Dollar buying the day after the FOMC hike

The forex market whipped around after the FOMC decision yesterday. It was not all that pretty, but today, the dollar has decided to be more supportive of a USD rise. That has made the greenback the strongest of the major currencies as North American traders enter, while the CHF has been slotted as the weakest.

The price action vs the 22 day averages is not bad although the USDJPY is up and down as stocks rotate up and down (the low to high trading ranges is only 34 pips). The USDCHF (up 0.52% and 50 pips), USDCAD, AUDUSD and NZDUSD are trading close to the day's extreme for those pairs.

The Italian budget remains in the news. The Kavanaugh sexual assault drama will play out in Washington. There is a lot of data out at the bottom of the hour with weekly claims, Durable goods, GDP revision for 2Q, Wholesale inventories all being released

In other markets:

- Spot gold is down $.92 or -0.09% at $1193.18

- WTI crude oil futures are up $.76 or 1.06% at $72.33. The US said that they would not release oil from the strategic reserves.

- Bitcoin is near unchanged levels at $6489.51 on Coinbase.

In pre-market futures trading for US stocks, the imply a positive open:

- Dow futures imply a 22.72 point rise

- S&P futures imply a 3.25 points rise

- NASDAQ futures imply a a 24 point rise

In Europe, are mixed

- German Dax is unchanged

- France's CAC is also trading near unchanged levels

- UK's FTSE is up 0.17%

- Spain's Ibex is down -0.5%

- Italy's FTSE MIB is down -1%

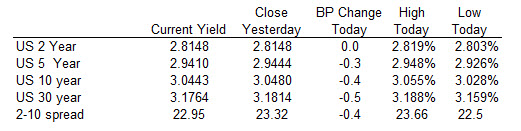

US yields are down modestly.

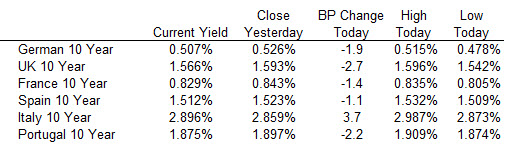

10 year benchmark yields in Europe are mostly lower with Italy bucking the trend as they work through their budget issues.