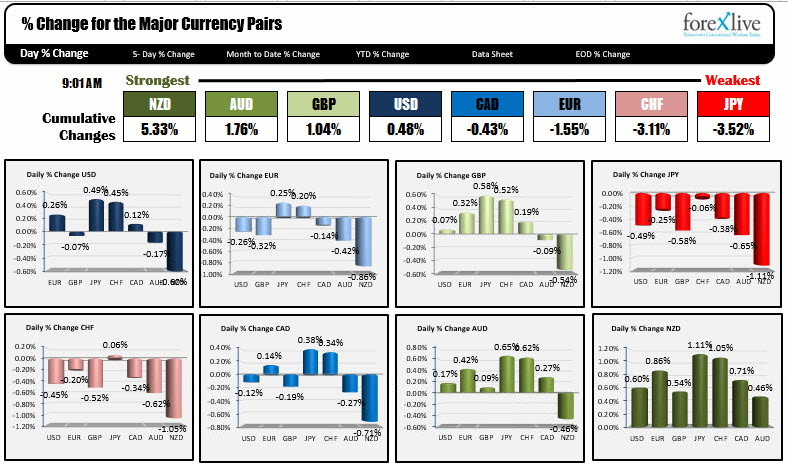

USD mixed

As the market moves toward the start of the US stock market (European shares soaring), and we await the ISM, Construction spending, oil inventories and the FOMC decision later today, the NZD is the strongest (better employment) and the JPY is the weakest (no flight to safety of the JPY). We do have the rest of auto sales coming out today too (Ford up 6.1% vs 5.1% est being released now).

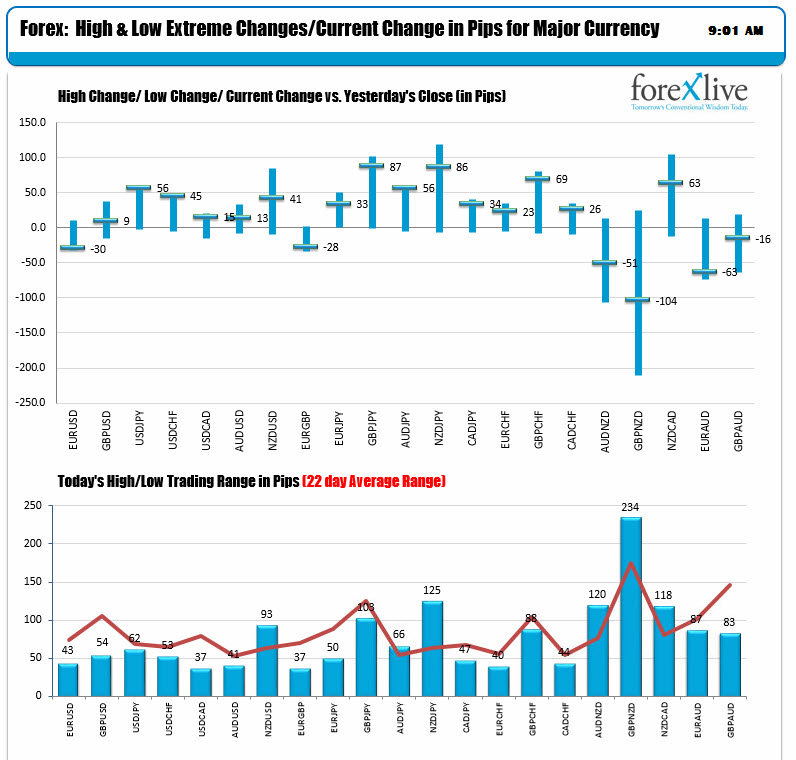

The ranges for the major pairs - with the exception of the NZD - are all hanging below their 22 day average signaling non volatile trading. The EURUSD only has a 43 pips range but it is trading at session lows as I type. The USDJPY, USDCHF are also trading at highs now.

Snapshot of other markets:

- Spot gold up $2.70 or 0.22% to $1273.76

- WTI crude oil is up $0.55 at $54.96 before inventory data. The private API data showed larger than expected draw downs yesterday.

- US yields are showing a flatter yield curve play. 2 year is up 2.4 bp. 10 year is up 0.3 bp. The 5 year is up 1.6 bp. The 30 year is down -1.1 bp

- US stock futures are up in pre-market trading. S&P futures up 8.8 points. The Dow futures are up 130 points. The Nasdaq futures are up 22.50 points. Faceook and Tesla are two of the companies releasing after the close