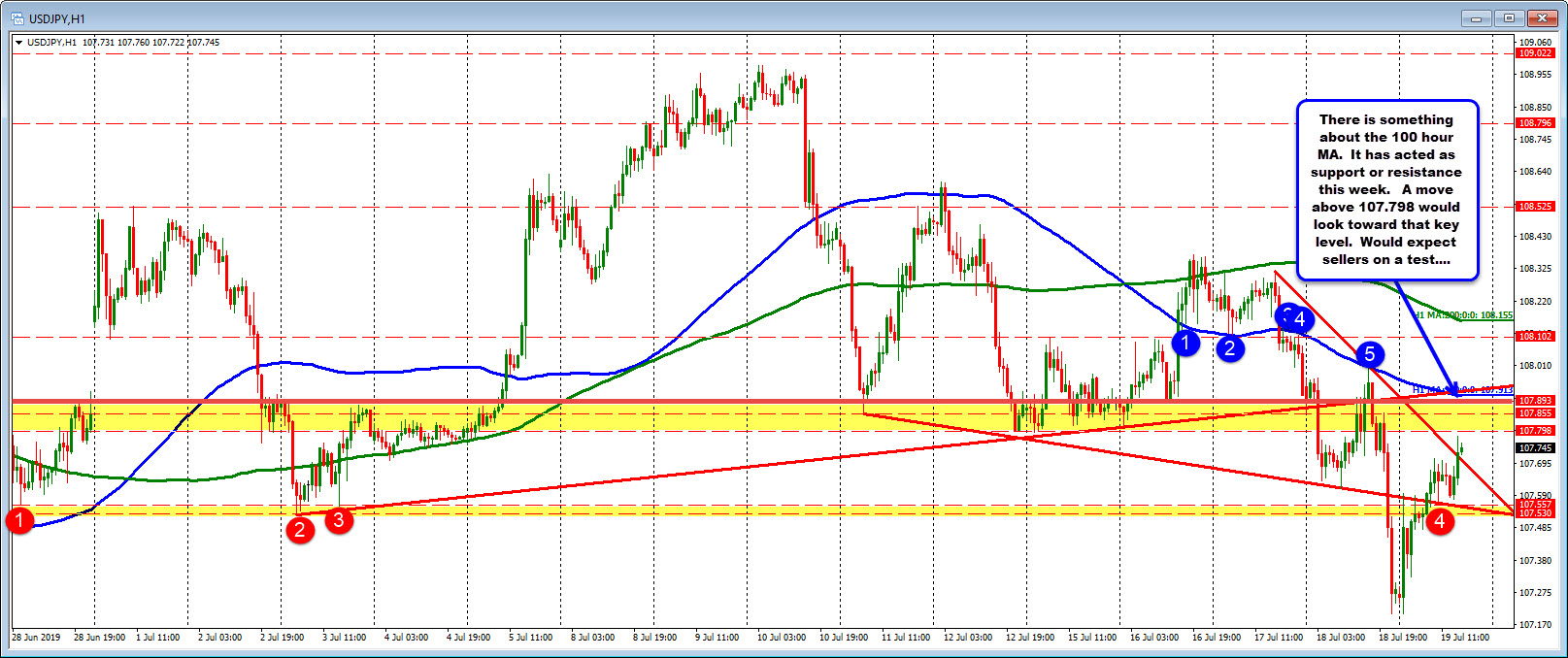

Retracing the fall from yesterday

The USDJPY scooted to - and eventually back above - the swing lows from June 28 and July 3rd at the 107.53-557 on the Fed Williams retraction. Later in the session, traders based against that level on a test (see red circle 4). That area is back to being support for the USDJPY. Stay above is more bullish. Move below is more bearish.

On the topside, the price has moved close to the 107.798 which was lows from last Friday and Monday. The high just reached 107.783.

That may be a high, but if not (i.e., if broken), the momentum break of the level should see another test of the 100 hour MA (blue line) currently at 107.913 (and moving lower).

There is something about the 100 hour MA. It has acted as support or resistance this week (see blue numbered circles) including a test and hold agaisnt the level yesterday (see blue circle 5). IN a post yesterday, I spoke of that level saying:

The run higher has now taken the price back above a broken trend line at 107.90 area, is above the close now and approaches the 100 hour MA at 108.006. The MA should put a stall on the rally with a battle between 106.90 to 107.00 the next fight. (see post here).

That 100 hour MA did in fact stall the rise yesterday (see blue circle 5).

So a move above 107.798 would look toward that key level. I would also expect sellers on a test....