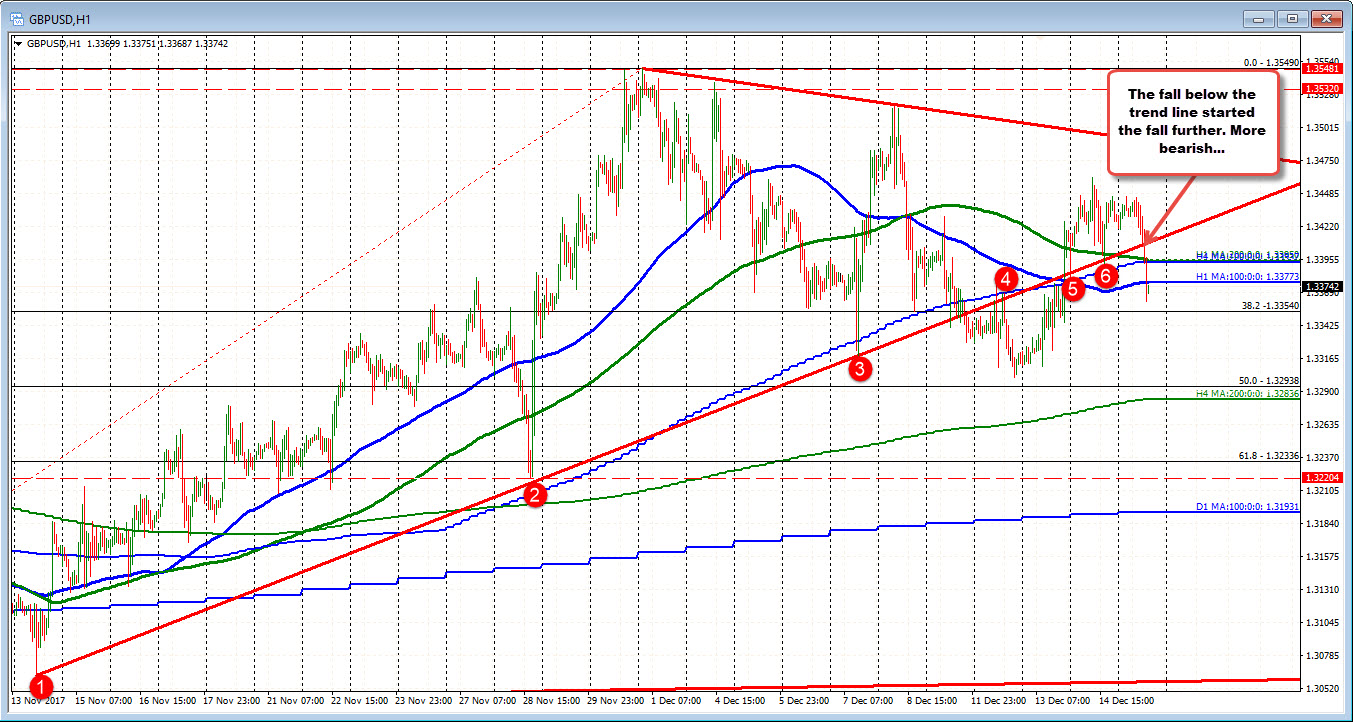

As for the GBP, the GBPUSD fell through a trend line at 1.3406 today and then the 200 hour MA and the 100 hour MA at 1.3386 and 1.3377 respectively. That helped to lead the GBP lower against other currencies as well.

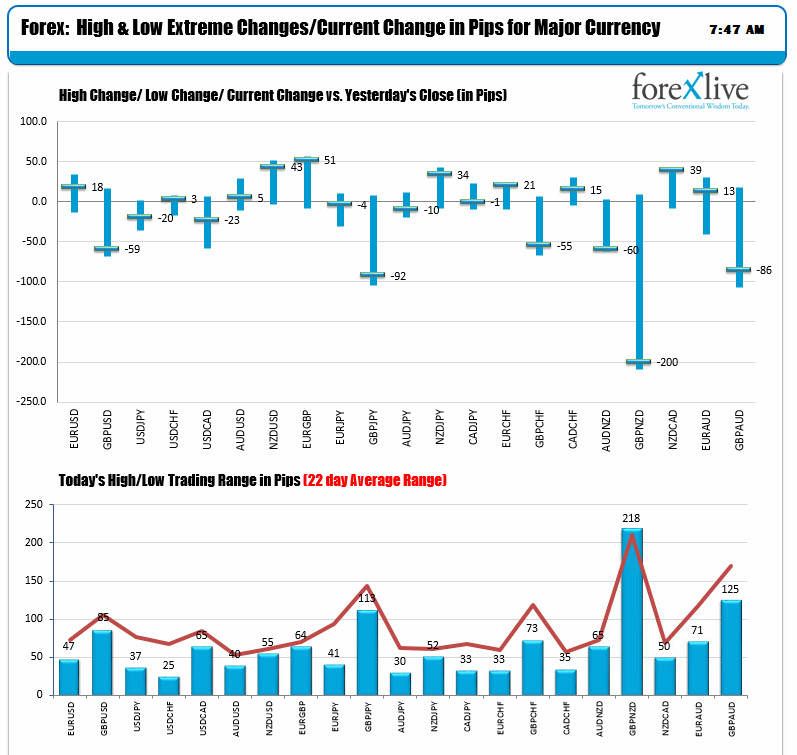

The GBP pairs have the biggest ranges for the day but all the major pairs vs the USD are still below their 22 day averages. So there is some room to roam.

Data today is not as robust.

- Canada manufacturing sales will be released at 8:30 AM/1330 GMT. The expectations are for a 1.0% gain versus 0.5% last month

- Also at 8:30 AM ET, the Empire manufacturing for December will be released in the US with expectations of 18.7 versus 19.4

- At 9:15 AM ET/1415 GMT, the US industrial production for November is expected to rise by 0.3 versus 0.9%. Capacity utilization is expected to also rise to 77.2% versus 77.0%. Manufacturing production is expected to come in at 0.3% versus 1.3% last month

- At 1 PM the weekly Baker Hughes rig count will released

In other markets, the snapshot today shows:

- Spot gold is up $6.76 or 0.54% at $1259.78

- WTI crude oil futures are up $.16 or 0.28% at 57.20

- US yields are slightly higher with the yield curve flattening a touch. Two-year 1.8235%, +1.2 basis points. Five-year 2.1487%, +1.0 basis point. 10 year 2.356%, +0.7 basis points. 30 year 2.706 percent, unchanged

- In the US stock market, the futures are higher. S&P futures are up 7.5 points. Dow futures are up 81 points and NASDAQ futures are up 18 points.

- In the European debt market yields are lower. Germany 0.301%, -1.5 basis points. France 0.63%, -1.6 basis points. UK 1.151%, -2.3 basis points. Spain 1.428%, -1.9 basis points. Italy 1.779%, -1.6 basis points. Portugal 1.73%, -4.1 basis points.

- European stock markets are mixed. German DAX +0.10%. France's CAC -0.16%. UK's FTSE up 0.18%. Spain's Ibex unchanged. Italy's FTSE MIB -0.4%.