Elliot wave technical analysis on the DXY (USD) via UBS

(I've summarised)

Where do we stand tactically in the US dollar?

- ... the DXY has already reached our initial bear cycle target at 93! ... we have already bullish reversals underway

- ... The US dollar is pretty much oversold, where particularly the CAD was historically high oversold. With the reversal of the last 2 seeks we are getting buy signals in our daily trend on pretty oversold levels, which we see as the basis for a tactical multi-week rebound into later August.

Conclusion:

... we expect a USD bounce into later August, trend-wise we remain bearish DXY (bullish EUR) where we expect at least one further down-leg and new lows into later 2017.

However, a new low in the DXY would very likely form divergences in our trend work on multiple time frames.

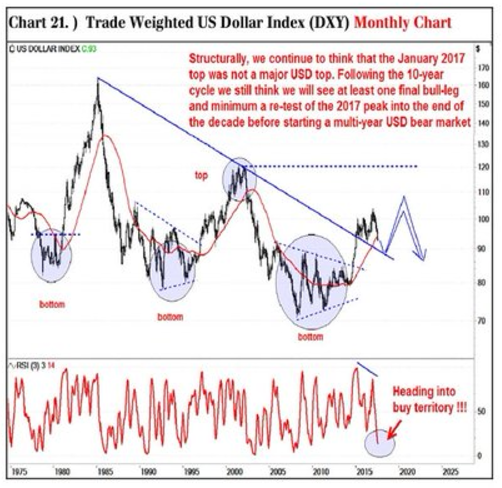

Together with our monthly momentum heading into contrarian buying territory and key pairs (CAD, AUD) completing a corrective a-b-c pattern this low could bring us a very important USD bottom.

With taking into account the extreme long positioning in the EUR this means that the worst of the 2017 USD bear cycle (EUR bull cycle) is behind us, which from a price perspective implies that we can see a final undershooting towards 90/88 but perspective wise we would see these levels as a good basis for buying the USD and position for a new bull cycle into 2018.